- The oral care market is expected to experience a 2% compound annual growth rate 2007–2012.

- Organic, internal growth will be increasingly difficult to develop.

- Asia-Pacific and Latin America are anticipated to see respective growth rates of 19% and 24% 2007–2012.

- Chemical ingredients are being replaced by plant-based ingredients as functional claims for these ingredients increase.

- The key to sustained growth may be consumer education.

- Volume sales are likely to remain solid, but there is likely to be an increase in response to private label products.

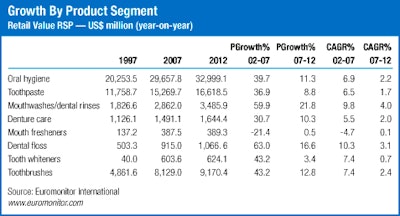

According to Euromonitor International, in 2007 the global oral hygiene market grew 6%, broadly in line with overall cosmetics and toiletries market trends. The category is a solid and dependable sales engine—people always need toothpaste—and, as such, it has become far more commoditized than other parts of the cosmetics and toiletries market.

This has influenced the strategies of most leading manufacturers, which typically look for the consolidation of leadership positions by developing scale and global share rather than category-creating innovation. In short, the oral care category is proving difficult to add meaningful value to, as the scope for innovation narrows and mass-market imitations of products such as battery toothbrushes and whitening toothpastes quickly lessen the impact of new product categories.

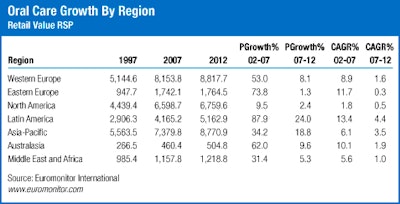

Nonetheless, the category has continued to develop in value terms despite the enormous price pressure brought to bear on oral hygiene. This pressure is especially strong in the developed markets of Western Europe and North America, which accounted for a combined 49% share of global oral hygiene sales in 2007. Retailers such as Wal-Mart and U.K.-based Tesco are able to dictate pricing terms to producers, lower retail prices to consolidate market share, and carry extremely plausible and surprisingly sophisticated private label products.

Punitive Costs of Development

To counter price pressures, brand owners have had to resort to an increase in the number of product launches in order to stay ahead of trends. Colgate-Palmolive, for example, is leading the global oral hygiene market with a 24% share (60% of its business is in oral hygiene), and claims to have launched 772 new products in all categories of its cosmetics and toiletries portfolio in 2007—with the bulk of those being oral hygiene products. How much of this is genuine innovation is debatable. Most new products coming to market appear to be new flavors or packaging, or toothbrushes with strong claims for increased cleaning power. This looks like tweaking, and these new launches typically do not provide gains beyond the short term.

Nonetheless, these developments are expensive—and not just in research and development terms. Colgate-Palmolive increased its global advertising spending by 17% in 2007, despite the negative impact on margins due to fuel and raw material costs. These trends seem impossible to sustain, but the market continues to grow and is anticipated to see a value development of 2% compound annual growth rate (CAGR) 2007–2012. This is hardly record-breaking growth, but for a product category with such high levels of commoditization, it is still impressive.

New Products Seek Authority

In terms of product development, brands are looking to segment the market to the greatest possible degree, with “professional” alignment helping to support price positions. Leading brands have all developed products that are clinically aligned. Procter & Gamble, for example, launched its new Crest Pro Health Whitening toothpaste with the tagline “protects all those areas dentists check most,” and the product’s distinctive packaging and marketing all underline its professional positioning. This gives such products an air of authority, and reinforces claims of function—but, most importantly, it supports price positioning.

Manufacturers typically spend heavily to build this relationship—making sure they are visible at dental conventions in old and new markets, supporting global oral health campaigns and running widespread professional sampling programs. These trends are not restricted to mature markets. In Brazil, for example, professional endorsements helped drive up Colgate-Palmolive’s market share for its premium toothpastes, Colgate Total and Colgate Sensitive, with Colgate Total growing its share of the company’s toothpaste sales from 1% in 2005 to 3% in 2007.

Market Focused on Large Brands

Growth has also been helped by revised branding strategies. Most leading marketers have incrementally increased their share of the global market over the review period not through innovation, but by using their largest brands to leverage share. Brand strategies have become increasingly monolithic as a result. Larger, unified brands are cheaper and easier to market, and marketers are able to have the largest possible brand equity to develop new markets. This trend characterizes the market as a whole. However, the high degree of concentration in the oral hygiene market—the top five manufacturers, Colgate-Palmolive, P&G, GlaxoSmithKline, Johnson & Johnson and Unilever, hold a combined 67% share of the global market, with private label holding another 3%—makes it more pronounced. Share movement is gradual.

Fluctuation in global share has increasingly become a result of external factors. P&G, for example, lost share over the review period after merger-related dislocations following its 2005 acquisition of Gillette, which saw the new company unable to fulfill increased demand for Oral-B toothbrushes.

And Johnson & Johnson’s acquisition of Listerine mouthwash in 2006 is likely to help Colgate-Palmolive grow its Colgate Plax mouthwash business internationally if Johnson & Johnson fails to maintain its marketing efforts. These are not events management can depend on, and organic, internal growth seems increasingly hard to develop.

Immaturity in Emerging Markets Supports Value Growth

When compared to mature markets, emerging markets demonstrate more fluidity. And like the rest of the global cosmetics and toiletries market, oral hygiene marketers are looking to surging economic growth in Asia-Pacific and Latin America to buoy sales over the forecast period; these two regions are anticipated to see respective growth rates of 19% and 24% through 2012, compared to growth of 2% in North America and 1% in Eastern Europe.

Sales will be driven by consumers persuaded to trade up from less expensive national/regional products to global brands that marketers are throwing their weight behind. In Brazil, one of the most dynamic global oral health care markets, Colgate-Palmolive appears to be committing far more resources to its Colgate brand than to its market-leading mass brand, Sorriso—which saw toothpaste sales drop from 70% in 2005 to 67% in 2007. As a result of this general trend, both marketer and brand share are markedly more volatile in these markets.

Heavyweights Look to Niches

The global market remains dominated by toothpastes (which generated 51% of values in 2007), and most new product launches, appropriately, are in this category. The emergence of a number of new formulas and ingredients from niche producers with a more natural or organic positioning has been one interesting development. Alcohol, cetylperidinium chloride and saccharin are being replaced by ingredients such as fennel, mint, spearmint or horse chestnut, with marketers making functional claims for many of these new ingredients.

Leading manufacturers have leapt on this trend—leading brands Colgate, Signal and Crest all have herbal formulations—but there still remains a great deal of room for further development of natural ingredients. However, the scale and other products in these marketers’ brand portfolios often mean their “natural” positions appear untenable to consumers drawn to these claims and who typically choose smaller brands. In 2007, Colgate-Palmolive acquired Tom’s of Maine, a more premium-aligned natural marketer in the U.S. market with a significant oral hygiene offer; this is likely to set the future tone of market development from the big five brand owners.

Toothbrushes is another core part of the market, generating 27% of market value in 2007. The category grew by a 7% CAGR 2003–2007, outperforming the overall oral hygiene market. Product development in toothbrushes really seems to have reached an impasse. Even private label operators are offering battery-powered products as standard, and market growth has largely come from persuading users of manual products to trade up to electric ones, as well as trying to build consumer awareness of regular replacement.

Education Will Promote Rinse, Floss Growth

According to Euromonitor International, mouthwashes/dental rinses was the most dynamic part of the market over the review period, and is anticipated to grow at a 4% CAGR over the forecast period—making it, once again, the most dynamic category. Floss is forecast to be the second fastest growing category. Low usage rates in most markets, as well as professional recommendation for use of these products, could open up significant potential for both markets. Use of these products is standard in North America, but consumption rates are low in the rest of the world.

Value Development Restriction

In many of the global industry’s leading markets, persuading consumers to remain brand loyal and responsive to new products during a time of recession is the core difficulty marketers are currently faced with. Volume sales are always likely to remain solid, consumers won’t stop brushing their teeth, but there is likely to be an increase in response to private label products, higher price sensitivity resulting in discounters building market share and a rejection of those parts of the oral hygiene market of which consumers question function—such as home teeth-whitening kits or toothbrushes with added blades, spikes or ridges. Obviously, these trends characterize the more mature parts of the global market, but the relative immaturity of markets such as India or China means there is still opportunity for brand building. However, the market as a whole is still dominated by Western Europe and North America, and manufacturer responses to these problem areas need to address the growing threat of mass-market price pressure.

The key to sustained growth seems to be consumer education. This could drive consumption of floss and mouthwashes, for example, but brand owners are going to have a hard time keeping these markets to themselves and out of the hands of private label. It will also be expensive—marketing costs across the industry are already expensive—and marketers will have to shout ever louder in order to demonstrate their differences and build consumer share.

Irina Barbalova is Euromonitor International’s global cosmetics and toiletries research manager.

![Burst founder Hamish Khayat says, 'The kids’ brush is a great example [of our product development philosophy]: the biggest problem with existing brushes was that brush heads aren’t curved at the end, so they can’t reach the rear molars. So, you curve the head and you solve that problem.' Pictured are variants of the BurstKids Sonic Toothbrush.](https://img.gcimagazine.com/files/base/allured/all/image/2022/05/BURSTkids_Sonic_Toothbrushes.6287fd790c577.png?auto=format%2Ccompress&fit=crop&h=191&q=70&w=340)