- “Audacious” makeup looks, and vinyl- and plasticlike finishes, are becoming a major trend.

- To gain a stronger foothold in emerging, faster-growing markets, marketers must consider and serve specific skin tones—as well as climate and culture.

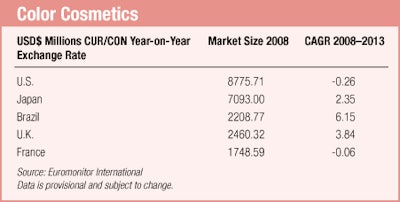

Color cosmetics will likely grow at a slower rate than the overall cosmetics and toiletries market due, primarily, to saturated Western markets. Alongside limitations in volume growth opportunities due to high levels of maturity, these markets have also come under increased pressure due to the current economic downturn, and Euromonitor International expects many of these markets to see a further slowdown in volume demand.Moving forward, success in the color cosmetics market will be defined by product innovation and geographic expansion.

Innovation Drives Color in Western Markets

Novelty is the buzzword in color cosmetics in Western Europe and North America. Competition and market saturation in these regions are making novel product concepts and designs evermore imperative, and color cosmetics manufacturers and marketers are looking in the most unusual places for inspiration.

Marketers in Western markets are relentlessly engaged in wooing consumers with unusual products, particularly in the eye makeup category, which is projected to achieve the strongest growth in color cosmetics globally. Euromonitor International’s preliminary growth forecasts for eye makeup in the U.S., however, indicate a more moderate compound annual growth rate (CAGR) of 1.31%, compared to a -0.26% CAGR for overall color cosmetics for the period 2009–2013.

Many of the new product developments have been in the mascara category. Inspired by battery-operated toothbrushes, a number of manufacturers, including L’Oréal and Lancôme, have introduced battery-powered mascaras. These mascaras are designed to give a professional touch to makeup. For example, Estée Lauder’s TurboLash mascara is a battery-operated vibrating mascara said to plump up lashes, while Lancôme’s Oscillation mascara applies the mascara in a zigzag fashion, replicating the finishing touch of a professional makeup artist. In addition, formulas and other packaging choices continue to be refined. L’Oréal, for example, has introduced Extra Volume Collagen Mascara with an enriched hydra collagen formula and a longer brush intricately designed to deposit the right amount of mascara on every lash, resulting in an appearance of more voluminous eyelashes.

Manufacturers have not stopped at either applications or eye makeup; they are also investigating new colors and textures, to the extent that they have even been inspired by the iridescence of a beetle’s carapace or a frog’s skin. Experts believe audacious makeup looks are becoming a major trend, and makeup today is viewed as a means of self-expression rather than just enhancing skin tone. To this end, vinyl- and plasticlike finishes in makeup are expected to be among the major trends, and Lancôme is in the process of introducing a lacquer makeup that will create the much desired vinyllike finish. Lacquer, in general, can be described as a wet varnish from which a solvent dries to leave a very hard, durable, smooth and water damage-resistant color. In introducing lacquer makeup, Lancôme intends to create these very features in its products. To take the process further, materials that better interact with light continue to be a major area of research for cosmetics manufacturers.

Natural Cosmetics Create Price-resilient Demand

Parallel to the self-expression through bold looks trend, manufacturers are also looking into natural cosmetics—a popular area driven by greater health awareness and environmental concern. Apart from investing in new applications, marketers have also been tapping into natural color cosmetics. For example, L’Oréal’s Bare Naturale, a mineral makeup, has been well received by consumers. Revlon has also announced a natural line for Almay, Almay Pure Blends. Estée Lauder has gone further, purchasing a minority stake in Forest Essentials, a privately held Indian company that manufactures, markets and sells beauty products based on ayurvedic formulations.

New Product Development Not Enough; Value for Money Demanded

It is all well and good offering new products, but that, in itself, is not enough in the current market environment. Consumers are becoming very price-conscious, particularly to minimize the pressure on their purses. To this end, they are demanding products that offer good value for the cost. For example, masstige brands have been increasingly challenging premium brands. To make color cosmetics more acceptable to consumers, manufacturers will have to convince them that their products are a good value. New products such as battery-operated mascaras may achieve this because they are unique and designed to give a smoother finish, increasing the perceived value. Multipurpose cosmetics—foundations with antiaging benefits, for example—are also becoming increasingly popular.

Emerging Markets Offer Hope

In addition to new product development, emerging markets are coming to the rescue to counter slow growth in the West. Consumers in these markets now have more disposable income, and are increasingly taking to Western lifestyles. Latin America and Asia-Pacific are the two primary regions leading growth in the color cosmetics category. Noting this, Estée Lauder is focusing on India, and is planning to open as many as 20 outlets, covering all the major cities in the country. Its purchase of Forest Essentials is not only strategic positioning in naturals, but a move toward establishing share in a growing market, one that is well suited to the current market environment. L’Oréal posted its highest CAGR (21%) during 2001–2007 in Eastern Europe, followed by a 17% CAGR in Asia-Pacific during the same period, according to Euromonitor International. And all the major color cosmetics marketers are taking the BRIC markets more seriously.

Manufacturers Yet to Address Emerging Market Needs

Although emerging economies offer hope in the face of bleaker prospects in Western markets, color cosmetics marketers have yet to add color palettes and textures designed for the skin tones in emerging markets. Most facial makeup is designed for Caucasian skin tones, and thus is not a good match for consumers in developing countries with a different skin base. This is also true for other, more specific color cosmetic products, such as lipsticks and eye shadow—the suitability of which, again, depends on specific skin tone as well as climate and culture.

MAC is one of the few companies to have launched shades for consumers in emerging markets, and this appears to be reflected in the company’s strong CAGR of 17% globally, compared to 3% for Clinique and 4% for Chanel. Part of MAC’s growth was driven by Asia-Pacific and Latin America, in which it posted respective CAGRs of 14% and 13%. To further emphasize the importance of designing shades for skin tones other than Caucasian, Shiseido, a Japanese company with a particular focus on Asian skin tones, recorded a strong global CAGR of 14%. Other leading companies are now trying to catch up by setting up manufacturing units and research centers in various regional markets.

Color Cosmetics Prove Resilient in Economic Downturn

During the current economic downturn, color cosmetics have proven to be quite resilient. The segment has been described as small ticket luxuries, which consumers can afford and tend to substitute for expensive holiday gifts and accessories even as they tighten their purse strings. Consequently, color cosmetics marketers have posted positive growth from one quarter to another.

Looking Forward

It is vital that manufacturers invest in research and development to come up with new products that offer good value for the money. This is the only way to engender consumer loyalty, a key factor for survival in today’s market. More and more consumers will demand color cosmetics that are more closely tuned to individual skin tone, and in emerging markets, therefore, manufacturers should focus on introducing colors and textures that achieve this.

Oru Mohiuddin is a research analyst for personal care at Euromonitor International. She is responsible for contributing to the content and quality of Euromonitor’s personal care research, providing strategic analysis of companies and the global market.

![Curious about the latest trends in Beauty and Personal Care innovation? [download free report]](https://native-x.imgix.net/allured/65fde687b40d3e0001e2ce0d/_Thumbnail%20Image%201-19-24.jpg?crop=focalpoint&fit=crop&fp-x=0.5&fp-y=0.5&h=191&w=340&auto=format%2Ccompress&q=70)