- A Russian cosmetics market research group valued Russia’s beauty market at $9.2 billion in 2008.

- The market for upscale, luxury products has experienced a tremendous growth rate, with beauty retail developing more rapidly than the economy as a whole— expanding by 30–40% annually.

- Market growth has created new shopping habits, and major changes impacted beauty distribution channels—including the rise of channels non-existent a decade ago.

- Russia is still far behind Western Europe in the number of specialized stores, and beauty retail is far from being saturated.

- The recent 25–30% devaluation of the ruble has led to many local retailers that ignore list price recommendations and the wide use of discount policies, despite a significant fall in profits leading to a 10–20% decline in sales volume expected in 2009.

- Russian brand owners are gaining market share.

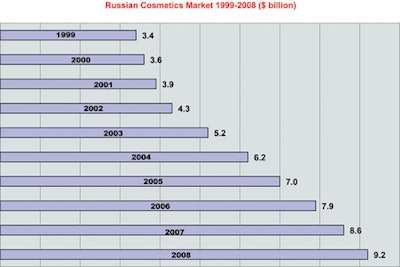

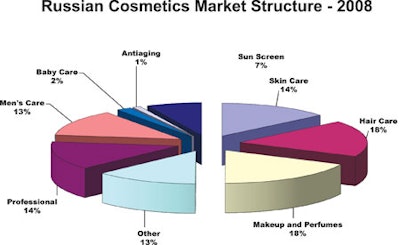

According to Staraya Krepost, a Russian cosmetics market research group, the beauty market in Russia reached a value of $9.2 billion in 2008 (see Figure 1) with the highest market share in makeup/perfumes and hair care, both at 18% (see Figure 2). The growing segments of skin care and professional cosmetics followed with 14%, and men’s care came in third with 13%.

From the beginning of the 1990s, the market for upscale, luxury products experienced the highest growth rate in the world, and has already become one of the five largest in Europe. Thanks to Russian women’s desire for beauty after the penny-pinching years of Communism, the Russian beauty market was growing by 20% annually by the early 2000s.

However, the growth slowed down to 10–15% by the mid-2000s, and the growth rate was only 7.9%, according to Staraya Krepost, by 2007–2008. During the Perestroika years, beauty retail was developing even more rapidly than the economy as a whole—expanding by 30–40% annually, second only to the grocery market (60–80%). And direct sales of cosmetics, especially in the makeup sector, grew an average of 8% annually during the last seven-year period. According to Romir Monitoring, Avon (47%) and Oriflame (32%) led catalog sales in 2007.

Market growth has also created new shopping habits, and major changes have impacted beauty distribution channels. During 1997–1999, nearly 40% of beauty products were sold in kiosks, open-air markets and department stores. Direct sales accounted for approximately 5% of sales, and specialized stores accounted for much of the rest—with almost no sales in pharmacies and supermarkets. The current distribution channel structure has taken 10 years to form, and now presents a quite different picture.

Speciality beauty stores account for approximately 30% of retail sales, followed by direct sales (20%) and pharmacies (10%). The number of kiosks and open-air markets dropped from 40% to 9% (see Figure 3). In addition to existing channels, totally new Russian sales concepts have surfaced—notably hypermarkets, the Internet and drogeries, a Russian version of the European retail concept, similar that of British chain Boots UK, where beauty products are sold along with pharmaceutical and hygiene products. The early attempts to develop an American model of a drugstore, combining a pharmacy with a grocery, were not successful. But the pharmaceutical channel is a large one, with the fastest growing Russian pharmacy chain, 36.6, currently operating 750 stores across the country. In addition, Russian retailers are demonstrating operational improvement as they work to cut sales channels for “gray market” cosmetics, mostly attributed to kiosks and open-air markets.

Improved Retail Experiences

Russia, however, is still far behind Western Europe in the number of specialized stores, and this channel is far from being saturated. Having been neglected in the Soviet era, it has (until a slight slump in 2007–2008) grown significantly and shows no signs of slowing down.

The rise in the number of specialized stores can be attributed to consumers’ demand for both higher quality products and better shopping experiences, in which customers can be advised by a skilled sales staff and makeup advisors. In the last four to five years, Russian cosmetic retail has expanded almost five-fold, with sales at the largest stores in Moscow and St. Petersburg gaining 200–300% annually. Out of the four major retail players, the uncontested leader in terms of the number of chain stores in Russia is L’Etoile, which dominates Moscow with 150 stores, and operates nearly 600 stores nationwide. Ile de Beaute (100 stores in Russia), Rive Gauche (32 stores in St. Petersburg and more than 40 across the country), and European chain Douglas (with 15 doors in Moscow) are the most developed retailers. Arbat Prestige, the former number-two chain, used to be Russia’s best known beauty chain, holding a number of agreements with global beauty brands. It, however, closed its last door in February 2009 due to liquidation, with its owner in prison for tax evasion.

Local Players—Leveraging Historical Success for Ongoing Growth

Currently, Russian brand owners, many of which also produce pharmaceuticals and household goods, are gaining market share. According to the data from a number of local sources, these companies account for 25–40% of the beauty market, operating primarily in the middle and low price range. There are a number of large, medium and small beauty companies in Russia (notably Kalina, Nevskaya Kosmetika, Svoboda, Nouvelle Etoile [formerly Novaya Zarya], Green Mama and Krasnaya Liniya) with established economy-priced brands—however, their products typically rely on imported ingredients.

A number of Russian beauty companies have long-standing operations, and are taking steps to maintain or improve their position in the market. The Kalina Consortium was founded in 1942 in Sverdlovsk (now Ekaterinburg) when the then oldest Russian cosmetics factory was evacuated from Moscow—an apt example of a Russian beauty company adjusting and thriving. Owner of the Black Pearl, Clean Line and Little Fairy brands, Kalina is the first Russian beauty company to gain ISO 9001 certification, and owes its rapid growth to economic reforms that changed the entire face of the Russian beauty industry. Now with production facilities in Russia, Ukraine and Uzbekistan, the company produces products in the skin care, hair care, oral care, makeup and perfume categories.

Another major Russian company, Novaya Zarya (or “New Dawn”) recently changed its name to Nouvelle Etoile to reflect its partnership with a French company. In the late 1700s, Russian nobility was infatuated by French culture and encouraged a number of skilled French craftsmen to start a new life in Russia. One of these emigres, Henry Brokard, founded the country’s first domestic perfume factory in 1864. After the Socialist Revolution of 1917, when all businesses were nationalized, the Brokard Factory was renamed Novaya Zarya, and its most famous creation, The Empress’ Favorite Bouquet, became the best selling Soviet-era perfume: Krasnaya Moskva (Red Moscow). Now, the company, as Nouvelle Etoile, it is actively introducing and selling perfumes through its own retail outlets in Moscow and other major Russian cities. Again, it is a company that leveraged its long-standing foothold and strengths while making forward-looking business moves to take advantage of current economic potential.

Toll of Global Economic Climate

The ongoing world economic downturn is changing market conditions in Russia. The recent 25–30% devaluation of the ruble has brought price increases and decline in consumer activity. Local retailers stopped following the brand owner list price recommendations, and began widely using discount policies, despite a significant fall in profits. In December 2008, L’Etoile reduced prices 40–50%, starting a price war among its competitors and driving a number of small independent stores into bankruptcy.

With a 10–20% decline in sales volume expected in 2009, the crisis, however, may bring positive changes to the entire beauty market—while profitability declines, the loyalty to products and brands increases, creating smart shoppers who will make targeted purchasing price/value decisions. This process will be a kind of cold shower for Russian consumers—who were, to a degree, confused and spoiled by new brand offers flooding the market throughout years of explosive growth.

Greg Grishchenko is a packaging consultant and independent market and technology specialist based in the U.S. He has carried out extensive research on Eastern Europe and the countries of the former Soviet Union, and is the author of several reports on the Eastern European packaging, converting and printing sectors. E-mail: [email protected].