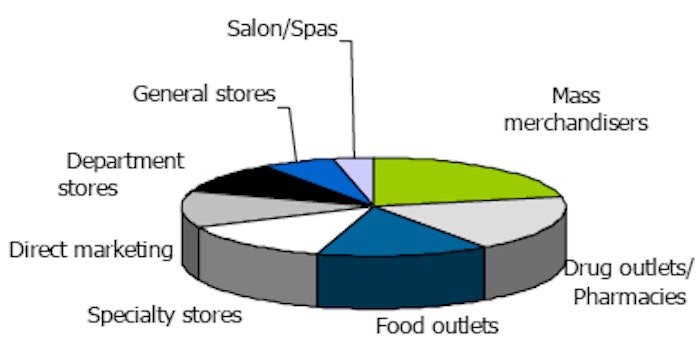

According to Kline & Company's Beauty Retailing 2008 Global Series, the cosmetics and toiletries market posted a respectable 3.9% growth in sales in 2008 despite the global recession, affirming that consumers will keep up their personal grooming and beauty habits no matter how dire the financial outlook may seem. But perhaps more important than the overall growth, the latest numbers indicate a significant shift in where consumers are shopping in nearly all of the major markets around the world. Channels that are posting declines in one market are experiencing growth in another. Marketers looking to compete on a global scale must stay ahead of the shift and examine local trends in retail patterns in order to compete in this complex market.

While the United States remains the dominant nation in the global beauty retailing equation with an 18.4% share, the emerging markets of the BRIC countries (Brazil, Russia, India, and China) continue to gain momentum posting double-digit gains, according to the Kline series. As these markets develop, consumers there are discovering the emergence of traditionally more Western retail formats. This delicate balance among distribution channels has enabled the industry to weather the economic storm fairly well, while other consumer goods markets have suffered worse.

Direct Sales Driven by Earnings Potential

As the fastest-growing channel worldwide, direct marketing posted an impressive 8.6% compound annual growth rate from 2003 to 2008. The current economic situation has made person-to-person sales an attractive earnings opportunity to help offset job losses. This, combined with the strong presence of the channel, has driven direct sales up by nearly 27% in China during the past five years. In Russia and Brazil, where direct marketing is still considered the primary purchase channel for high-quality cosmetics, sales have increased almost 20%, prompting leading marketers such as Avon and Oriflame to launch their pricier skin care products into these markets.

Meanwhile, in the largest, yet mature, direct sales market of Japan, the channel is losing share to other outlets—namely department stores, drug outlets/pharmacies, and specialty retailers as new, Western-style stores multiply.

Mass Merchandisers' Share Surges in BRIC Markets

Typically somewhat isolated from the effects of a dismal economy, the mass merchandisers channel may have suffered a tougher blow had it not been for stellar growth in the BRIC markets. Faced with a declining share from erosion by drug outlets/pharmacies and direct marketing, this channel eked out less than 2.5% growth in the United States. However, the developing BRIC economies posted double-digit growth in the channel: 14.1% collectively and around 25% each in Russia and India. The leading international retailers, Walmart and Carrefour, dominate in Brazil and China, with Walmart launching an aggressive expansion in Brazil through the acquisition of local chains.

Also contributing to growth through the channel, mass merchandisers have fine-tuned their product offerings and revamped store space to appeal to consumers and boost cosmetics and toiletries sales. By devoting more shelf space to naturally positioned brands, luxury and masstige products, and male grooming products (especially in India), the mass channel will continue to grow at a moderate rate.

Department Store Dichotomy

Perhaps the biggest dichotomy of all can be found in the department stores channel. The much-aligned stalwart of the American shopping mall has experienced a sharp decline in recent years, even before the economy began to falter. Shifting consumer patterns saw traffic move from the traditional mall to the strip mall and standalone stores, with specialty retailers offering a more intimate shopping experience, especially in the cosmetics and toiletries arena. Suffering the cost of high overhead and expensive real estate, the number of department stores in the United States and Europe has dwindled steadily—some closing up shop in the United States and others consolidating in Europe. Despite the notorious contraction, the U.S. is the only market to actually see sales decline in the channel, losing less than 1% of share.

On the other side of the globe, however, department stores are blossoming, with shoppers in India and China discovering this decidedly Western concept. Economic expansion in both countries has spurred new interest in shopping center developments anchored by major department store retailers. With more than 5,000 doors in China and 150 in India, the channel has become synonymous with the shopping “experience.” Department store sales of beauty products are up by 21.3% in India, albeit from a small base, and just above 19% in China, the third largest market in the channel. Clearly, all is not lost for department store brands on a global scale.

Market Hot Spots

The Chinese market stands out as the hands-down global growth leader for beauty sales, with double-digit gains in every channel. However, key hot spots exist in each of the top 11 markets examined in this report. Double-digit growth in every channel in Brazil also provides new opportunities for marketers, even in the absence of an established department store channel. Food outlets command a strong presence here, particularly in rural areas where there are few other options for consumers. Robust growth in the Russian market benefits modern retail establishments, such as the direct sales, specialty and mass channels, at the expense of the more traditional general store. Conversely, the Indian general stores channel, known as kiranas, maintain an overwhelming presence in the market with a 78% share and 9% growth, despite intensified competition from the department store and mass channels.

With overall sales growth for the global market expected to peak at 3.6% over the next five years, the outlook may seem a bit dim on the surface. But, as the individual channels continue to evolve, big gains are expected, particularly in developing nations. The key to success in this shifting global marketplace is to stay ahead of the curve for product and consumer trends with a diversified product portfolio and distribution strategy that allows for a nimble approach to strike while the iron is hot in a variety of channels and markets.