- Segmentation is a significant driver of growth in less developed markets, but there is also a reversal of that trend in other markets.

- Products that fit a natural niche are proving to be better placed to weather the storm of recession than standard premium-priced hair care products.

- Home colorants has received a boost from the recession.

- Consumers in key Western markets continue to firmly shift away from spending in premium channels.

- Innovation may not be enough in the current climate, and manufacturers should consider options in the mass market.

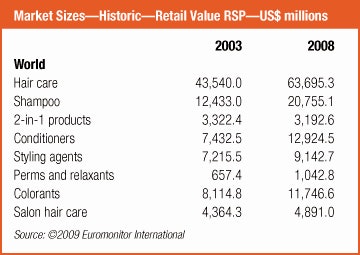

In 2008, the global hair care market was worth $63 billion, second only to skin care in terms of value size. In spite of the difficult economic climate, the segment still achieved respectable year-on-year value growth of 4%—slightly lower than the cosmetics and toiletries market as a whole at 5%. Although the recession is set to deepen, Euromonitor International believes hair care will continue to grow, posting a constant value compound annual growth rate of 1% in the next five years as consumers maintain an interest in new hair care products. That said, the industry has been far from immune to the impact of the credit crunch, and growth will be slower than in recent years, and lower than the anticipated compound annual growth rate of 2% for cosmetics and toiletries as a whole from 2008–2013.

Specialized Products Boost Sales Globally

Segmentation is one of the primary trends driving growth in less developed markets. Hair care products for different genders, age groups, and various hair types and needs are still a relative novelty in emerging regions, and are driving value growth in these markets as consumers are becoming more accustomed to buying several products to treat different needs. Antidandruff products are one of the most popular variants, as seen by the success of the Head & Shoulders brand—whose share has grown consistently in the past five years due, in great part, to the strong demand for the brand in China.

Pantene has also enjoyed global success thanks to its strategy of offering product ranges such as Colour Expressions Blonde, Perfect Curls and Enhanced Layers—each of which are tailored to highly specific hair needs and types. Male-specific hair care is one of the few areas where segmentation has struggled to boost sales, with the exception of styling products. Barriers to growth include the fact that men are still largely secondary consumers, and marketers have struggled to convince men to switch from standard hair care products. Brands such as the masstige-priced range L’Oréal Professionel Homme are, however, making some inroads into changing this situation.

Targeting Baby Boomers With Antiaging Hair Care

Antiaging skin care products have been the driving force behind global skin care sales during the past 10 years. With many key Western markets typified by an aging demographic, more and more hair care manufacturers have begun to realize the potential spending power of the baby boomer generation, and are launching products specifically designed to appeal to this lucrative consumer segment. Unilever’s Dove Pro-Age and Sunsilk’s Aging Care ranges, for example, are marketed as helping to restore hair’s youthful appearance.

Natural Hair Care Brands on the Rise

Naturally positioned hair care products represent a tiny but growing niche within the wider hair care industry, and are featured most in affluent key markets—notably the U.S., Germany and the U.K. Although value sales of natural products are negligible compared to global heavyweight brands such as Pantene, early indications are that they are proving to be better placed to weather the storm of recession than standard premium-priced hair care products. This is because consumers who buy natural products generally want to avoid the use of certain commonly used hair care ingredients such as sodium laureth sulphate or parabens. Because they perceive a tangible benefit in buying these products, they are less likely to trade down to less expensive brands or private label products.

Impact of Economic Climate

The effect of the economic downturn on hair care differs according to the product type. Consumers in most countries consider shampoo to be an essential purchase, but it has still been hit by the recession. Manufacturers have already begun to discount regularly to try to maintain pre-recession sales levels. This is resulting in consumers developing a habit of only purchasing shampoo when there is an attractive offer. Furthermore, many consumers, who purchased salon shampoo brands in positive economic times, have traded down to less expensive brands and private label products. Conditioners, on the other hand, still have a relatively low penetration rate in some key emerging markets, such as China, and are not considered a necessity. This means that as the recession deepens, the relatively low penetration rate conditioners already experience, could mean they’ll be dropped altogether from the shopping list in many households.

Home colorants is one of the few areas in the hair care industry, and indeed in the entire cosmetics industry, to receive a boost from the recession in some regions—particularly in Western countries such as the U.S. and the U.K. In these regions, many women previously thought nothing of paying £100 to have their hair colored at a salon. But as consumers are re-evaluating their spending habits, supermarkets in the U.K. have reported a rise in the number of home colorant products being sold. This, in turn, has sparked a wealth of new product developments—including Clairol’s Nice ‘n Easy Root Touch-Up, which is marketed for touching up roots between salon visits to help reduce the number of visits required to maintain the color.

Although the segmentation trend has been driving value sales, the recession is already leading to a reversal of that trend in many markets, and this has caused growth rates to slow—with consumers trading back down to less expensive brands and private label products. Private label still only accounted for less than 2% of total global hair care sales in 2008, but as consumers in key Western markets continue to firmly shift away from spending in premium channels such as department stores and head toward discounters such as Aldi or Lidl, which stock mostly a limited range of private label hair care items, the share of private label will increase.

Established Markets Continue to be Lucrative

Despite the strongest growth being achieved by emerging markets, the biggest region for hair care will continue to be Western Europe, which accounted for more than a quarter of total global sales in 2008, according to Euromonitor International. This is because it is one of the most mature markets for hair care products, and has a very high penetration of certain products—such as conditioners, which has yet to reach its full potential in other regions. For example, with value sales just shy of $3 billion in 2008, Germany alone accounts for higher hair care value sales than the Middle East and Africa combined (at $2.7 billion). Sales of salon hair care products have been particularly strong in key markets such as the U.S. and the U.K.

This means that, as the recession digs deeper, these regions will be hit harder than developing regions as consumers trade down. The biggest single market for hair care is still the U.S., with value sales of more than $10 billion in 2008, or a 16% share of the global hair care market. Americans are also the biggest consumers of salon hair care products, with an annual spend of $2 billion in 2008—though the recession has impacted sales of salon brands, which previously sold well because of their availability in key mass channels such as Wal-Mart. In 2008, the category’s sales nose-dived by 6% as consumers cut back on their spending. This contributed to an overall decline of 2% in U.S. hair care value sales.

The most promising growth regions are currently Latin America—in particular Argentina, where the hair care sector increased by around a third in value in 2007–2008—along with India and China, which are two of the biggest markets for hair care and are expected to continue to perform well in the next five years.

In China, people are now washing their hair far more often—the average is around once every two days compared to once every four days a few years ago. This has translated directly into stronger sales growth for shampoo and conditioners. In India, a rise in disposable income has resulted in consumers shifting away from buying a single bottle of two-in-one shampoo/conditioner for the whole family and embracing the segmentation trend by buying individual products tailored to gender, age or hair type.

In India, as in many other emerging markets, price is still a barrier to buying hair care products for many people, and manufacturers have tried to overcome this by selling sachets and smaller bottles of products that are more affordable. Sales of conditioners are being boosted by consumers shifting away from buying hair oil, traditionally used to moisturize hair in India, to Western-style conditioning products.

Price Key to Staying Afloat

With some exceptions, such as the natural hair care niche, consumers will continue to trade down globally to less-expensive products as the credit crunch continues. Innovation, though often touted as the key to survival in a recession, is simply not enough to prevent this from happening, and manufacturers operating solely in the premium hair care segment should consider a move into the mass market. In a similar vein, those whose primary focus is currently the ailing Western regions should shift their attention to emerging markets that are not as dependent on the fortunes of Western economies.

Carrie Lennard is a research analyst at Euromonitor International.