- Growth is anticipated to remain solid in the next five years, and the category will continue to outpace the rest of the C&T market.

- Scientific/medical positioning for the category has helped market growth, and new technologies are also emerging.

- The recent participation of large multinationals with their higher brand equity justifies higher price positions and supports values across the market.

- Sales of self-tanning products in a number of markets have been lost to tinted or active moisturizers with bronzing properties.

- There is strong demand for glamour-aligned brands in both protection and self-tanning, alongside clinical positions.

Long gone are the days when sun care meant getting as brown as possible. Consumers are increasingly aware of the link between UV exposure and skin cancer, and the top end of the market emphasizes protecting skin, rather than bronzing. The category has seen great technological improvements in the last several years, and looks set to push on and achieve further success.

Sun care was the most dynamic category in global cosmetics and toiletries in the 2003–2007 review period, according to Euromonitor International. Growth was partially exaggerated by its relatively low base (total sun care sales generated 2% of global value in 2007), but use of these products is becoming increasingly commonplace. This means that growth is anticipated to remain solid during the next five years, and the category will continue to outshine the rest of the market.

Necessity Primary Driver

Sales have primarily been driven by heightened consumer awareness of the dangers of exposure to the sun. Unlike in any other segment of the cosmetics and toiletries market, use of these products has been driven by necessity and products increasingly marketed with an emphasis on protection. Usage in some parts of the global market has been partly driven by public health campaigns. In Australia, for example, the Slip-Slop-Slap (slip on a shirt, slop on sunscreen and slap on a hat) campaign has significantly lowered the incidence of the most common skin cancers, and helped grow volume sales of sun care products.

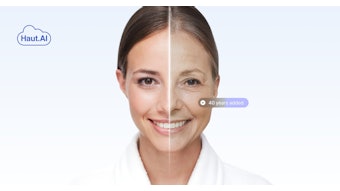

However, in true cosmetics and toiletries style, the emphasis on cancer prevention has increasingly been superseded by a focus on the link between unprotected exposure to the sun and premature skin aging. In a variety of markets, this has changed consumer attitudes toward tanning. International consumer beauty magazines such as Elle and Marie Claire push a fairly consistent line on reader education and the dangers of unprotected exposure to the sun. A 2007 poll by iVillage.com, a women’s lifestyle Web site, found that 53% of Americans did not believe that they looked better with a tan, while 63% stated that a tan does not make someone look more attractive. In fact, an anti-tanning trend has emerged. The number of poor self-tanning products or tanning salons that turn out leathery-looking consumers with orange skin has undoubtedly helped drive this trend, although the tanned look does remain extremely popular.

As a result of this increased consumer awareness, as well as a shift in cosmetics and toiletries fashions, sun protection was the most dynamic part of the entire global market, generating sales growth of 52% throughout the 2003–2007 period, according to Euromonitor International. The category was also the largest part of global sun care, generating 83% of global values in 2007. Geographic trends also underlined fashion trends. Asia-Pacific, for example, accounted for 18% of total sun care, but 21% of sun protection sales. A far higher premium is placed on a pale complexion in markets such as Japan and South Korea. These long-standing trends show little sign of abating, and in Japan the market was driven by products such as Kanebo Cosmetics’ Allie Whitening Protector and Nivea Sun Protect Whitening Gel.

Technological Development

Value development in the category has been further supported by the relative ease with which producers have added value to their products, largely taking their cue from developments in the skin care market. Typical developments in the review period included the addition of antiaging or moisturizing formulations, and levels of product development have been high. In Western Europe, more than 450 sun care products were launched January–August 2008. Herbal and botanical trends continued to grow, and products utilizing nanotechnology are being developed. However, research suggesting that nanoparticles may penetrate sun-damaged skin has caused concern about their increasingly widespread use in sun protection, and as a result sun care remains a step behind skin care.

Nonetheless, the inclination toward a more scientific/medical positioning for the category has helped market growth.

Consumers are largely unsure of exactly what is required for full sun protection, and manufacturers have exploited this uncertainty with a wide range of products that supposedly offer the correct coverage. Products that offer “photo-stable broad-spectrum protection” for example, which refers to products containing ingredients that offer long-term protection against UVA and UVB rays, have underpinned strong price positions within sun care, as producers push the idea that a high SPF product that only protects against sunburn-causing UVB rays is insufficient for proper sun protection.

Application technology has also greatly helped to underpin price positions, in particular the widespread use of sprays, which make the application process more convenient while increasing the average dose of each application. Other new technologies are also emerging, including “edible beauty” products such as lutein esters extracted from marigold flowers. Specialty chemical company Cognis claims that these esters improve skin hydration and elasticity, boost skin moisture and enhance the skin’s ability to protect itself from the sun. The sun care category, therefore, appears to be on the verge of a great leap forward, despite adverse market conditions that are lowering disposable incomes.

Big Beauty Brands on Board

The market has also been characterized by the entrance of cosmetics and toiletries manufacturers not traditionally associated with sun care. Companies such as The Estée Lauder Company and Clarins offer a wide range of self-tanning products. The position of these brands is more of pure beauty, although they are, of course, backed by proven research and development efforts. What these players offer is usually an improved version of the patchy or orange self-tanning products that characterize much of what is offered on the mass market, generally with some sort of added function such as moisturizing. The significantly higher brand equity that these producers bring to the market is of more importance. This justifies the higher price positions and supports values across the market. It has also helped blur the boundaries between sun care and other sectors in the global cosmetics and toiletries market. Again, the status of these manufacturers aligns their products more with color cosmetics or skin care. As a result, sales of self-tanning products in a number of markets have been lost to tinted or active moisturizers with bronzing properties.

Emerging Markets

In common with underlying cosmetics and toiletries trends, the strongest growth has come from emerging markets in Asia-Pacific and Latin America. According to Euromonitor International, in dollar terms, sun care values in Brazil grew by 233% from 2003–2007, compared to global growth of 50%. Sales were partially underpinned by the growth in disposable incomes in these markets. However, in several key markets sun care remains a niche product. In China, for example, value sales grew by 16% in local currency terms in 2007, with growth driven by skin-whitening sun protection products such as Dior Snow Sublissime UV and mass sun protection products such as Herborist Sunblock Emulsion.

However, a minority of consumers use sun care, partly because it remains beyond the means of the majority of the consumer base and partly because awareness of the need for protection is low. Demand for high SPF products is strong among the limited consumer base, but more from a desire for whiter skin than for sun protection. Most Chinese consumers are far more likely to cover up and use a hat for protection.

Nonetheless, the strength of growth in these emerging markets suggests that there is strong residual potential. Unlike other parts of the cosmetics and toiletries market, sun care products, especially sun protection, are not especially frivolous. Growing consumer awareness of the damaging effects of the sun on skin should support the strongest global growth in these markets, as young female consumption habits come into line with patterns in more developed markets.

A Bright Future

The global sun care market is expected to maintain strong growth throughout the forecast period, benefiting from many current key trends in the cosmetics and toiletries industry—for example, an aging global consumer base determined to resist the signs of aging, demand for functionality in as many areas of a cosmetics and toiletries regimen as possible, more scientifically and medically aligned products, and strong interest in emerging markets. The practical position of sun protection, the largest and most dynamic part of the market, will also support the value of the sector, as health campaigns increase consumer awareness of the need for protection.

Manufacturers have the luxury of being able to assume a variety of positions in the market. There is strong demand for glamour-aligned brands in both protection and self-tanning, alongside clinical positions. Both support solid price positions. Increasingly, this success will see sun care formulations spread across other categories—in 2007, for example, more than 400 hair care products with UV protection were launched in Europe. There is plenty of room for technological development across sun care, and thus the future looks bright.

Irina Barbalova is Euromonitor International’s global cosmetics and toiletries research manager.