- Sun protection products accounted for 85% of all sun care sales in 2009.

- The idea of a correlation between price and better protection from the sun has taken something of a hit in recent times.

- Other than protection, one of the main selling points in sun care was convenience.

- Self-tanners saw value growth drop by -4% globally 2008–2009.

- Asia represented 21% of world sun protection sales in 2009; demand for high SPF products and premium brands is strong among affluent consumers, who are looking for skin-lightening benefits.

- Global sun care is set to swell by $1.3 billion 2009–2014.

Despite dwindling value growth in Western regions, there is still plenty of mileage left in the sun care category, with fresh innovations, awareness of the risks of sunbathing and growing demand from emerging regions all helping to maintain demand for sun care, according to Euromonitor International.

Sun Protection Accounts for Lion’s Share of Sales

Sun protection products accounted for 85% of all sun care sales in 2009, up from 84% in 2008. Yet, despite consumers being more aware than ever of the potential dangers of the sun, value growth in sun protection fell from 9% in 2007–2008 to 5% in 2008–2009. The key factor in the dip was the recession-induced trend for consumers in key Western markets to become staycationers—holidaying in their (often cooler) native countries as opposed to flying abroad to sunny climates. According to Euromonitor International data, the total number of leisure departures globally fell from 576 million in 2008 to 553 million in 2009.

Trade Down to Private Label Sun Care Impacts Industry

Buy one/get one free offers and consumers trading down to less-expensive brands and private label impacted sales in crucial sun care markets such as the U.S. and Germany, where the idea of a correlation between price and better protection from the sun has taken something of a hit in recent times. Consumer test magazines have consistently rated certain private label products as better than certain branded products. In Germany, Stiftung Warentest, a widely trusted German consumer magazine, recently published efficacy tests of sun protection products that showed some premium-priced brands offer inadequate protection from the sun’s rays. As a result, the share of private label sun care rose from 26% in 2004 to 32% in 2009 in the country. Private label sun care is also emerging as a very potent competitor in the U.S., with its share rising from 7% in 2004 to 11% in 2009, according to Euromonitor International.

Globally, however, many consumers still aren’t convinced that private label is equally as effective as branded products. The share of private label sun care was still just 6% in 2009 due to this widespread lack of conviction and also limited availability in many key regions. Asia and Latin America (which accounted for a combined 32% of global sun care sales in 2009) both have a negligible share of private label sun care.

Low SPFs Fade Away

New product developments in sun protection are almost exclusively centered around high SPF protection. Recent innovations such as Hawaiian Tropic’s Ozone Ultimate Continuous Clear Spray, with SPF 80 and La Roche Posay’s 50+ protection fluid are now becoming the norm, while manufacturers have all but stopped development of sun protection products with an SPF lower than 10.

In Western Europe, the European Commission recently simplified its categorization of SPF products. Now only four segments exist: very high protection (50+ SPF); high (30 or 50 SPF); medium (15, 20 or 25 SPF); and weak protection (6 or 10 SPF). Both mass and premium brands anticipated this change and tweaked their ranges accordingly—Avene by Pierre Fabre, for example, replaced its 40 SPF sun protection with a 30 SPF.

Convenience is Key to Success

Other than protection, one of the main selling points in sun care was convenience, which resulted in the ongoing development of spray at the expense of the majority of other formats. Sprays makes the application of sun protection faster and does not leave a greasy residue. Bottles that can be used upside-down have emerged as a new trend, as well. Other formats still secured a large proportion of value sales in sun protection but were less dynamic in 2009.

Non-greasy Formulations Lead the Way

Responding to the trend toward higher protection factors and demand for lighter textures, L’Oréal introduced Garnier Ambre Solaire Light & Silky, a sun protection “milk” that absorbs more evenly and faster in comparison to standard products. Similarly, Garnier Ambre Solaire offered differentiated products for the winter such as UV Ski, available in sun protection creams and sticks.

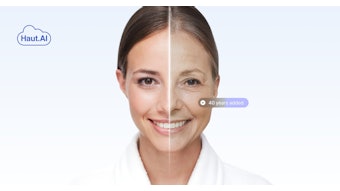

Antiaging a Key Focus

Consumers are increasingly paranoid—not just about skin cancer, but also the aging effects of the sun. In response to these fears, brands have continued to offer more sophisticated sun protection products with cosmetic claims, such as antiaging or age-spot preventing properties. L’Oréal Paris Solar Expertise expanded its line with the addition of Solar Expertise Active Anti-Wrinkle & Brown Spot.

Year-round Protection

Beauty companies not traditionally associated with sun care are continuing to enter the category with year-round sun block and antiaging properties. Recent launches such as Aveeno’s Positively Ageless sunblock and Johnson & Johnson’s Minesol sun care range (under the RoC brand) both aim to protect from the aging effects of the sun all year round.

Brands Utilize Skin Cancer Awareness in Marketing

In addition to developing higher factors, many brand owners have aligned their brands with various campaigns to raise awareness of skin cancer. In the U.K., Superdrug continues to lend its support to the Teenage Cancer Trust’s Shunburn campaign, with British popstar Leona Lewis as ambassador. The campaign aims to educate on how to stay safe in the sun. The funding includes a free “Burn Alert” text message system, warning people when sun is forecast. Sunless tanning brands have also jumped on this bandwagon with the “Save Your Skin” campaign, which focuses its message to school children throughout the U.K. toward raising awareness on the dangers of the sun—as well as petitioning the Prime Minister to ban coin-operated sun beds found in unmanned tanning salons, which are believed to be a contributing factor to the rise in skin cancer cases among the young.

L’Oréal’s La Roche Posay brand is also attempting to help raise skin cancer awareness with the launch of its My Skin Check Web site in May 2009. The site helps users evaluate their personal risk of developing skin cancer, instructing how to check your skin as well as offering advice on how to protect skin from the sun.

Self-tan; After-sun Sales Stagnate

Self-tanners and after-sun both remain comparatively niche, accounting for just 8% and 7% respectively of global sun care sales in 2009. Sun protection products are commonly used by many different age groups, while affluent young urban women are the main users of after-sun and self-tanning products. Sales of self-tanners are even on the decline after falling out of fashion in many countries. Despite some strong innovations in mass priced self-tanners—such as Alliance Boots Soltan Once Gradual Face, which contains SPF 25—many women no longer deem self-tan to be an essential purchase, and cut it from their shopping list as the recession hit. According to Euromonitor International statistics, this meant that the segment saw value growth drop by -4% globally from 2008–2009.

Hot Regions Maintain Growth

Most regions saw rather subdued value growth in sun care 2008–2009 compared to the previous year period, with the exception of Latin America (up to 14% 2008–2009 from 12%), the Middle East and Africa (up from 7% to 14%) and Australasia (just over 10%, unchanged from 2007–2008). The hot climates and growing disposable income levels in the former two regions make them perfectly poised to eventually catch up with Western Europe and North America in producing high per capita sun care sales.

Meanwhile, Australians took no chances with their skin. A study by the Australian Institute of Health and Welfare and Cancer Australia found there are currently nearly one million annual visits to general practitioners for the treatment of non-melanoma skin cancer in the country.

Asia Instrumental in Driving Growth

Thanks to the region’s obsession with pale facial skin, Asia represented 21% of world sun protection sales in 2009. Demand for high SPF products is strong among affluent consumers in the region, but more from a desire for pale protection than for sun protection. Skin-lightening benefits are key in countries such as Japan and China, and many sun care products now provide whitening and antiaging features in addition to SPF. The small percentage of male consumers who use sun care products tend to purchase mass offerings, while women account for the bulk of consumption of sun care products in the region and overwhelmingly prefer premium brands. This is why 38% of all Asian sun care sales in 2009 were comprised of premium brands, far higher than other key regions such as North America at 7%.

Outlook Best in Emerging Regions

According to Euromonitor International, global sun care is set to swell by $1.3 billion 2009–2014, just over half of the absolute growth seen 2004–2009. Despite the maturity of sun care in Western Europe, the region will be the biggest contributor to this growth, accounting for 29% of the increase in value sales sun care. However, the growing dominance of budget brands and private label in the region means that premium sun care manufacturers, in particular, may be better off focusing their attention on Asia—where the threat of private label having a serious impact on the sun care market is still rather a long way off.

Carrie Lennard is a research analyst at Euromonitor International.