F-1. Artificial intelligence (AI) stands out as having the greatest impact on beauty and personal care technologies in 2023 and beyond

F-1. Artificial intelligence (AI) stands out as having the greatest impact on beauty and personal care technologies in 2023 and beyond

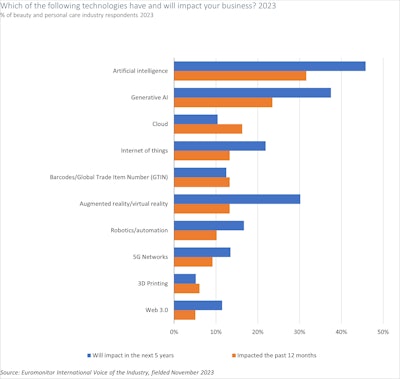

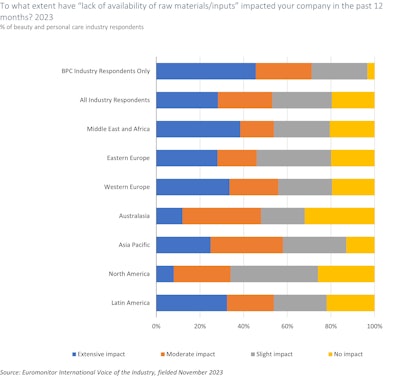

Fielded in November 2023, Euromonitor International’s Voice of the Industry—which surveys more than 1,200 industry professionals in 97 countries—revealed the top areas of current and future investment, leading company strategies, and key challenges facing the beauty and personal care industry.

Here's what we found.

Half of Beauty Organizations Investing in AI

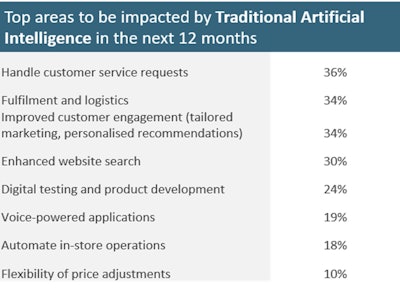

F-2. The industry expects different advantages from traditional AI (pictured) and generative AI

F-2. The industry expects different advantages from traditional AI (pictured) and generative AI

In fact, 32% of beauty and personal care industry respondents reporting AI affected their business in the past year, and almost half planning to invest in it in the next five years.

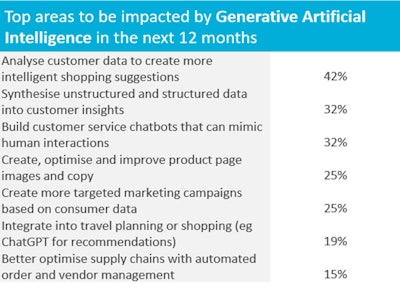

The industry expects different advantages from traditional AI and generative AI (F-2 and F-3, respectively).

Thirty-six percent of respondents plan to utilize traditional AI in the next 12 months to handle customer service requests, while 34% will do so to address logistics (34%).

At the same time, 42% plan to use generative AI to analyze customer data for more intelligent shopping suggestions.

F-3. The industry expects different advantages from traditional AI and generative AI (pictured)Euromonitor

F-3. The industry expects different advantages from traditional AI and generative AI (pictured)Euromonitor

Euromonitor predicts this will likely impact developing markets experiencing high demand for dermo cosmetics where there is less access to dermatologists, with consumers turning to these technologies as the next best, cost-effective option to improve skin health when they have difficulties accessing a doctor.

Ingredient-led Beauty is Here to Stay

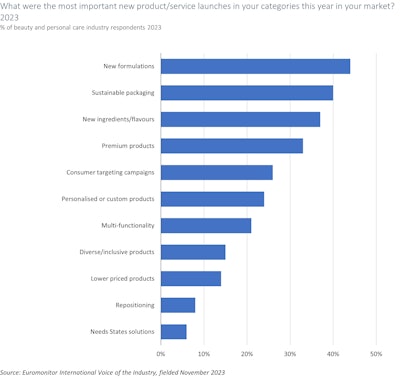

F-4. Formulations and ingredients are among the leading launches in 2023

F-4. Formulations and ingredients are among the leading launches in 2023

This type of ingredient-first product highlights the benefits of particular materials and empowers consumers to seek out specific actives to treat or prevent skin concerns, leading to a more personalized and efficacious skin care routine.

Ingredient-led beauty also demonstrates how bio-engineered ingredients can be just as effective as naturally derived ingredients. The result is greater consumer appetite for sustainability, biotech and international beauty concepts that contribute to a wellness-positioned view of cosmetic ingredients.

Formulations and ingredients are among the leading launches in 2023, with about 44% of beauty and personal care industry respondents focused on new formulations in 2023 (F-4). Additionally, 37% stated that most important launches were related to new ingredients, a figure notably higher than the 21% of respondents from all other industries.

With increasingly educated and efficacy-driven skin care consumers, players should continue focusing on hero ingredients. This will allow companies to meet the increasing need for solutions-based benefits, such as spotlighting products that serve specific needs or problems, like targeting dark spots or being safe for eczema-prone skin.

F-5. Among beauty and personal care industry respondents, 65% believe that rising cost of raw materials extensively impacted business

F-5. Among beauty and personal care industry respondents, 65% believe that rising cost of raw materials extensively impacted business

Among beauty and personal care industry respondents, 65% believe that rising cost of raw materials extensively impacted business (F-5).

Efficacious bioengineered alternatives to conventional naturals are becoming more appealing to the industry in 2024 in part due to lower cost, acting as significant motivators to lessen the sourcing and production footprint of ingredients used in beauty.

As a result, Euromonitor predicts ingredient-led beauty to become an even more appealing avenue for beauty and personal care players to achieve ingredient-driven efficacy and sustainability goals.

Beauty Still Has a Pricing & Inflation Problem

Beauty and personal care companies took these three top actions as a response to inflation in 2023:

- increased prices of some products/services (50%);

- accepted a lower profit margin (42%);

- and (3) increased prices of all products/services (32%).

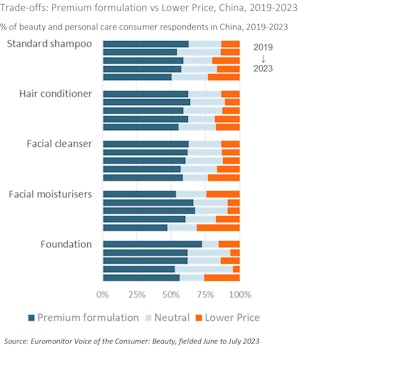

F-6. In China, consumers have not stopped their appetite of premium, but price is becoming a more important factor

F-6. In China, consumers have not stopped their appetite of premium, but price is becoming a more important factor

Consumers are making more considered decisions regarding their purchases, resulting in a polarization of spending. Some opt to trade down and limit their consumption of certain items to afford more premium offerings in other categories. Most consumers are opting to trade down when it comes to practical categories, like soap and depilatories, when the products are perceived to provide a similar outcome regardless of the price.

This year, global inflation is expected to moderate, though only at a slow pace. Despite a successful post-COVID-19 recovery in many categories of beauty and personal care, the industry is still being “moderately” or “extensively impacted” by inflation—felt by 91% of industry respondents, especially those in Latin America and Western Europe.

Despite challenges from inflation, the beauty and personal care industry is still heavily focused on expansion. Euromonitor International’s Forecast Model, last updated on February 5, 2024, predicts the beauty and personal care industry to grow by 5% in current terms in 2024, with standout performers being color cosmetics, fragrances and sun care. What is likely to linger in 2024 is consumer pricing sensitivity and further consumer trade-offs.

Inflation is not the only contributing factor of consumer pricing sensitivity. Euromonitor’s Voice of the Consumer survey, fielded in July 2023, found that in the most-used beauty and personal care products, Chinese consumers’ preference for lower price surged in 2023. In China, which is currently experiencing deflation and other indicators that suggest a wider economic downturn, consumers have not stopped their appetite of premium, but price is becoming a more important factor (F-6).

The Beauty Outlook for 2024 and Beyond

The global economy consistently outperformed expectations in 2023 but, in 2024, global economic growth is expected to slow to 2.7%, due primarily to the lagging effects of high interest rates and ongoing cost pressures for businesses and consumers globally.

As companies pivot to portfolio expansion, channel expansion, entry to new markets and greater consumer segmentation, Euromonitor expects rosier prospects in 2024. About 56% of beauty and personal care industry professionals expect 2024 performance to improve slightly from 2023, while 46% expect 2028 performance to improve greatly from 2023. Optimism among beauty and personal care professionals in 2024 will be driven by wellness-positioned products, technological developments, and innovations that widen consumer perception of value.