- Research by SKIM shows that, although there are a lot of conversations happening on social media about body care and its associated products, there is a lot of room for brands to improve how consumers feel about products.

- Consumers discussing body care on social media and who seem happiest with their body care products often use Tumblr, possibly creating the need for a positive visual when discussing body care online.

- Body care brands can use social media sites to learn where consumers are happy purchasing their body care products, what they look for in the products themselves, and their intent to repurchase products—as well as other factors.

Body care, which has seen sales pick up recently after some slow years, has the ability to be a significantly growing segment of the beauty industry, owing to seasonality, varied skin types, myriad of needs, and the plethora of remedies and treatments that brands offer for different parts of the body. Of more than 50,000 online conversations about skin care that were generated in early summer 2013, 67% were about body care, underscoring its importance in the beauty industry. Those results come from a 2013 study of body care brand representation in social media by market researcher SKIM.

The Dialogue in Social Media

The web space is alive with conversations that are freely and publicly available. Social media exists as a solution to candid insight where other research methods are either too advanced to yield a simple understanding or are simply outdated in a mobile-enabled, cosmopolitan world. Today’s consumers are empowered to go public through mass communication outlets such as tweets, blogs, product reviews, Pinterest images, YouTube videos and Facebook updates. And anything that becomes public—no matter the source or the medium—becomes the brand’s face in full view of all consumers, current and potential, as well as competitors.

It is a missed opportunity when brands do not find a way to organize social media and use it to shape marketing strategies. Or at the very least, take it as another point of view. SKIM researchers have found a way to organize social media’s “big data” bundle in a way that makes it actionable, which is much needed in the potentially vibrant body care category.

The key takeaway from SKIM’s body care study is an apparent overwhelming lack of positivity in the category, i.e. consumers are not thrilled with product offerings. Perhaps they are even confused by the overwhelming deluge that hits them daily. And more often than not, body care conversations are dominated with talk about product flaws or problems instead of success stories.

Although social media consumers tend to be more negative on the web in general, the study shows fewer positive perceptions in body care compared to other cross category studies conducted by SKIM in areas such as frozen desserts or condiments. Whether talking about product effectiveness, distribution and store preference, or the overall evocative emotions generated about brands, the body care category, overall, shows a need for more positivity. The good news is there are plenty of opportunities for this to happen.

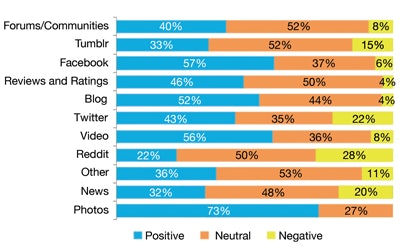

Where Consumers Talk About Body Care

While forums and communities represent the largest proportion of conversations, only 40% of these are positive. Tumblr, which has the second highest number of conversations about body care, represents 34% positive conversations and 15% negative ones. With the exception of Facebook and videos, all other platforms that generate body care conversations are less than 50% positive, exposing a wealth of opportunity for body care providers to boost positivity in the social media space. (Table 1)

The least talked-on platforms for body care were those that constituted primarily photos, which evoked 73% positive conversations, perhaps due to the importance of a visual impact in the beauty category as a whole. Brands can learn from this to boost visual content via larger presences on visual, photo-based platforms such as Pinterest and Instagram, alongside Tumblr.

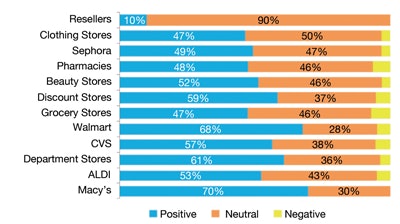

Favorite—and Not So Favorite—Stores

Chatter around the distribution of body care products shows a similar trend: the more a retailer is talked about, the less positive the conversations. While resellers are the largest source of conversations about the placement of body care products, they garner a mere 10% positivity. (Table 2)

Other highly talked about retailers are much more positive (47% at clothing stories, 49% at Sephora and 48% at pharmacies). Macy’s alone gathers 70% positive conversations, compared to 61% in all other department stores combined. This further exemplifies the need for body care providers to create meaningful retail partnerships to combat increasingly crowded shelf space.

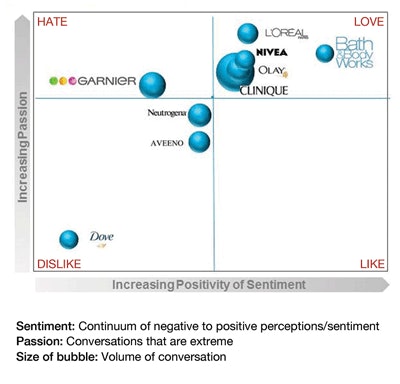

The Body Care Competitive Landscape

One of the key strengths of social media is that it allows brands to compare their position on an even, competitive landscape. Because consumers speak freely of their preferences and brands, a level playing field is difficult to acquire through classical, asking-based research. Consumers are less likely to talk authentically about a brand when asked a question, particularly when it is asked by the brand itself. A two-by-two matrix plots sentiment (a range of conversations that increase in positivity) versus passion (the strength of these emotions, which distinguish love from like and hate from dislike). Among body care products, the most talked about brand is Clinique, which falls into the “love” segment. Consumers like its dependability, and it has a loyal following. Consumers say things such as: “Been using it and it really works!” (via Facebook) or “I’ve loved everything I’ve tried in the [Clinique] line!” (via an online forum). (Table 3)

Clinique shares this space with less talked-about brands, perhaps indicative of lower distribution or sales volumes. They include three mass/masstige market brands: L’Oréal Paris, Nivea and Olay, and one specialty store brand, Bath and Body Works.

And while no brand is especially liked, Dove falls into a dislike segment, and Garnier to the hate side. This is due in particular to ideas like Dove’s selling of “lightening products” (via Tumblr), and Garnier’s perceptions regarding a product line that separates (via an online community). Digging deeper can uncover more trends about why brands occupy the spots they do—and what they can do to improve their perceived positioning.

Perceived Identity of Brands

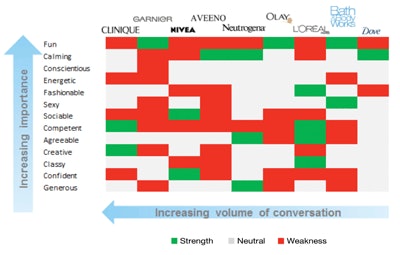

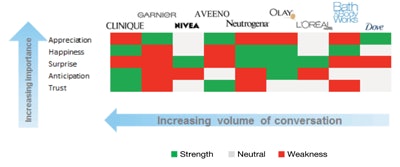

Social media can also be used in ways similar to traditional forms of research. SKIM researchers demonstrated this by using a grid-question approach to understanding different elements of personality and emotions that brands can stand for, identifying these as a strength or weakness. The results further build a case for the overwhelming lack of positivity in the body care market. (Table 4)

In terms of personality, the grid-question analysis demonstrates the kinds of brand profiles that consumers seek, which is a reversal of the way brand management typically works. In other words, while brands try to create a profile for themselves, social media reveals the consumer interpretation of this profile, thus providing a reality check.

In body care, consumers want their brands to be fun, calming and conscientiousness. However, only a handful of brands have a relative strength in these areas, while many fall short with an inherent weakness. Only Garnier, Olay and Bath & Body Works are considered fun brands, while Aveeno, Neutrogena and Dove are considered calming. No brand is considered conscientiousness.

Similarly, several brands have very few traits that they can capitalize on as strengths. If you look on the bright side, this offers brands a plethora of opportunities to create a personality for themselves that is both distinguishing and desired.

Keeping the interpreted brand profile in mind, consumers aspire to have feelings of appreciation, happiness and surprise from their body care products. While several brands evoke appreciation and happiness, they also embody weaknesses in other desired emotional evocations. While Clinique can improve its appreciation, it can claim a forte in evoking happiness, alongside Neutrogena, Olay and Bath & Body Works. One of the most loved brands, Bath & Body Works, only succeeds in evoking happiness, while it needs to improve perceptions of trust and surprise. (Table 5)

Both analyses help explain the love-to-hate matrix, too. Clinique, despite not having strengths in key personality traits, evokes happiness and anticipation, the former of which is much desired in the body care category. And Garnier, despite being fun and appreciated, has a solid weakness in every other type of emotion and personality trait, making it a likely candidate for its position in the hate quadrant. Similarly, Dove becomes a neutral-to-disliked brand owing to a lack of strength or weakness in many of these categories.

Purchase Behavior Via Social Media

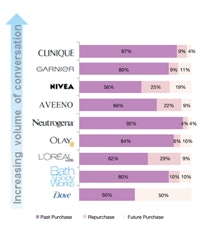

One of the main goals of marketing research is to assess purchase behavior. And sure enough, social media can help here as well. Naturally, most consumers speak of past purchases when sharing their interactions with brands. However, Nivea and L’Oréal Paris have consumers speaking the most about a repurchase, which is a high indicator of brand loyalty.

Conversely, Dove comes up as most talked about for future purchases, which might have been a good sign had Dove not been the least talked about brand overall. For Dove, this particular finding depends on a matter of proportions. Every brand should not only drive more conversation but also drive conversations that motivate repurchase and future purchase, all of which can help boost positivity. (Table 6)

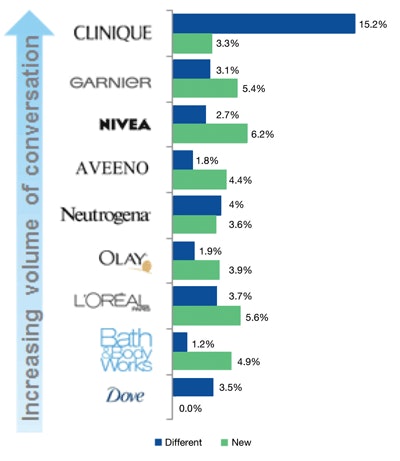

Every brand launches new products. In the body care category, which is saturated with moisturizers and body butters, being new and different is critical. One of the reasons Clinique’s emergence as most loved may be because 15% of its body care conversations are about different products, exceedingly more than any other brands.

Similarly, Bath & Body Works and Nivea emerge with the most conversations about new products at 6% each. This analysis also shows why Dove is perhaps a disliked brand, owing to a lack of conversations about new products and merely 3% about different products. (Table 7)

The Path Forward

Social media has proven to be beneficial not only for viewing brands on a level playing field but also as a complement—and perhaps even a replacement—for classical research about purchase behavior. While these examples show the body care category could benefit from more positive conversations, social media is ultimately a mirror brands can use to see themselves in a new light. Because, as beauty brand owners and marketers should well know, the role of a mirror is not just to show the truth but to reflect what can be improved and how.

Sourabh Sharma comes to SKIM with a keen eye for understanding consumer behavior. He adds perspective to marketing research from his years in brand management and product development at L’Oréal, where he launched hair color and makeup products for brands in Asia and North America. His work there allowed him to file for multiple patents and present a new technology at symposiums focusing on beauty. He built on this with his work in strategy consulting in the consumer sector, which allowed him to broaden his understanding of the beauty industry. With a multifaceted background, having earned degrees in engineering and marketing and an MBA from the Wharton School at the University of Pennsylvania and the Rotterdam School of Management, Sharma enables the firms he works with to acquire a stronger understanding of their end users. Furthermore, he strives to extract value from the evolving brand-to-consumer interface through his work in social media research.

!['Snoopy and Woodstock are cherished [characters] across generations and pairing them with our most-loved body care essentials creates a collection that feels classic with a modern twist. This launch is about celebrating our community with something unforgettable while starting an exciting new era for the brand,' said Luis Garcia, Chief Marketing Officer.](https://img.gcimagazine.com/mindful/allured/workspaces/default/uploads/2025/10/tree-hut-peanuts-fullcollection-fall26-1x1-1253.lGcuurUszp.jpg?auto=format%2Ccompress&fit=crop&h=191&q=70&w=340)