In today’s hyper-green culture, it’s easy to presume that everyone is striving to make cleaner, greener and more sustainable choices when it comes to their beauty and personal care product purchases.

Indeed, for many female consumers sustainability and being green are high priorities, but for others, electing to buy or use green and sustainable products is simply not top of mind because it’s not the primary benefit she seeks from her beauty and personal care products.

What’s more, in spite of a decade’s worth of consumer education and messaging around making more sustainable choices, many consumers are still bewildered by what sustainability means and how they can adopt more eco-friendly habits into their own beauty routines.

To understand more, The Benchmarking Company (TBC) surveyed more than 7,300 U.S. female beauty consumers about sustainability. In part one of our two-part series, we take a look at attitudes, habits, drivers, and influencers for everything green.

Consumers’ Top 3 Purchase Drivers

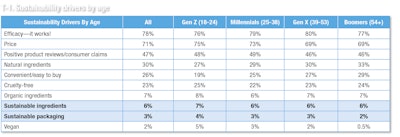

This study first asked respondents to select the top three attributes most important to them when considering the purchase of a beauty or personal care product. The result? Products that contain sustainable ingredients or sustainable packaging are not at the top of her list. Her top three drivers (T-1) are overwhelmingly dominated by how well the products work and what they cost:

- efficacy (78%)

- price (71%)

- positive consumer reviews/claims (47%)

- natural ingredients (30%)

- convenience (26%)

Sustainable ingredients and sustainable packaging were only important product attributes to 6% and 3% of consumers, respectively. Similarly, organic ingredients were important to 7% of consumers.

However, these stats don’t reflect how consumers feel about protecting the environment. When it comes to their level of commitment to being greener or protecting the environment, 41% rate their level of commitment at a four on a scale of one to five, with five being the highest, 31% rate themselves a three, and 24% say they are a five, or fully committed.

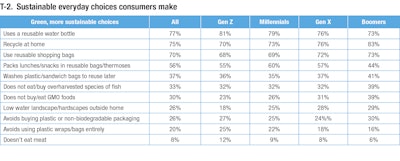

In fact, as seen in T-2, most consumers are making some sustainable choices as part of their daily routines.

What Does Sustainability Mean, Anyway?

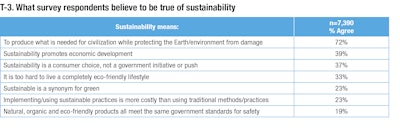

A further discussion of sustainability ensued. When asked, 72% of all consumers overwhelmingly agreed that, “The goal of sustainability is to produce what is needed for civilization while protecting the Earth/environment from damage.” They also agree that sustainability is, stands for or means several other specific things, as detailed in T-3.

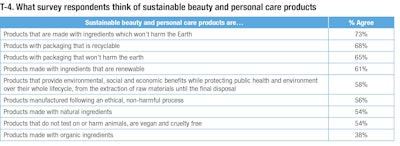

What consumers think when they hear the word “sustainable” in relation to beauty and personal care products, meanwhile, is detailed in T-4.

Sustainability and Purchasing Motivators

While being greener and opting for more responsible choices is attractive to many consumers, it’s not yet quite attractive enough to change purchasing behavior. Only 33% of survey respondents replied emphatically “yes” that they’d be willing to pay more for a brand or product that has sustainable manufacturing processes, while 53% said they might be willing to pay more.

Sustainability practices aren’t something that many consumers seek out when considering the purchase of a beauty or personal care product. The majority of consumers (53%) say they only sometimes research the manufacturing processes of the beauty/personal care products they buy, and 32% flat out say they don’t do any research at all.

Only 16% say that they always consider the impact of the manufacturing process of their favorite beauty/personal care products on the planet before making a purchase decision.

Even more surprising is the lack of attention consumers are paying to whether or not their products/packaging are recyclable: 50% of all consumers only sometimes pay attention to whether or not the beauty or personal care items they buy are made from recyclable materials; only one in three consumers always pays attention, and one in five doesn’t pay attention at all to recyclability.

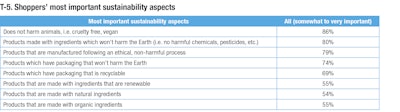

The sustainability aspects most important to consumers in the market to purchase beauty and personal care products are cruelty-free status, non-harmful ingredients and ethical manufacturing processes, as seen in T-5.

Signaling Sustainability

To help in their understanding about which products and brands are sustainable, survey respondents said they want visual cues such as a label that states whether packaging is biodegradable or made of recycled material (68%), USDA Organic and green certification/Green Seal labels/symbols (47%), a Fair Trade Certified seal (43%), and importantly, an explanation from the brand as to why they consider their product sustainable (43%).

The Shelf Life Challenge

When it comes to packaging, 63% of women say they prefer packaging that is a combination of any of the following: recyclable, reusable/refillable and biodegradable vs just one of these attributes.

Where she draws the line with sustainable packaging is shelf life. If sustainable packaging meant her favorite beauty or personal care product would have a shorter shelf life, only 28% of consumers agreed they’d absolutely be willing to make that sacrifice, while the majority (65%) said it depended on whether or not the product was something they’d use up quickly or not.

A Preview of Part 2

In part two of this report, we’ll take a closer look at how recycling and survey respondents’ recycling habits at home impact her purchasing decisions with regard to beauty and personal care products, including an exploration of refillable/reusable packaging, as well as the safety and sustainability of ingredients.

Author bio:

Denise Herich is co-founder and managing partner at The Benchmarking Company (www.benchmarkingcompany.com), which provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport and consumer beauty product testing for marketing claims. The company’s latest report is The New Age of Naturals, which provides a detailed look at the U.S. beauty and personal care consumers’ affinity for natural and organic beauty and personal care products and the motivators and influencers that drive consumers to purchase more natural and organic products than ever before.