This article is only available to registered users.

Log In to View the Full Article

Innovations in sun care from the United States and abroad are causing a frenzy of consumer excitement, whether those innovations are coming from Korea with advanced UV filters and pleasing finishes, or companies like Shiseido that are introducing protection that strengthens with heat, water and sweat.

For these reasons and more, the outlook for sun protection product sales is rosya, with sales expected to surge at 6.6% CAGR through 2031.

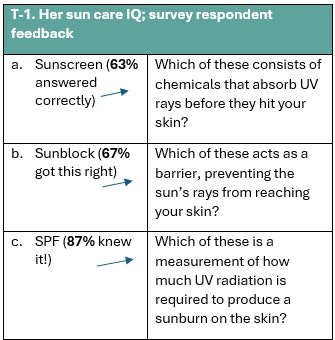

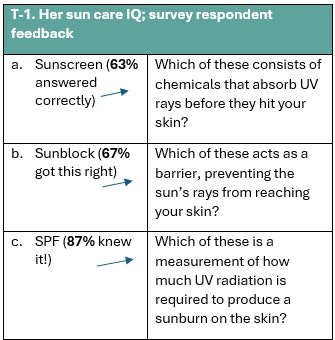

To learn more, in March 2024 The Benchmarking Company surveyed more than 2,600 U.S. females from its PinkPanel to learn what the shopper is buying now in sun care, along with the innovations she’s eagerly awaiting from your brand.

The Need for Protection

T-2. Lingering consumer questions about sunscreens

T-2. Lingering consumer questions about sunscreens

They also have lingering questions about usage (T-2).

With nearly three-quarters of consumers using sun care products more now than they did five years ago and 21% using the same amount, only 5% are shrugging off the urgency to protect against sun exposure.

Usage Patterns

One hundred percent of sunscreen users say they use it in the summer, 75% in spring, 57% in fall and 46% in the winter. Sixty-four percent of sunscreen users sometimes to always reapply their sunscreen if they’re still outside in the sun after 5:00 p.m.

Sun Care & Medical Professionals

In addition to using sun care products, 40% of survey respondents say they undergo a skin check by a medical professional on a yearly basis or even more often, and 28% do so every 2-3 years. Forty-three percent say that a medical professional has told them that they should use a sunscreen daily. When heeding this advice, 65% are applying a sunscreen with an SPF protection level of 50.

Her Sun Exposure Concerns

F-1. Top consumer concerns over sun exposure

F-1. Top consumer concerns over sun exposure

Eighty-five percent are concerned about wrinkles/premature aging; 81% worry about age spots/sunspots; 76% are concerned about skin discoloration/hyperpigmentation; 76% are concerned about skin cancer; 74% are concerned about burning; 66% worry about peeling/flaking skin; and 40% worry about bleaching or drying of her hair.

Current Sun Exposure Damage

As a result of sun exposure, 52% of respondents say they now have age spots/sunspots; 44% have freckles; 41% believe they have more wrinkles as a result of prolonged sun exposure; 32% have uneven skin pigmentation; and 29% attribute their dry skin to sun exposure.

Sun Care She’s Buying

Among purely sunscreen products, 62% of shoppers buy mineral sunscreen for the face; 61% buy chemical sunscreen for the body; 51% buy mineral body sunscreen; and 42% buy chemical facial sunscreen.

Top Sun Care Retailers & Yearly Spend

F-2. Annual sun care spend among survey respondents

F-2. Annual sun care spend among survey respondents

For a look at how much shoppers are spending, see F-2.

Shopper Preferences Favor Variety, High SPF

T-3. Shopper motivations for varying sunscreen product usage

T-3. Shopper motivations for varying sunscreen product usage

Fifty-three percent say they use different sunscreens because they’re marketed for different purposes, such as tanning, sports or waterproof performance.

Forty-eight percent buy a variety because they feel some sunscreens weigh differently on the skin; 47% buy a variety due to how different products feel on the skin overall.

Because of her varied needs, 46% buy three or more cosmetic products with SPF per year; 35% buy three or more chemical sunscreens a year; and 27% buy more than three mineral sunscreens yearly.

Sixty-five percent prefer an SPF level of 50.

Hybrids Win: Cosmetics/Skin Care with SPF

To protect her skin, 82% of consumers say buy cosmetics/skin care products with SPF whenever possible. Seventy-four percent say they currently use cosmetics/skin care products that contain SPF and they do so because:

- 84%: can easily be incorporated into my daily skin care regimen

- 76%: love products that do double duty–skin care benefits + skin protection

- 40%: believe their cosmetics/skin care products provide ample sun protection

- 39%: absorbs easier into skin than a regular sunscreen

- 39%: aren’t sticky/tacky like traditional sunscreens

- 32%: doesn’t leave residue on my skin post-wash

- 27%: doesn’t have a sunscreen smell/taste

- 23%: easier to remove at the end of the day

The cosmetic products containing SPF that she’s currently buying include facial moisturizers with SPF (72%), lip balm/lip products with SPF (69%), foundation makeup (60%), body lotions with SPF (34%), facial serums with SPF (30%), color cosmetics with SPF (29%) and tinting spray/lotions for the face/body with SPF (14%).

Sun Care Brand Favorites: Melanin Matters

Seventy percent of sun care users admit they aren’t brand loyal to any specific brand, but 52% have a current favorite. These favorites are 1) Banana Boat, 2) Neutrogena, 3) Supergoop!, 4) Coppertone and 5) Sun Bum.

Those with melanin-rich skin have slightly differing favorites; 39% of these sunscreen buyers say they specifically seek out sunscreens designed for darker skin tones. The favorites among melanin-rich buyers are 1) Black Girl Sunscreen, 2) Neutrogena, 3) Supergoop!, 4) Banana Boat, and 5) Elta MD tinted sunscreen.

Ingredients, Finishes & Application Preferences

T-4. Most-preferred sun care ingredients

T-4. Most-preferred sun care ingredients

She’d ideally like to see vitamin C included in her sun care ingredient profile (72%), followed by collagen (70%) and hyaluronic acid (70%) (T-4).

Matte finishes are most appealing to her (64%), followed by a dewy finish (63%), milky finish (43%), oil finish (42%) and a shimmery/glimmer finish (40%).

When applying sunscreen, 79% like to apply sunscreen from a tube with their fingers, 58% like an aerosol spray, 49% prefer a pump spray and 42% enjoy roll-on/glide-on applicators. Twenty percent are warming to sun care products in powder form.

Words She Values & Top Influencers

When consumers consider the purchase of a sunscreen product, 63% want to see the terms invisible and/or age-defense on the product (both tied at 63%), as well as sheer (45%), defense (44%), water (34%), transparent (33%), glow (28%) and reef-safe (24%).

The word invisible ties in with the top influence in her decision to buy—whether the product leaves a white cast on the skin after application.

An invisible finish is important to 73% of consumers when purchasing a sunscreen, followed by proof that the product works in the form of product reviews or claims (63%), that the product is multifunctional (54%), has a pleasant scent (48%), contains some natural ingredients (46%), and is affordable or on sale (40%).

Online articles or stories touting the “best of” sunscreens or “sunscreens to avoid” are noted as influential to 25% of respondents’ purchasing decisions.

She’d Like Sun Care Products with These Superpowers

The cosmetic products containing SPF that survey respondents are currently buying include facial moisturizers with SPF (72%), lip balm/lip products with SPF (69%), foundation makeup (60%), body lotions with SPF (34%), facial serums with SPF (30%), color cosmetics with SPF (29%) and tinting spray/lotions for the face/body with SPF (14%).Darya Lavinskaya at Adobe Stock

The cosmetic products containing SPF that survey respondents are currently buying include facial moisturizers with SPF (72%), lip balm/lip products with SPF (69%), foundation makeup (60%), body lotions with SPF (34%), facial serums with SPF (30%), color cosmetics with SPF (29%) and tinting spray/lotions for the face/body with SPF (14%).Darya Lavinskaya at Adobe Stock

She’s seeking sun care innovations that:

- 88% Tighten/restore crepey skin caused by UV damage

- 85% Reduce skin discoloration

- 84% Reduce appearance of dark spots

- 82% Provide UV scalp protection

- 79% Deliver SPF & moisture scalp products to prevent flaking

- 75% Protect hair from sun damage

- 69% Protect hair from chlorine or ocean water bleaching

- 69% Provide hair color fade protection from sun

- 68% Deliver natural-looking artificial tans w/SPF that lasts several days

- 58% Provide UV ray-blocking effects via oral supplements

Other innovations she’s eager to try include:

- UV protective face powder (66%)

- After-sun sheet masks (64%)

- Soaps designed specifically to remove sunscreen (55%)

Based in sun-seared San Diego, Denise Herich is co-founder and managing partner at The Benchmarking Company. The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus group, and consumer in-home use testing (IHUTs) for marketing claims and risk mitigation.

FOOTNOTE

awww.factmr.com/report/140/sun-protection-products-market