Beauty buying skews younger with each new generation, thanks to easier and faster access to products along with the steamrolling influence of social media. With the rise of Gen Alpha and Sephora kids, proliferating messages of aging prevention and children’s urge to start using skin care at a younger age have predictably caused parental concern and some industry backlash.

To understand the #SephoraKids phenomenon better, The Benchmarking Company’s August 2024 teen/tween beauty survey asked more than 2,600 parents about the beauty and personal care habits of their children, ages 7-17, encompassing Gen Alpha and the youngest members of Gen Z.

Here’s what we’ve learned: girls and boys as young as 7 are displaying enthusiastic interest in cosmetics and skin care, while their wary parents have specific brand needs and expectations for keeping their kids safe. Let’s break it down.

Kids’ Beauty Journeys Start Very, Very Early

The Benchmarking Co.

The Benchmarking Co.

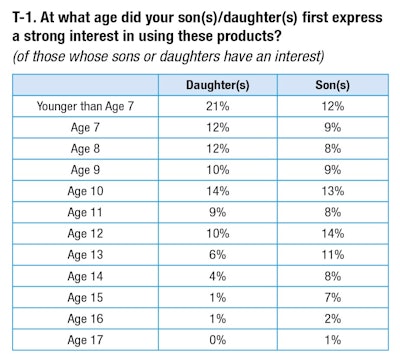

Many first expressed a strong interest in using these products to their parents at a very young age, with 69% of girls expressing interest at age 10 or younger, and 50% of boys at 10 years old or younger (T-1).

Twenty-one percent of girls and 12% of boys expressed this interest before they were 7 years old. While this may seem shocking compared to past generations, it shouldn’t come as a surprise.

This cohort was born into the social media age and, when given the opportunity to view television, a laptop or social media apps on a cellphone, routinely engage with beauty product ads featuring attractive young influencers.

Teens’ and Tweens’ Beauty Category Preferences: Girls & Boys

For boys, the top areas of interest are body care and hair care (both 88% interest among males). For girls, top interest areas include facial skin care and fragrance (both 92%), followed by hair care and body care products (both 91%).

Kids’ Social Media Usage & Key Influencers

Seventy-nine percent of teens and tweens are watching “these are my favorite things” videos; 25% are actually making this type of video.Dasha Petrenko at Adobe Stock

Seventy-nine percent of teens and tweens are watching “these are my favorite things” videos; 25% are actually making this type of video.Dasha Petrenko at Adobe Stock

That’s not a surprise given that children ages 7-17 are using their own YouTube (72%), TikTok (70%) and Instagram (63%) accounts to learn about beauty and personal care.

Many of them also participate in product marketing. In fact, 84% not only watch influencer videos, but 19% have created their own influencer video at least once. Other social media activities in which they’ve played a part include:

- Looking for product reviews (79%) or creating product reviews (24%)

- Watching “these are my favorite things” videos (79%) and making this type of video (25%)

- Viewing before and after photos (77%) and taking their own before and after photos (27%)

- Watching skin care and hair care tutorials (75%) and creating their own tutorials (16%)

- Watching “get ready with me” videos (74%) and filming their own “get ready with me" videos (22%)

While social media remains a strong influence on a child’s interest in beauty and personal care products (65% rank it so), a child’s social circle of friends holds the strongest sway (73%). Familiarity with beauty products (like mother like daughter) is an influence for 52%.

Tweens’ and Teens’ Skin Care Needs & Routines

Sixty-eight percent of parents say their children have a “skin care routine,” with 76% saying their children practice that routine both morning and night, using three or more skin care products (57%).serg at Adobe Stock

Sixty-eight percent of parents say their children have a “skin care routine,” with 76% saying their children practice that routine both morning and night, using three or more skin care products (57%).serg at Adobe Stock

- acne (69%)

- moisturization (59%)

- sun protection (58%)

- smooth lips (41%)

- soft/smooth skin texture (40%)

- maintaining glowing skin (39%)

Sixty-eight percent of parents say their children have a “skin care routine,” with 76% saying their children practice that routine both morning and night, using three or more skin care products (57%).

Kids’ Skin Care Brand & Ingredient Obsessions

Thirty-one percent of parents say their child self-describes themselves as being “obsessed” with a particular skin care brand.

Gen Alpha uses many skin care brands and may be more learned and thoughtful about cosmetic ingredients than their older cohorts. Parents say they’ve heard their child mention or ask for products containing:

- vitamin C (69%)

- hyaluronic acid (57%)

- salicylic acid (50%)

- retinol or retinoids (29%)

- niacinamide (26%)

- peptides (24%)

- acids such as AHA, BHA and lactic acid (23%)

Parents say they trust mainstream brands for their children, with top trusted brands mentioned including CeraVe, Bubble, Neutrogena, Aveeno and Cetaphil.

Kids’ & Parents’ Beauty Shopping & Spending Habits

When it’s holiday time or they’re having a birthday party, parents say 71% of their children ages 7-17 have asked for a high-priced fragrance product, 58% for a specific beauty brand product, 54% for Bath & Body Works gift cards, 51% Ulta or Sephora gift cards (tied), and 45% for a high-priced hair care device.

Ten percent of these children don’t need to wait for a special occasion to receive a beauty gift because they already have a cosmetics subscription. Top subscriptions include:

- 87% Ipsy

- 27% Allure Beauty Box

- 23% Walmart

- 16% FabFitFun

- 14% Beauty Fix

- 5% other

Some children use their own loyalty accounts when they shop at their favorite places for beauty, with 15% having their own Sephora loyalty account and 14% having their own Ulta loyalty account. Forty-one percent of children use their parent’s loyalty account.

Fifty percent of parents say the child’s overall beauty and personal care product spend is between $21 and $100 per month, which includes both their money and their parent’s money. For 35% of these parents, that spend is $101 or more per month, with 15% spending less than $20 per month on the child’s beauty and personal care products.

Teens/Tweens Favorite Beauty Products

Kids’ Favorite Skin Care

Fragranced shower products and facial moisturizers (tied at 70%) hold the highest appeal for teen/tween skin care, followed by:

- cleansers (67%)

- fragranced lotions or creams (62%)

- masks (51%)

- serums (29%)

Kids’ Favorite Makeup

Of the 31% of boys and 60% of girls ages 7-17 who use color cosmetics, lip products are the most desirable. Ninety-one percent use lip gloss, 86% use lip balm and 55% use lipstick. Other popular color cosmetics used by this age group include:

- mascara (79%)

- eye shadow (74%)

- blush (71%)

- eyeliner (52%)

- bronzer (41%)

- contour (36%)

- brow pencil (35%)

Kids’ Favorite Hair Care

Hair health and conditioning are important to 55% of children, with hair styling products holding high appeal (66%), along with hair devices (46%) and hair serums (35%).

Kids’ Fragrance Preferences

According to parents, 57% of children switch fragrances on a regular basis.

Teens’ and Tweens’ Favorite Beauty Brands

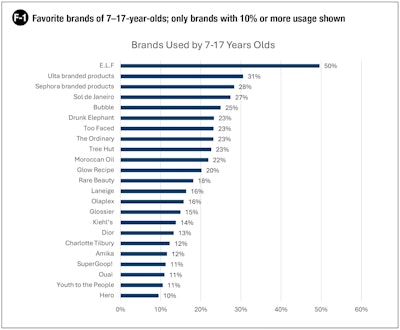

e.l.f. Beauty plays a big part in the teen/tween beauty frenzy, with 50% of those children interested in beauty and personal care using at least one of the brand’s products (F-1).

The Benchmarking Co.

The Benchmarking Co.

Parental Concerns for Gen Alpha and Gen Z

While an early interest in using skin care has led to positive behaviors among children (i.e., awareness of the importance of using sunscreen has never been higher), some parents have concerns about their early bloomers.Look! at Adobe Stock

While an early interest in using skin care has led to positive behaviors among children (i.e., awareness of the importance of using sunscreen has never been higher), some parents have concerns about their early bloomers.Look! at Adobe Stock

Seventy-five percent say they’ve discussed their child’s skin care routine with their doctor or dermatologist.

Seventy-three percent of parents believe that beauty brands are actively targeting the teen and tween market, and 56% are concerned the ingredients in some beauty and personal care products may be too strong for their child’s skin.

Forty-two percent say their kids spend too much money on beauty and personal care, and 29% believe their kids are being manipulated by marketers.

Parents say they would feel more comfortable buying beauty and personal care products for their child if brands provided the following:

- 80% if there were warning labels on products that may contain ingredients that are too strong for pre-tween, tween and teen skin

- 71% if the brand showed clinical and consumer claims that are substantiated using a panel of tweens/teens to measure impact on young skin/hair

- 63% if the products are recognized as “clean”

- 59% if the brand provided transparency (other than warning labels) about the product's suitability for young skin

- 56% if the brand had a line of products specifically designed for tween/teen skin

- 36% if the brand provided education online or in store about the ingredients

Based in sun-seared San Diego, Denise Herich is co-founder and managing partner at The Benchmarking Company. The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies through its 250,000+ female PinkPanel database, focus group, and consumer in-home use testing (IHUTs) for claims substantiation and risk mitigation.