It’s often said every artist is a cannibal and every poet a thief. Given the vast number of new ingredients at a formulator’s disposal, and how quickly brands move to incorporate them into their next product, it’s easy to see how this sentiment can apply to beauty. Yet even now, in beauty’s hyper-focused phase of something for everyone, ingredient stories and discoveries still dominate the consumer search for that “next great” product because ingredients are still the star of the show. How they work (or don’t); what benefit(s) they provide; proof of efficacy...what trends are driving ingredients and what are beauty consumers looking for in ingredients in 2025? To get these answers, The Benchmarking Company asked more than 3,000 U.S. beauty consumers to share their thoughts and opinions on ingredients.

This article is only available to registered users.

Log In to View the Full Article

It’s often said every artist is a cannibal and every poet a thief. Given the vast number of new ingredients at a formulator’s disposal, and how quickly brands move to incorporate them into their next product, it’s easy to see how this sentiment can apply to beauty. Yet even now, in beauty’s hyper-focused phase of something for everyone, ingredient stories and discoveries still dominate the consumer search for that “next great” product because ingredients are still the star of the show. How they work (or don’t); what benefit(s) they provide; proof of efficacy...what trends are driving ingredients and what are beauty consumers looking for in ingredients in 2025? To get these answers, The Benchmarking Company asked more than 3,000 U.S. beauty consumers to share their thoughts and opinions on ingredients.

Consumers Prioritize Ingredient Transparency in Skin and Beauty Products

Like a chef seeks the perfect ingredients to create a culinary masterpiece, consumers seek out products with their preferred ingredients that they believe are the best choice to help them address their skin and beauty concerns. Sixty-five percent always or most of the time read ingredient labels (when shopping for skin care or beauty/wellness products), and 62% look for ingredients they both want and don’t want in their products. Of all age groups, Gen Z is the most likely to use ingredient labels to seek out ingredients they don’t want (24%), followed by millennials (19%).

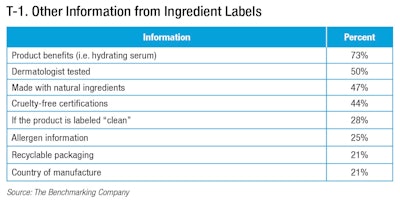

In addition to the ingredient list, consumers read labels to gather a trove of other information, including understanding specific benefits, cruelty-free certifications, allergen info, and where products are manufactured, among others (T-1).

Ingredient-Conscious Shoppers: How Consumers Are Redefining Beauty LabelsThe Benchmarking Company

Ingredient-Conscious Shoppers: How Consumers Are Redefining Beauty LabelsThe Benchmarking Company

Besides the information gathered from labels, consumers also look for other forms of proof to help them decide what products to buy, most notably claims. Nearly 60% rate consumer claims (i.e., 94% agree reduces the appearance of fine lines and wrinkles in 7 days) as highly influential, while nearly the same percentage of consumers feel similarly about clinical claims (i.e., reduces the depth of a wrinkle by 12%). Online reviews (69%) and before/after photos (62%) also rank “highly influential” to purchasing decisions.

Why Consumers Seek the Perfect Skin Care Ingredient: A Blend of Trust and Trend

If there’s one thing about beauty and skin care consumers that has remained steady over the years, it’s their quest to find that one product (or ingredient!) that is perfect for them.

When asked why they are eager to try new ingredients, 77% of respondents believe they might find something that works better for their unique skin care needs.

Consumers also believe new ingredients may be better multi-taskers and can address multiple skin care concerns (55%); innovative new products may work better than what is already on the market (35%), and new innovations/products will work quicker than what is currently available.  Consumers seek both trusted, proven ingredients and trendy new ingredients to meet their skin care needs.AdobeStock by Minerva Studio

Consumers seek both trusted, proven ingredients and trendy new ingredients to meet their skin care needs.AdobeStock by Minerva Studio

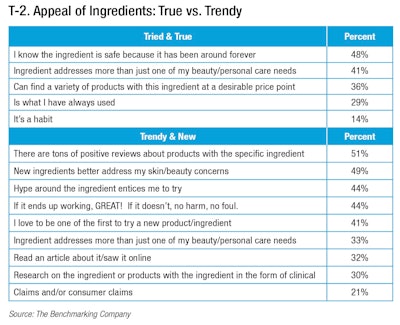

When asked to describe the types of ingredients they seek, it should come as no surprise that 65% of consumers indicated they want a combination of tried and true and new trendy ingredients to meet their needs. But are those needs the same? Not quite. Tried and true ingredients are appealing for just that reason: they can be trusted, they are proven and often more affordable and they are like an old friend. Trendy and new ingredients gain traction when other consumers start raving about them in reviews or hyping on social feeds, or the belief that they can better address skin concerns, and—many consumers just want to be one of the first to embrace the newest thing (T-2)!

Tried-and-True vs. Trendy: What Consumers Really Want in IngredientsThe Benchmarking Company

Tried-and-True vs. Trendy: What Consumers Really Want in IngredientsThe Benchmarking Company

With so many ingredients on the market, it’s clear they are still compelling purchase drivers for consumers across multiple categories, not just skin care.

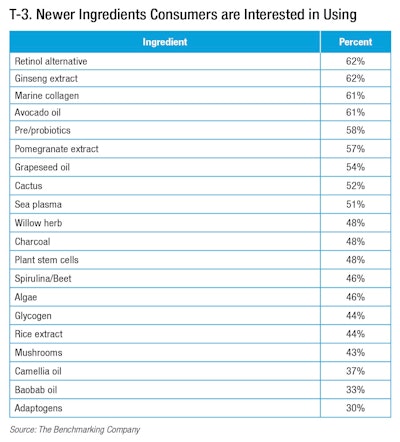

And while brands continue to offer formulations with the latest and greatest ingredients, only 6% of consumers seek these products vs the nearly 30% that look for formulas with trusted players such as hyaluronic acid (64%), vitamin C (62%), vitamin A/retinol (57%), aloe vera (50%), cocoa butter (43%), salicylic acid (43%), vitamin E (42%), niacinamide (41%), glycolic acid/caffeine (36%) and honey (29%). In terms of which newer ingredients consumers are interested in trying, those that closely resemble ingredients consumers are already familiar with, such as oils, herbs and gentle versions of acids, show high potential and interest (T-3). Retinol, a vitamin A derivative, is well-known for its anti-aging benefits. However, concerns about side effects and skin sensitivity have led consumers to seek gentler alternatives with similar effects.The Benchmarking Company

Retinol, a vitamin A derivative, is well-known for its anti-aging benefits. However, concerns about side effects and skin sensitivity have led consumers to seek gentler alternatives with similar effects.The Benchmarking Company

Even more interesting are the ingredients consumers told us they don’t know. Along with fairly obscure ingredients like Asparagopsis armata (66%), hydroxypropyltrimonium hyaluronate (61%) and NAD+ (57%), there are a handful of ingredients currently being used by well-known brands that consumers claim to not know/have not heard of, including ectoin (68%), Centella asiatica (61%), polyglutamic acid (59%), tranexamic acid (61%), beta-glucan (57%) and copper peptides (40%), among others.

For those early adopters already using skin care with newer ingredients, claims of superior benefits (58%) was cited as the number one reason the ingredient sparked interest in the first place as well as online reviews, and claims—both consumer and clinical. Things that aren’t spurring trials of newer ingredients? Buzz on socials (22%), the ingredient is used in other parts of the world/cultures (20%), and exclusivity or ‘it feels exclusive’ (15%) (T-4).

What drives beauty consumers to try new skin care ingredients?The Benchmarking Company

What drives beauty consumers to try new skin care ingredients?The Benchmarking Company

Consumers Warming Up to Biotech

Like the food industry, one of the newest frontiers for beauty is the use of bioengineered ingredients. A controversial practice, we wanted to know where consumers stood on biotechnology, or the use of living organisms to create products and technologies, and the role that biotech plays in the development of new beauty/personal care products/ingredients.

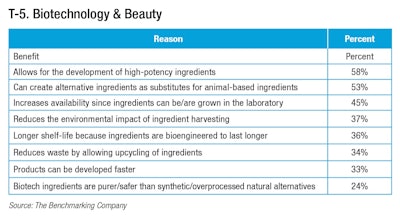

Overall, consumers are excited and see it as a positive association for the industry and more broadly, the planet: 52% are excited about innovations in beauty using biotech, 49% are excited for more high-performance products on the market, and 34% like that biotech can reduce environmental impacts (T-5).

Exploring biotech in beauty: How do consumers feel about bioengineered ingredients in personal care products?The Benchmarking Company

Exploring biotech in beauty: How do consumers feel about bioengineered ingredients in personal care products?The Benchmarking Company

The Importance of Clear and Accurate Claims in Beauty Marketing

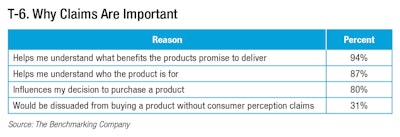

And finally, a bit more about claims and how they impact ingredient trends—or anything related to beauty. Consumers have told us and shown through their purchasing habits the importance of claims. And although 88% of consumers notice claims in the marketing of beauty and personal care products and 53% say product claims are more influential in their purchase decision than they were 2 years ago, nearly one in three respondents attest they have difficulty understanding the difference between a clinical and a consumer perception claim. And it’s not surprising (T-6).

Too often, brands label claims as “clinical” when they are consumer perception claims derived from an add-on survey to a clinical study. These are not clinical claims, nor do they necessarily follow the international standard, such as ASTM or ISO for consumer perception claims testing. So not only does this confuse consumers (bad enough), but it can also garner unwanted legal woes (worse).

What does this mean for brands? It means that while consumers seek out and trust claims, brands must ensure clarity in their messaging. Whether it’s a usage claim or a statement about a raw ingredient, consistency across all touch points is crucial for consumers to understand and believe the claims being made.

Beauty Claims Decoded: Building Consumer Trust Through Clear MessagingThe Benchmarking Company

Beauty Claims Decoded: Building Consumer Trust Through Clear MessagingThe Benchmarking Company

About the Author

Based in Reston, Virginia, Jennifer Stansbury is co-founder and managing partner at The Benchmarking Company. The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its Beauty by the Numbers, and consumer beauty product testing for marketing claims.

www.benchmarkingcompany.com