- Buoyant demand in Latin America helped sales climb 18% at fixed U.S. dollar exchange rates to $2.3 billion.

- Brazil leapfrogged the U.S. to become the biggest sun care market in the world in 2014, with spending reaching U.S. $1.7 billion.

- Most consumers, from East to West, perceive sun care as a product with very specific function.

- There’s a need for increasing consumer awareness that sun protection is part of a larger skin wellness regimen.

- Getting closer to consumers through social media platforms will be especially important.

It’s a slippery slope when a product category becomes over-reliant on discount activity to drum up demand. Take wine: Its year-round, 2-for-1 deals are now the norm in some Western markets. As a result, millions of consumers only buy wine if it is on sale. Not surprisingly, suppliers’ margins are getting battered.

The sun care category has more in common with wine than one might think. Like wine, it urgently needs to recruit new consumers. But, unlike wine, it is locked into a cycle of increasingly aggressive pricing to attract those consumers.

In the U.K., for example, the buildup to summer 2014 saw a dizzying array of 2-for-1 sun protection deals in leading supermarkets and pharmacies.

The problem with discounting in sun care is that consumers will not think twice about stockpiling. That rationale is simple enough: Grab a good 2-for-1 deal if you see one and store away the surplus sun protection or aftersun until it’s needed.

In the U.K., indeed, it will be interesting to see if sales in 2015 drop off on the back of the previous year’s higher-visibility promotions.

Multitasking

It’s easy to see why discounting might seem an attractive route for sun care brands. The category has been negatively affected by the proliferation of multifunctional skin care and color cosmetic products, most of which now have UV protection as one of their default functions.

Women, especially, increasingly rely on products such as BB and CC creams for their daily UV protection—as well as on body lotions as an alternative to aftersun.

If anything, these trends have narrowed the occasion profile of traditional sun care products. Yes, many people still buy sun care brands for their summer (and winter) vacations, but even in the vacation period, skin care and color cosmetics are seizing some of the momentum.

A Latin American Lifeline

Such fierce cross-category competition is taking its toll. In 2014, sun care’s global retail value grew at its slowest pace in a decade, according to the latest data from Euromonitor International (based on values at fixed U.S. dollar exchange rates). Tellingly, growth in North America and Western Europe was flat.

The category was bailed out, to a large extent, by buoyant demand in Latin America, where sales climbed 18% at fixed U.S. dollar exchange rates to $2.3 billion. In fact, Brazil leapfrogged the U.S. to become the biggest sun care market in the world in 2014, with spending reaching $1.7 billion.

Brazil (and Latin America as a whole) is battling strong economic headwinds at the moment, however. If spending power were to tighten significantly, which appears likely, we could see more and more Latin American consumers skimping on their sun care.

It means there is little room for complacency among global sun care brands currently doing well in the region.

Three Big Challenges: Functionality, Segmentation and Occasion

The challenge for sun care brands is to come up with more innovative ways of driving sales, especially in the developed markets. Rather than competing on price, brands need to win over consumers with more effective functionality and segmentation strategies.

In relation, there remains a need to increase the occasion usage of sun care, especially in markets where consumption is primarily fueled by summer vacations.

To some extent, innovation in functionality is already happening. In Western Europe, for example, a handful of brands are bringing a more sophisticated tan-maximization technology into play.

While in Asia Pacific (where the West’s tanning fashion is turned on its head), there are growing numbers of sun care brands offering skin lightening technology. In both cases, however, the impact on the overall sun care category is still quite small.

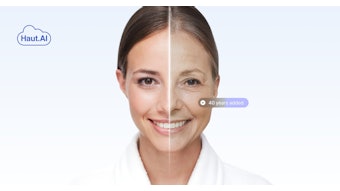

The problem is that most consumers, from East to West, perceive sun care as a product with a very specific function. To be clear, it was always going to be easier for skin care and color cosmetics to broaden their functionality platforms because these products were already part of a daily beauty regime for millions of consumers.

It was a case of adding value to something that people were already buying into.

The challenge for sun care is much bigger because the category is straitjacketed by its heritage as an occasion-specific product. Even in Brazil, where sun care has managed to elbow its way into the daily routine of growing numbers of middle-class women, its usage still declines markedly outside the summer vacation season.

Connecting With Consumers

It will take time to change consumers’ perception of sun care. Stronger development of brands with anti-aging, moisturizing and skin-hydration benefits will definitely help. But sun care brand owners also need to get better at increasing consumers’ awareness of the differences in efficacy between their products and the multitasking skin care and color cosmetics products in which sun protection is only an added benefit—not a primary function of the products.

The sun care category needs, perhaps, to be more aggressive in its marketing and less aggressive in its pricing.

Getting closer to consumers through social media platforms will be especially important. This type of connectivity has helped, to an extent, in Brazil—but sun care still lags a long way behind color cosmetics and skin care in its social media profile. Overdependence So, are the storm clouds gathering around sun care? The simple answer is: yes. The latest projections from Euromonitor International show Latin America fueling 62% of the category’s absolute global growth (growth in incremental retail value) through 2019. Such a high level of dependency, in a region tipping toward economic instability, is risky.

At the same time, consumers in Western markets are starting to get comfortable with their multitasking skin care and cosmetics brands (and brand loyal to boot). How long before those brands start eating significantly into sun care’s vacation occasions, too?

Keep in mind that consumers are buying those brands not because they are cheap (on the contrary, they are often quite pricey) but because they give the impression of offering good overall value.

It is, in short, their functionality and convenience driving the demand. Promotion-wielding sun care brands need to cotton onto this—and fast.

Rob Walker, senior fast-moving consumer goods analyst, Euromonitor International, can be contacted at [email protected].

Reproduction in English or any other language of all or part of this article is strictly prohibited. © 2015 Allured Business Media.