In China, as consumers’ demand for skin care has become increasingly sophisticated and science-based, home-use beauty devices have gradually become an important step in the skin care routine.

Euromonitor International projects the 2024 market size of small personal care appliances in China to reach $7.4 billion, with a constant CAGR of 2.4% between 2024 and 2028. Among small personal care appliances, the beauty device market has witnessed rapid growth, attracting new players pouring in the market.

However, with the introduction of new regulations for beauty devices in 2024, the market landscape is poised for a significant reshuffling.

Millennials Lead Growth

Driven by the trends of the “joyful economy” and the “beauty economy,” Chinese consumers’ demand for skin care is shifting toward precise scientific routines. The popularity of content marketing on social media, such as XiaoHongShu and Douyin, has deepened consumers’ understanding and accelerated the need of at-home beauty devices.

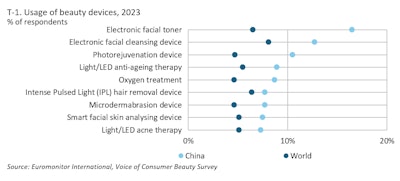

According to Euromonitor International’s Voice of Consumer, Beauty Survey 2023, Chinese beauty consumers embrace beauty devices at a higher rate than the global average. Electric facial toners, for example, were used at home by almost 17% of Chinese beauty consumers—up from 13% in 2020.

Brands are also constantly deepening insights on consumer demand by developing segmented skin care functions, such as eye care, jawline lifting, etc. Usage benefits tended to resonate most among millennials, particularly since millennial females have the highest spending power on beauty products and services. Generation X is the next largest user group, followed by baby boomers.

Most Popular Beauty Devices in China

LED beauty devices with various wavelengths address distinct skin concerns, including acne, allergies, skin whitening and brightening. And, compared to RF devices, LED devices are more suitable for sensitive and acne-prone skin with less irritation. This is a critical distinction because, in 2023, 16% of Chinese cosmetics consumers reported sensitive skin issues—up from almost 14% in 2021.

Moreover, when using mask-type LED products, consumers can also safely open their eyes and move their hands freely.

Integrating Devices Into Beauty Routines

In 2023, Lancôme unveiled its new device for Rénergie product line at the 6th China International Import Export event.Lancôme

In 2023, Lancôme unveiled its new device for Rénergie product line at the 6th China International Import Export event.Lancôme

A pivotal factor influencing their purchase decisions is the synergy achieved by using beauty devices in conjunction with skin care products. Over social media, influencers have played a significant role in promoting these synergies by demonstrating how to maximize efficacy with different combinations of topicals and technologies.

Furthermore, the market has witnessed an expansion of skin care brands moving into devices and vice versa. In 2023, Lancôme unveiled its new device for Rénergie product line at the 6th China International Import Export event.

Many beauty devices now come bundled with skin care products like serums and face masks. For instance, Chinese brand QuasarMD highlights the booster effect to attract consumers by offering device and skin care kits.

Multifunctionality and Personalization to Drive Premiumization

“Smart personalization” has emerged as a key feature of premium products. Smart beauty devices now not only offer a range of different functions, but also include visual skin analyses through mobile apps and tailored programs addressing various concerns.

One notable example is the Chinese brand OGP, which has introduced the concept of intelligent systems in its new Photorejuvenation device. This device can emit three different wavelengths of photons to target melanin, redness and dullness, respectively.

Users can get their treatment programs customized, including the usage cycle, duration and recommended wavelengths, all based on skin analysis results through the connected mobile app.

Looking ahead, beauty device players will need to focus on providing a seamless user experience in addressing consumers’ evolving skin care needs with technology.

New Beauty Device Regulations Could Reshuffle the Landscape

Leading local Chinese brands like Flossom (pictured), Yaman, OGP and AMIRO have already begun their clinical trials to obtain China's new medical device registration.

Leading local Chinese brands like Flossom (pictured), Yaman, OGP and AMIRO have already begun their clinical trials to obtain China's new medical device registration.

To better regulate the RF beauty devices, China’s National Medical Products Administration has issued the “Radiofrequency Beauty Device Registration Review Guidelines” that will regulate RF devices as Class III medical devices, which is the highest-risk level of medical devices. Starting in April 2024, the production, import and sale of RF beauty devices is now prohibited unless medical device registration is obtained.

The new regulation is expected to change the current competition landscape of the RF beauty device market, and long-tail brands without qualifications will be eliminated. With the stringent regulation, the threshold for the RF beauty device industry will increase, and the unit price is likely to rise.

Leading local Chinese brands like Flossom, Yaman, OGP and AMIRO have already begun their clinical trials to obtain the medical device registration. In the future, beauty device products with innovation and true efficacy are likely to win the market.

The Future of Beauty Devices in China

The beauty device market in China has witnessed remarkable growth. With advancing consumer knowledge and rising demand for beauty devices, as well as the newly introduced regulations further standardizing the market, overall market competition will gradually shift from price competition to product innovation and scientific validation.

The increasing demand for high-efficiency skin care products and the widespread acceptance of non-invasive aesthetics indicate that the demand for beauty devices will increase further.

The implementation of new regulations will lead to a major reshuffle in the industry. Brands without medical device permits will be filtered out, leaving only top-tier brands, which may cause a short-term volume decrease and price increase on the overall market size.

In the long run, it means a shift in market competition from marketing and price competition to product innovation and scientific support.

!['[W]e can predict better ingredients, faster, with our best-in-class models that we have invested in over several years,' says Joshua Britton, Ph.D., founder and CEO of Debut.](https://img.gcimagazine.com/mindful/allured/workspaces/default/uploads/2025/08/debut-biotechnology.c4slA2p7t3.jpg?auto=format%2Ccompress&fit=crop&h=191&q=70&w=340)