Achieving that perfect hair day—when hair looks fuller, shinier, more youthful and effortlessly holds a style all day—is a goal of many women. Consumers now understand that good hair and scalp health is the means to attain that goal.

This article is only available to registered users.

Log In to View the Full Article

Achieving that perfect hair day—when hair looks fuller, shinier, more youthful and effortlessly holds a style all day—is a goal of many women. Consumers now understand that good hair and scalp health is the means to attain that goal.

In recent years, hair care buyers have become significantly more concerned about hair and scalp health, and beauty brands have responded en masse to help solve some of her most pressing concerns. With promises of mending, repairing and bonding hair, women are flocking to products that give them healthier, smoother, shinier, and more moisturized looking and feeling hair.

In a recent primary study of 3,200-plus U.S. female hair care buyers, The Benchmarking Company’s latest research reveals how consumers define hair and scalp health, what hair and scalp concerns top their list, which products they use, and the results they expect from these products.

What She Knows About Her Hair

Ninety-seven percent of U.S. women surveyed say that hair health is important or very important. But does she understand that hair comprises dead cells into which life cannot be infused? Does she understand that, consisting of keratin and protein, strong bonds are what give hair a healthy appearance and feel?

In this study, the majority of respondents correctly indicated that each hair strand is made of dead organic matter or cells, just like fingernails. However, hair can still appear either healthy or unhealthy, with 98% saying the use of hair care products can make hair look and feel healthier.

Her Definition of Unhealthy Hair

Brittleness, excessive shedding and strand fraying are all visible signs of unhealthy hair according to 98% of women surveyed. Other visible and tactile signs of unhealthy hair include:

- hair that breaks/snaps when brushing (79%)

- loss of shine or luster (65%)

- frizz (55%)

- hair thinning (53%)

- lack of volume (29%)

Ninety-eight percent of respondents agree that healthy-looking and -feeling hair begins with the health of the scalp. According to 99% of those surveyed, she believes that hair health can be impacted by stress, nutrition and underlying health issues. She recognizes that scalp health is a critical component of having a healthy-looking head of hair.

Issues with the scalp are thought to cause rough hair, lack of shine and hair breakage, according to 94% of those surveyed. Ninety-seven percent agree that scalp inflammation affects the growth and health of hair, while 96% agree that poor scalp health can cause premature hair loss.

What She’s Using

Taking care of her hair is not a one- or two-step process. Sixty-two percent of survey respondents note they use more than three products daily to improve or maintain hair health. The usual suspects top the list with 94% using shampoo and 85% using a rinse-out conditioner. But, her hair care regimen is more comprehensive than just a wash-and-go.

Products Used to Improve Hair Health/Reduce Damage

- 94% shampoo

- 85% rinse out conditioner

- 60% leave-in conditioner

- 54% wide-tooth combs

- 47% moisturizing hair treatments

- 44% hair masks

- 42% hair oils

- 41% heat protectant products

Sixty-five percent of women surveyed purchase products specifically marketed to address hydration and moisturization concerns.

Products designed to combat frizzy ends grace the carts of 57% of women surveyed, while 41% purchase products to smooth the appearance of split ends. She is also concerned with the damage caused by heat styling. Heat damages the structure of the hair and separates the chemical bonds that make hair look and feel smootha.

In an effort to improve hair’s healthy appearance, this consumer purchases products marketed as damage repair (69%), strengthening (58%), volumizing (54%) and bonding (20%).

Expectations of Bonding and Repair Products

Many bonding and repair products work to fix broken chemical bonds that occur in the hair shaft. Products formulated to include amino-acids, the molecules that combine to create proteins, can chemically strengthen hair by operating much like keratin, the predominant protein in the hair shaft. When these chemical bonds occur, hair appears smoother, silkier and less frayed—or, in the mind of the consumer, healthier-lookingb.

Ninety-five percent of respondents in the study say they expect a product marketed as a repair or bonding treatment to change the look and feel of her hair.

The top reasons she purchases hair care products marketed as “repair,” “bonding” and “strengthening” are to reduce the appearance of damaged hair (79%), leave hair looking healthier (78%), feel healthier (72%), feel more moisturized and less dry (75%), appear smoother (73%), and feel softer (72%).

She also understands these benefits won’t last forever.

Eighty-eight percent of those surveyed believe a bonding or repair treatment is temporary. “Wash and wear” is how she describes the length of time she expects the results to last, with 63% expecting the product to work only until the next wash or the product washes off. Eighty-six percent of respondents noted they would still purchase a mending, bonding or repair product that indicated the results would only be temporary.

She Cares About Her Scalp

According to a study documented by the National Institutes of Health (NIHc) “scalp care is essential because it determines the health and condition of the hair and prevents the diseases of scalp and hair.”

Study respondents agree. Ninety-six percent of respondents note that it is just as important to take care of the skin on your scalp as it is to take care of your facial skin, and 82% are currently purchasing products designed for scalp health.

Her Scalp Care Beliefs

- 96%: poor scalp health can cause premature hair loss

- 97%: the health of your scalp can be impacted by diet and stress

- 97%: scalp inflammation affects the growth and health of hair

- 92%: scalp health affects hair health

Scalp Care Awareness is Growing

Scalp conditions were once stigmatized, whether it was dandruff, alopecia, or red, flaky bumps associated with eczema or psoriasis. But no longer: these conditions are now diagnosed with more frequency. Women today suffer from a range of scalp conditions, including itchy scalp (42%), dry scalp (40%), dandruff (26%) and oily scalp (23%).

The past three years have witnessed a double-digit increase in consumers’ interest in caring for the scalp.

During the past three years, 23% of respondents have begun purchasing (for the first time) products designed especially for her scalp; 24% have bought more scalp-specific products than she did three years prior; and 34% have purposely reduced the number of times per week she washes her hair and scalp.

Today’s consumer is more aware of ingredients that may be harsh to her delicate scalp, with 39% noting she reads labels more now to ensure that the product is free of harsh ingredients.

A gentle shampoo is what is best for your scalp health according to 92% of those surveyed. Sixty-eight percent believe washing away excess oil on the scalp is important to maintaining a healthy scalp, while 89% indicate that more washing does not equate to a healthier scalp.

Her Scalp Care Favorites

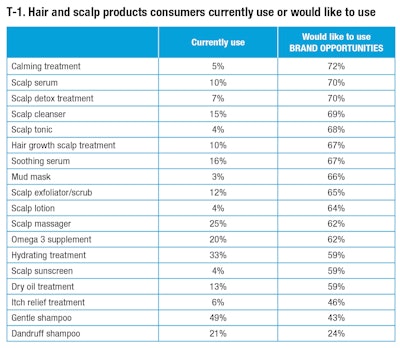

As awareness of the importance of scalp health continues to rise, the myriad of products on the market designed to resolve even her toughest scalp issues will see higher adoption rates. Given the extensive interest in newer scalp products, including calming treatments, serums, detox products, cleansers and tonics, we can expect to see scalp care as its own defined step in her health and wellness routine.

She’s using a number of products now, with an eye toward trying other scalp scare solutions. (T-1).

Shining the Spotlight on Your Hair and Scalp Care Products

Survey respondents offered some advice for brands to successfully market their hair and scalp products.

Seventy-five percent expect brands to clearly detail what the product does and state the benefits on the package. Sixty-nine percent suggest engaging real consumers in pre-product launch research, and most expect to see themselves reflected in brand marketing—women of all ages and ethnicities, with a variety of hair and scalp issues.

Consider consumer focus groups and consumer perception studies for hair and scalp products pre-launch. Buyers want to see proof that the product is effective in the form of consumer claims from women like themselves, with 86% saying these claims are important to very important to her purchase decisions.

________________________

Based in sun-seared San Diego, Denise Herich is co-founder and managing partner at The Benchmarking Company (www.benchmarkingcompany.com). The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport, and consumer beauty product testing for marketing claims.

Footnotes:

ahttps://koreascience.kr/main.page?&lang=ko

bwww.allure.com/story/bond-building-hair-care-products

chttps://www.ncbi.nlm.nih.gov/pmc/articles/PMC5551307