A version of this article was presented as part of the 2024 Beauty Accelerate event in Los Angeles. Stay tuned for details of our 2025 edition. -Editor

This article is only available to registered users.

Log In to View the Full Article

A version of this article was presented as part of the 2024 Beauty Accelerate event in Los Angeles. Stay tuned for details of our 2025 edition. -Editor

The global hair and scalp care market is expected to grow and an annual rate of 6.6% from now until 2028a, with prestige hair care growing 14% in 2023, per Circanab.

U.S. consumers are doing their part to keep the category moving strongly forward, with more than 95% of U.S. females buying at least one hair care product for themselves in the past 6 months.

To take a deep dive into the hair care products she’s buying now and what she’s looking for from brands in the future, The Benchmarking Company conducted a primary online research study in February 2024 of more than 3,300 U.S. female hair care consumers.

Here’s what we found.

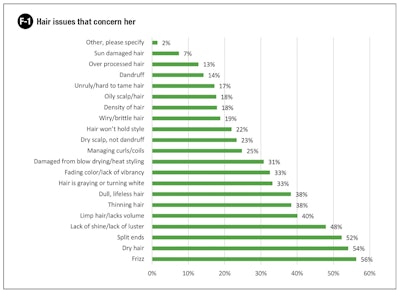

She’s Got Issues

These issues are followed by graying hair (33%), hair that lacks vibrancy or has color fade (33%), heat damaged hair (31%), managing curls or coils (25%), dry scalp issues (23%), hair that resists holding a style (22%), and wiry/brittle hair (19%).

Only 1% of respondents surveyed said they have no current hair concerns.

What She’s Buying & Why

Traditional shampoos (99%) and conditioners (96%) remain the most popular hair care products she buys, with 47% saying they wash their hair 2-3 times per week. Fifty-four percent of respondents say they have 3-5 bottles of shampoo and conditioner in their shower right now.

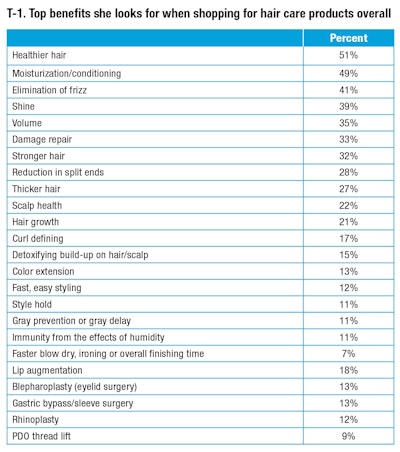

Ninety-seven percent say they look for specific benefit statements on their shampoos and conditioners that can assist with their current concerns, as detailed in T-2.

Specific problem-related hair care products were purchased with less frequency, as they are need-specific. These products include scalp treatments (17%), hair loss/thinning solution products (13%), keratin products (12%) and gray protection/gray delay hair products (3%).

Ingestible supplements to combat hair issues are currently used by 27% of respondents for these reasons:

- Make hair healthier

- Reduce hair loss

- Strengthen the hair follicle

- Reduce constant shedding

- Improve health of the scalp

- Delay/reduce gray hair

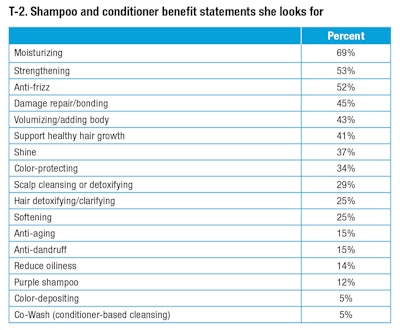

Spending Patterns for Hair Care

Hair Care Retail Preferences

Superstores (61%) remain the consumers’ top retail outlet for hair care products, followed by Amazon.com (55%), Ulta or Ulta.com (43%), Sephora or Sephora.com (36%), drug stores (26%), a hair care brand’s own website (23%), discount department stores (21%), grocery stores (17%), salons/spas (16%), beauty specialty stores other than Sephora or Ulta (16%), and big box stores such as Costco (13%).

Less than 10% of respondents said they buy hair care regularly through a subscription box service (9%), upscale department store (7%), a traditional beauty online retailer such as netaporter.com (5%), direct sales (3%) or home shopping channels (3%).

Hair Care Brands Aplenty, Loyalty is Rare

Only 6% say they never switch their shampoo, conditioner or styling product brands.

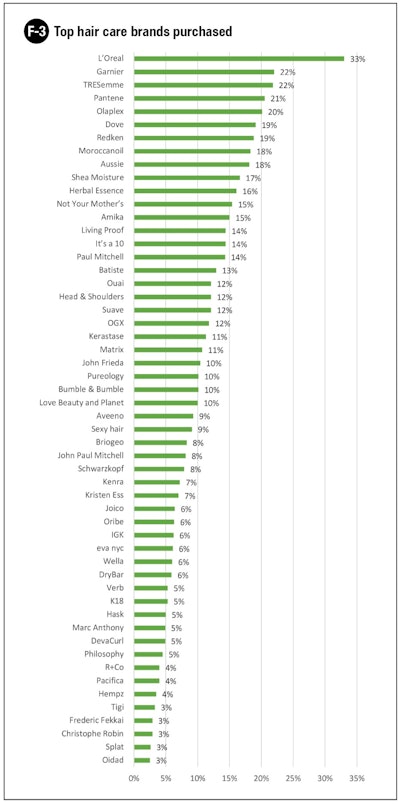

The most popular brands she’s using now (F-3) are in the mass or masstige category, with few exceptions. L’Oreal continues to dominate consumer hair care, with 33% saying they purchase the brand’s products. Garnier and TRESemmé follow (both at 22%), followed by Pantene (21%), Olaplex (20%), Dove and Redken (both at 19%).

Scent as a Buying Motivator

When considering the purchase of a new hair care product she’s never purchased, 33% say the smell of the product can act as a purchase motivator.

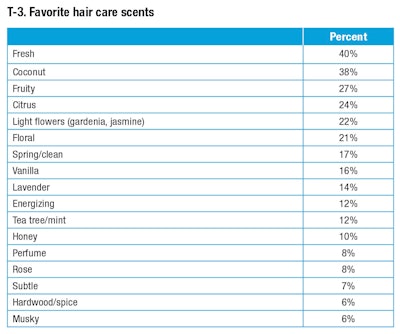

Her favorite hair care product scents include those that are fresh (40%; T-3), coconut (38%), fruity (27%), citrus (24%), light flowers (22%) and floral (21%).

Ingredients of Importance

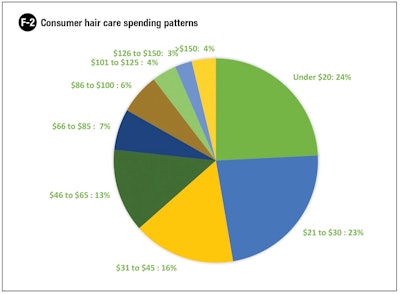

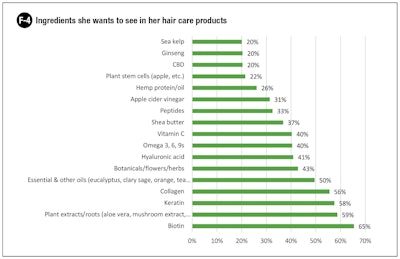

Biotin, the water-soluble B vitamin, remains the workhorse ingredient for healthier and fuller hair, and is a desired ingredient by 65% of hair care buyers (F-4). Plant extracts and roots (59%), keratin (58%), collagen (56%), essential and other oils (50%), and botanicals (43%) remain at the top of her ingredient lists.

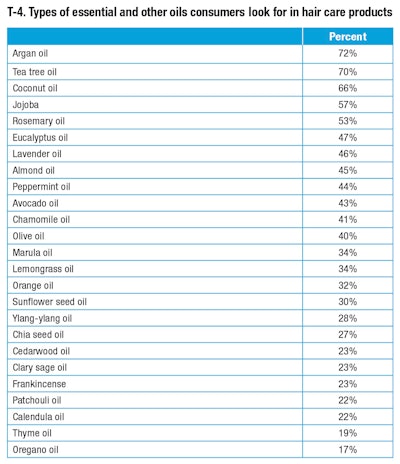

The array of specific essential and other oils consumers seek in hair care products is much more extensive (T-4), with argan oil topping the list at 72%.

Skinification Trends & Her Wish List

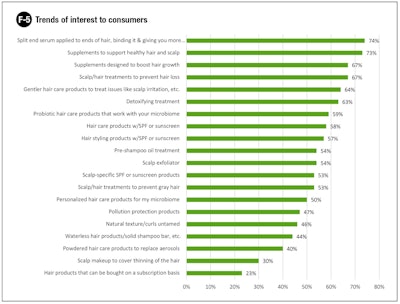

When asked to rank a wide range of current trends and future product possibilities, 74% said they would like to see a split end serum product that is applied to the ends of hair, binding it, and giving the consumer more time between haircuts.

Hair care supplements for healthy hair and scalp (73%) and hair growth boosters (67%) were product types that are highly anticipated for those who don’t already take supplements.

Probiotic hair care products that work with one’s microbiome were intriguing to 59% of respondents, with hair care products containing SPF (58%), styling products containing SPF (57%) and scalp care products containing SPF (53%) also ranking highly.

Connecting with the Consumer

“In a retail store” and through friends and family were in the top five on respondents’ lists of where they first learn or new hair care products, but social media is a much stronger mechanism for communicating with the next generation of buyers (T-5).

Top Buying Influencers: the Tipping Point

Other than basic affordability, we asked women about their top influencers when it comes to purchasing an unfamiliar hair care product. What pushes her over the edge to make the buying decision?

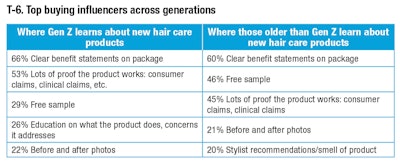

First, consumers must see clearly communicated benefit statements on the package—understanding exactly what the product is intending to do or help is important (T-6).

Proof of efficacy, in the form of consumer claims from independent studies, clinical claims, and before and after photos, are paramount to her decision to add your new brand to her bathroom shelves.

Based in sun-seared San Diego, DENISE HERICH is co-founder and managing partner at The Benchmarking Company. The Benchmarking Company provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport, and consumer beauty product testing for marketing claims.

FOOTNOTES

awww.grandviewresearch.com/press-release/global-hair-care-market

bwww.circana.com/intelligence/press-releases/2024/growth-streak-continues-for-the-us-beauty-industry-in-2023-circana-reports/