Korean beauty gets a lot of attention because of its elaborate steps and unusual product formats and ingredients. Much of the K-beauty brands that have transitioned to the United States and other markets tend toward the prestige side of the market.

But Janice Kang, director of marketing and new business development, and Sunyoung Lee, director of purchasing, for Club Clio (of DK Cosmetics) say that mass in Korea is eye-catching, offering playful packaging that captures consumer excitement. It’s specifically this dynamic that DK Cosmetics and its sub brands seek to bring to the United States and beyond (see About DK Cosmetics).

Making K-beauty More Discoverable

DK Cosmetics’ brands have begun to appear in mass channels, including Amazon (Dr.G), Target (Derma Dr. Lab), Ulta (Goodal) and Walmart (Soo Ae, Derma Dr. Lab), offering both value and performance to a new group of consumers.

Lee and Kang note that products such as masks are ideal for inspiring impulse purchases and offer an effective way to make K-beauty more discoverable. Because DK Cosmetics owns its means of production and distribution, so it can offer the Soo Ae brand at low prices.

DK Cosmetics’ brands leverage packaging to educate the mass consumer about ingredients, such as a set of masks with ingredients and their function listed side-by-side in a highly visual design. Club Clio’s Clio seven Clio stores in the United States also serve as testing grounds for new products and packaging.

K-color

Korea is a highly homogenous country; for this reason, it is often difficult for K-beauty brands to address the diverse range of skin tones found in the U.S. and other markets. Kang and Lee noted that other cultural factors are at work.

For instance, while matte lips have been a hot trend in the West, matte is sometimes interpreted by Korean consumers as dry, which is anathema to their desire for a well-hydrated appearance. However, matte lips are now becoming more popular in the country, and Club Clio is launching a range of products reflecting this, including Clio Professional Mad for Matte and Peripera Ink Velvet and Airy Ink Velvet.

Lee and Kang noted, however, that a number of Western color brands are making headway in Korea, including Kat Von D and Stila. In fact, some Korean women prefer the textures of Western formulations.

Broadening the Audience

In addition to its mass channel expansions, Clio Professional has been strategic about its storefronts. While the brand opened its first shop in Flushing, Queens, where roughly 70% of residents are of Asian descent, and where many Asian travelers visit, Clio Professional has deliberately expanded into non-Asian-centric neighborhoods, including New York’s Union Square.

Kang noted that the brand wanted to be accessible to all types of consumers and to ensure that the focus remained on the products, not their national origin.

Expanding Affordable Beauty

DK Cosmetics is also focused on bringing brands that have withstood the extremely fickle Korean market to the United States. To modify an old saying, if you can make it in Korea, you can make it anywhere.

It’s precisely this challenging dynamic that has led so many smaller K-beauty brands expand to the relatively less turbulent market in the United States. These brands have a distinct advantage, said Lee and Kang, because Korea excels at affordable, quality beauty that truly works.

With $3 sheet masks expanding across the United States and elsewhere, and popping up in social media feeds worldwide, more consumers are being initiated into K-beauty every day.

About DK Cosmetics and Its Brands

DK Cosmetics, based in New York, offers R&D and contract manufacturing services for skin care and beauty brands. It also owns a range of its own brands, including:

- Soo Ae, a U.S.-only nature-based skin care brand that includes masks and skin cleansers. The brand aims to simplify the complex traditional K-beauty rituals for a U.S. audience at an affordable price. Soo Ae products are distributed via 3,000 Walmart stores (and growing), Target.com, Ulta.com, and is expanding in the U.K., Puerto Rican and South American markets.

- L.O.C.K. Color, which offers color cosmetics for the millennial generation.

- JKNLEE, a multimedia Korean lifestyle ambassador.

DK Cosmetics also owns the Club Clio and Dr.G array of brands for the U.S. market. In addition, the company operates seven brick-and-mortar Club Clio stores, including five in the New York area. Club Clio’s brands include:

- Clio Professional, the “MAC of Korea,” which includes eye, lip and base makeup.

- Peripera, Clio Professional’s cuter and more playful “little sister.”

- Goodal skin care, which features fermented ingredients in formats such as skin mists, eye creams and cleansing foams. The brand has launched in 305 Ulta stores nationwide, with some low-end SKUs offered at Target.com.

- Derma Dr. Lab, a skin care sub-brand owned by Dr.G, which is powered by biofermented actives, antioxidants and anti-inflammatory ingredients. The brand’s range comprises toners, water balancing creams and serums and has launched in Target and Walmart (in more than 600 doors).

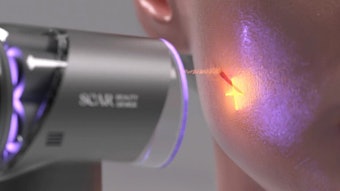

- Dr.G, a legacy K-beauty brand that popularized bb cream. Dr.G is the top beauty brand in Korea, where it performs well in the “Sephora of the East,” Sasa. The brand offers makeup-skincare bridge products that offer coverage and care. It operates 18 clinics in Korea, which serve as testing grounds for new products and devices. In the United States, the brand retails at Nordsrom and Dermstore, as well as Amazon.