Federal Package offers both stock and custom lip balm formulas manufactured with hot pour, anhydrous filling processes. Hot pour formulations can reportedly have a longer shelf life because the blending process doesn’t include water and oil phases, which can separate over time. They also are less prone to bacteria growth since they typically don’t have water, so there is little for the microorganisms to feed off. Furthermore, waxes help products maintain their function and quality, acting as an emulsifier for other ingredients. They prevent oils from separating within the product and keep other ingredient substances together, per Federal Package. This purportedly makes a more homogenous finished product.Federal Package

Federal Package offers both stock and custom lip balm formulas manufactured with hot pour, anhydrous filling processes. Hot pour formulations can reportedly have a longer shelf life because the blending process doesn’t include water and oil phases, which can separate over time. They also are less prone to bacteria growth since they typically don’t have water, so there is little for the microorganisms to feed off. Furthermore, waxes help products maintain their function and quality, acting as an emulsifier for other ingredients. They prevent oils from separating within the product and keep other ingredient substances together, per Federal Package. This purportedly makes a more homogenous finished product.Federal Package

As a result, Mintel analyst Carson Kitzmiller wrote, “Sunscreen brands should look to incorporate ingredients, benefits and claims traditionally seen in the facial skin care space to offer benefits beyond sun protection and anti-aging and prove value in daily routines.”

Federal Package’s lip balms are available in any Pantone color and a wide variety of stock and custom styles; containers can be finished with several decorating options. Sizes range from 0.05 oz to 0.21 oz, including propel-repel containers and a variety of caps. All injection molding and automated assembly are done on-site at the company’s FDA-registered facility in Chanhassen, Minnesota.Federal Package

Federal Package’s lip balms are available in any Pantone color and a wide variety of stock and custom styles; containers can be finished with several decorating options. Sizes range from 0.05 oz to 0.21 oz, including propel-repel containers and a variety of caps. All injection molding and automated assembly are done on-site at the company’s FDA-registered facility in Chanhassen, Minnesota.Federal Package

Notably, he says, “The latest interest is incorporating SPF in lip balms. By adding SPF to a lip balm formulation, brands get moisturizing and sun protection in a single product. At Federal Package, we offer stock lip balm formulas with SPF built in as well as natural, organic and vegan formats to help our customers find the right fit for their market.”

4 SPF Innovation Opportunities

With so much competition from multifunctional SPF personal care products, pure-play sunscreens will also need to be formulated to overcome the category’s experiential and textural issues. At the same time, both sunscreens and multifunctional SPF beauty will need to address underserved sectors, from melanated skin to clean formulations.

Here, we round up top opportunities to capture shoppers with relevant SPF/sunscreen innovation.

1. Improved Ingredient Technologies: Texture, Spreadability & Transparency

In the last three to four years, sun blocks have featured improved spreadability, says Sundeep Gill, owner of beauty manufacturer Sun Deep Inc.Andrey Popov at Adobe Stock

In the last three to four years, sun blocks have featured improved spreadability, says Sundeep Gill, owner of beauty manufacturer Sun Deep Inc.Andrey Popov at Adobe Stock

For instance, the application of butyl octyl salicylate (BOS), a common inactive booster, delivers emolliences while solubilizing and stabilizing sunscreen actives in formulations. He adds that the use of nano materials have evolved as understanding of particle agglomeration has advanced, allowing for the use of materials in the 30-40 nm range. This allows formulations that feel much smoother than the “diaper paste” textures of the past.

Elsewhere, Siltech’s Siltech CA Plus (INCI: dimethiconol/caprylylsilsesquioxane/silicate crosspolymer) comprises a hydrophobic Q-resin-modified silicone that disperses pigments and sunscreen filters. It also provides water repellency and emolliency to formulations while providing a smooth sensorial effect.

Advances in zinc oxide technologies—the preferred SPF filter of North America, per WGSNb—have also improved the category, according to Gill. For instance, BASF’s Z-Cote Max broad-spectrum UV filter features greater transparency than some conventional equivalents.

Transparency is central to new Croda offerings based on its Solaveil Clarus technology, which delivers a tightly controlled particle size distribution. Solaveil CT-60W is a titanium dioxide (TiO2, the preferred SPF filter of Asia Pacific, per WGSN) water-based dispersion that allows for high SPF claims with clarity on the skin. This formulating process removes the undesirable whitening effect typically associated with TiO2 while the SPF efficacy remains uncompromised, per the company.

Croda also launched Solaveil CT-300, a dispersion of hydrophobic titanium dioxide in a naturally derived carrier oil that provides high SPF efficacy with true transparency on the skin. Solaveil CZ-300, meanwhile, is a dispersion of zinc oxide in a naturally derived carrier oil that provides effective UVA protection with true transparency on the skin.

EverZinc’s Zano ultrafine zinc oxide, meanwhile, is highly transparent and features broadband UVA/UVB absorption properties. Variants include Zano 10 (in standard and Plus editions) and Zano 20 (in standard, Plus and Plus 3 editions). According to Gill, Zano 20 disappears on the skin but boosts SPF less than Zano 10, which disappears less easily. To make up the difference, he says, formulators may add a sunscreen booster to a formulation featuring Zano 20.

Critically, says Gill, boosters can allow formulations to achieve SPF 30 protection with only a physical sunscreen ingredient listed as the active.

To speed up the formulation development process, Gill says his company conducts preliminary R&D testing in-house. By conducting initial in vitro investigational work during the development process, Gill says he’s able to speed up the process of achieving final regulatory approval.

With so many new boosters, he says, it’s critical to conduct more background testing and validation to avoid rejections that cost time and money.

These improvements in ingredients and processes are critical, particularly because so many brands are looking to round out their product assortments with SPF-enhanced products.

2. Improving Formulations for Melanated Skin

Mintel reports that 49% of Black consumers use sunscreen, with 54% applying product more often in 2023, versus 2022.Rido at Adobe Stock

Mintel reports that 49% of Black consumers use sunscreen, with 54% applying product more often in 2023, versus 2022.Rido at Adobe Stock

Unfortunately, the firm explains, “84% of U.S. Black sunscreen users wish there were more product options made specifically for their skin tones,” pointing to significant opportunities for product innovation. The key challenges for inclusive sun care are well-known, particularly white cast/lack of blendability upon application.

"[S]ome consumers may find traditional SPF products unpleasant to use because they can leave a white cast or have an unpleasant greasy or sticky feeling," says Alex Walther, technical services manager, beauty and personal care, Univar Solutions. "That is why new ingredient technologies are being developed to make SPF products more appealing and effective."

She continues, "For instance, new mineral UV filters with optimized particle size can greatly reduce white cast. By choosing new emollients and emulsifiers that are designed to help wet out mineral UV filters, the formula will have closer transparency on the skin."

Walther concludes, "Once a homogenous dispersion of the UV filter is developed, the next most important choice is the emollients. New emollient technologies offer the balance of fast-spreading oils that leave a powdery, yet moisturized finish that is comfortable to wear. These new emollients allow formulators to create products with SPF that have a pleasant texture and sensory experience."

Univar has developed a proof of concept formula highlighting several of these principles. The SPF 30 Tinted Cream Serum is a hybrid makeup with skin care benefits.

Key emulsifiers include Dow's Dowsil ES-5600 silicone glycerol emulsifier and Dowsil FZ-3196 fluid emulsifier, as well as a pair of inorganic UV filters from DSM-Firmenich, Parsol TX (titanium dioxide) and Parsol ZX (zinc oxide), and SunSpheres Bio, an SPF booster.

Other key ingredients include DSM-Firmenich's Valvance Touch 210 silica, Inolex's LexFeel WOW emollient and Dow's Dowsil DM silicone elastomer blend.

Skin-friendly materials in the formulation include DSM-Firmenich's Quali E vitamin E and Quali B niacinamide, and moisturizing Purasal NH/COS from Corbion.

As seen in the formulation breakdown, several ingredient firms have launched technologies to tackle the problem of sunscreens that leave a white cast on the skin. For instance, Tagra developed DeeperCaps to encapsulate pigments and shea butter with a double-layer cellulose/zinc oxide-based polymer to ensure optimal delivery and coverage of pigments with a natural finish—meaning no white cast or “ashy” look.

In addition, many of the transparency-focused ingredients discussed earlier in this article address some of these issues.

It’s also important to acknowledge a number of inclusive, often POC-led brands that have made the white cast complaint a key consideration of their product claims, including Kinlo, Black Girl Sunscreen, Undefined and Cay Skin.

3. Sun Care as Anti-aging

Notably, consumers aged 25-44 over-index for skin protection product usage, with key concerns including pollution and blue light.lielos at Adobe Stock

Notably, consumers aged 25-44 over-index for skin protection product usage, with key concerns including pollution and blue light.lielos at Adobe Stock

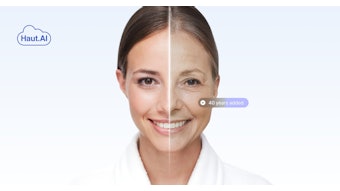

Notably, consumers aged 25-44 over-index for skin protection product usage, with key concerns including pollution and blue light. This points to a desire for products offering sun defense alongside allied claims. This holistic approach could potentially lead to greater and more frequent usage of defensive care products.

4. Multifunctionality as a Value Proposition

As the anti-aging movement in sun care shows, multifunctionality can be a winner. Euromonitor data builds on this theme. The firm reportsc, “rising demand of SPF moisturizers in Western Europe” reflects a desire for products that offer a superior sensory experience (texture, scent, etc.) compared to conventional sunscreens. It also points to a desire to achieve multiple benefits simultaneously (hydration and defense).

Skin Proud’s Gen Z-friendly Serious Shade Lightweight Hydrating SPF 50 Sun Serum is designed to provide broad-spectrum UVA/UVB protection.Skin Proud

Skin Proud’s Gen Z-friendly Serious Shade Lightweight Hydrating SPF 50 Sun Serum is designed to provide broad-spectrum UVA/UVB protection.Skin Proud

While value-seeking consumers are a natural audience for these multifunctionals, combining skin care claims with SPF defense can allow brands to offer innovation at a premium. To see this innovation in action, one can look to Byoma’s Moisturizing Gel-Cream SPF 30, which offers broad spectrum protection from UVA/UVB rays, instantly absorbing into the skin and leaving a glowing, radiant finish with zero white cast, as well as Skin Proud’s Gen Z-friendly Serious Shade Lightweight Hydrating SPF 50 Sun Serum, designed to provide broad-spectrum UVA/UVB protection.

According to a report from WGSN, SPF 30 is currently the preferred defense level in North America, a market that prefers spreadable, lotion-like formats in sun care.

Looking ahead, Euromonitor anticipates future daily use moisturizers featuring SPF50+ and benefits including hydration, reduction of dark spots, fine lines and pores. Meanwhile, WGSN has identified rising claims in the category, including “buildable” and “washable,” as well as increasingly popular formats such as serums and gels, powders, and sticks and similar portable formats.

FOOTNOTES

awww.mintel.com/press-centre/sunscreen-fountain-of-youth-use-of-sunscreen-for-anti-aging-purposes-increased-25-from-2021-22/

bwww.wgsn.com/beauty/p/article/6492592c6311e6dd591c1ffb

cwww.euromonitor.com/article/spf-moisturisers-moment-in-the-sun-how-skinification-is-changing-sun-care-in-western-europe