Read more packaging news and insights here.

The power of niche and exclusive retailer beauty brands has continued to gain momentum in the United States and around the world. Global retailers long ago recognized the potential for creating differentiation and loyalty with consumers through their own brands as a means of securing higher margins while also offering consumers a better value: a win-win situation for all.

In beauty, many consumers view the national brand equivalent as a valuable option. However, there are many beauty consumers that also want the latest innovation at an affordable price; this is the white space that niche and exclusive beauty brands can fulfill. To do that, the following key trends are important to keep in mind.

The Age of Experience: The Rise of Beauty Services

Consumers are looking for personalized, interactive experiences that transform store aisles into beauty destinations. Global retailers are answering the call by extending in-store beauty services beyond cosmetics and nail care to include salon and consultation options, and in-store services that offer a variety of customized beauty treatments.

One best-in-class example is Boots UK, which innovates with customized beauty match services. The retailer's “perfect foundation match” tool can analyze your skin tone and make recommendations on products and shades that perfectly match your skin. This was seen at Boots UK in 2012, at Sephora in 2013 and at Walgreens in 2014 .

Boots UK took this concept to a new level in fall 2014 by launching the No7 Match Made Lipstick service. This aid looks at your skin tone and matches it to the three ideal shades of lipstick. Customization and personalization deliver a perfect shade and more sales.

Implications for beauty packaging: “Recommended by a beauty expert” is more important than ever as a claim in marketing elements, including beauty packaging. The look and feel of a beauty product, combined with the retailer’s service package, provides synergistic brand building for both services and products alike.

Health & Wellness 2.0

Consumers are interested in all-natural and organic beauty products, free from unnecessary ingredients commonly found in mainstream cosmetics and health products. Nature-meets-science brands are important for the growing ranks of aging consumers, who are looking for multi-benefits and a balance between efficacy and performance with active natural ingredients.

The growing desire for more natural products is gaining traction in the men’s grooming segment, too, where male shoppers want equal opportunities to look their best.

Meanwhile, supplementation is evolving to age management, extending beyond preventative care approaches with the addition of services and diagnostic tools.

Implications for beauty packaging: Certifications and seals help the consumer quickly identify active ingredients that deliver on the brand promise.

You Had Me at Exclusive

Retailers are increasingly interested in providing exclusive health and beauty brands for their customers. Niche brands offer first-to-market products and create excitement in-store (a unique and engaging experience). The cache of discovering something new and sharing it in the social media world is a key motivator for many consumers of all ages.

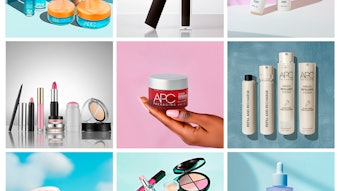

Implications for beauty packaging: Exclusive beauty brands need to stand out on shelf and drive the “must have” impulse-buy factor. Best-in-class exclusive beauty brands have unique packaging that is bold in color, font and shape.

Author information: Laureen Schroeder, Daymon Worldwide.