Top hair care brands, per Piper Sandler.

Top hair care brands, per Piper Sandler.

The fall survey was conducted September 4-27, 2023, featuring 9,193 U.S. teens with an average age of 15.7 years. Regional responses were 36% in the south, 29% in the midwest, 21% in the west and 14% in the northeast.

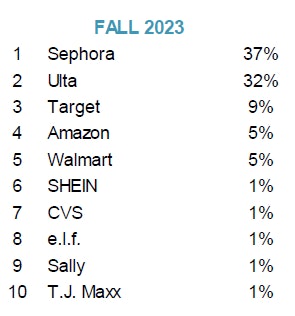

Preferred Shopping Channels

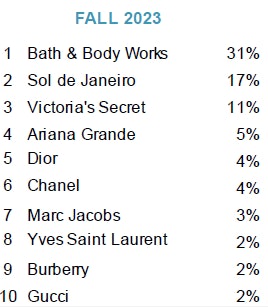

Top fragrance brands with U.S. teens, per Piper Sandler.

Top fragrance brands with U.S. teens, per Piper Sandler.

Piper Sandler has a simple explanation for this reversal: the average household income among surveyed teens has reached the highest level seen in five surveys. Because Sephora skews toward higher income consumers, the retailer was able to make a significant jump in teen engagement, year-over-year.

Specialty retail channels for beauty purchases reached the highest level yet, at 79%, while mass/department/drug channels reached a new low of 11%.

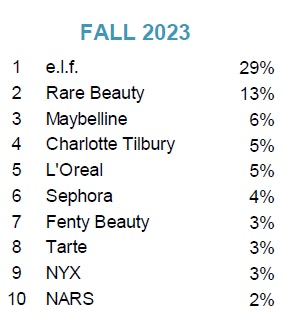

Top makeup brands with U.S. teens, per Piper Sandler.

Top makeup brands with U.S. teens, per Piper Sandler.

This came at the expense of specialty, discount and outlet channels.

Makeup/Color Cosmetics

As in earlier surveys, e.l.f. Beauty, Inc. was the top cosmetics brand among surveyed teens, increasing 13 points year-over-year to a 29% of females.

pending in the overall category was up 33% year-over-year. Upper income female spending was up 29% in the period.

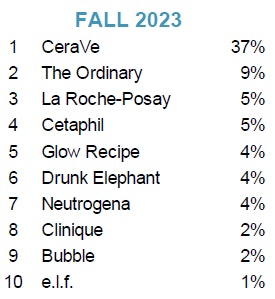

Skin Care

Top skin care brands with U.S. teens, per Piper Sandler.

Top skin care brands with U.S. teens, per Piper Sandler.

Fragrance

Teen fragrance spending has jumped 14% year-over-year. Annual fragrance spend now stands at $75, versus $66 in the fall of 2022. High-income teens are spending a bit less year-over-year, with current annual spending standing at $73.

According to the survey, 72% of surveyed teens noted use fragrance every day, while 23% noted using a fragrance sometimes and 6% reported never using a fragrance.

Hair Care

Top beauty retailers with U.S. teens, per Piper Sandler.

Top beauty retailers with U.S. teens, per Piper Sandler.

Media Preferences

TikTok is the most preferred social platform (rising significantly since spring 2023), topping Snap and Instagram.

As for online video, teens primarily prefer Netflix and YouTube.