"There is a lot of excitement in beauty, from trending brands and new product launches to the growing engagement from younger consumers," says Larissa Jensen, global beauty industry advisor at Circana. With Mothers' and Fathers' Days on the horizon and summer activities drawing near, products that make us look and feel good will continue to be top-of-mind.”

"There is a lot of excitement in beauty, from trending brands and new product launches to the growing engagement from younger consumers," says Larissa Jensen, global beauty industry advisor at Circana. With Mothers' and Fathers' Days on the horizon and summer activities drawing near, products that make us look and feel good will continue to be top-of-mind.”

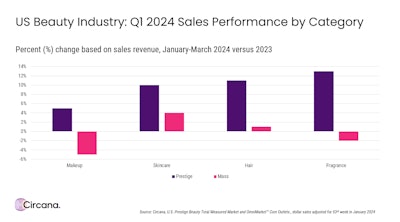

This represents more modest growth from the wild double-digit gains the industry experienced in recent quarters.

"There is a lot of excitement in beauty, from trending brands and new product launches to the growing engagement from younger consumers," says Larissa Jensen, global beauty industry advisor at Circana. With Mothers' and Fathers' Days on the horizon and summer activities drawing near, products that make us look and feel good will continue to be top-of-mind.”

Value & Sets Drive Q1 2024 Fragrance Sales

Prestige fragrance sales revenues jumped 13% in the quarter, faster than any other category. As Coty's latest financials have shown, consumers are all-in on scent.

Value was the watch word. Gift sets grew by 22%, faster than juices, and gained market share in the category, while travel size sets, including discovery sets, grew at double the rate of traditional full-size sets.

As previously reported, younger consumers in particular are drawn by accessible travel sizes and sets.

This trading down doesn't negate growth in the luxury sector, however, Circana explains. In fact, luxury fragrance units sold paced at more than double the rate of the rest of the prestige market in Q1 2024.

Gen Alpha continues to drive prestige sales among households earning more than $100,000, with kids' households growing at twice the rate of households with no children.

Notably, "spending per buyer was directly influenced by the presence of children: among households with children, the average spending per buyer in Q1 increased at five-times the rate as those without children," per Circana.

Gen Alpha is a beauty force to be reckoned with.

Skin Care Driven By Body, Clinical, Mass

Prestige skin care dollar sales increased 10% in Q1 2024, while mass skin care was that sector's fastest-growing category. As reported last year, the democratization of quality skin care has made mass a key competitor of prestige sales.

"Consumer spending [on skin care] was up double-digits in Q1 compared to the same period last year," Circana notes, while the number of buyers, their average spend and purchase frequency all increased.

Body spray was the top gainer in the skin care category overall with sales nearly tripling since Q1 2023. Face serums were the second-strongest grower in the category, driven by clinical brand launches. This result reflects a general rise in clinical, expert-backed brands.

Makeup Sales Soft, but Lips Continue to Boom

Makeup is the largest prestige beauty category, but its sales were the softest among all categories in the prestige and mass sectors in Q1, per Circana.

As in earlier periods, lip makeup led the pack, with dollar sales up 26% in Q1 2024. The lip boom is going nowhere.

Top performers in lips included tinted lip balms and oils.

Hair Wellness Drives Growth

Prestige hair product sales grew in the double-digits in Q1, led by products offering solutions for hair thinning and loss, as well as wellness-oriented SKUs such as hair oils and serums, scalp care, and heat protectants.

All of those categories grew sales between 13% and 25% in Q1, per Circana.

Salon brands continued to be the top sales contributor, but celebrity brands grew the fastest, up 64%.