A new report from independent market analyst Datamonitor shows that the male grooming market in U.S. is continuing to expand, although at a slower rate than previously expected.

"While the more lucrative women’s market is also continuing to grow, the potential of the male market remains enormous and will be important to manufacturers of consumer packaged goods," said Matthew Taylor, consumer analyst at Datamonitor and author of the Male Grooming Trends: Profiting in 2009 and Beyond report. "In order to succeed, the male grooming market needs a markedly different approach than the female market due to some substantial differences in attitudes and behaviors that exist across genders.’ .

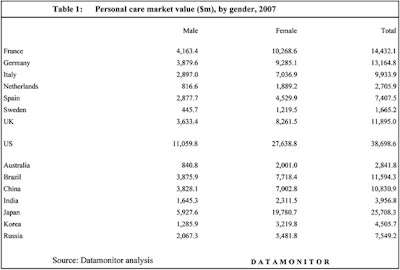

Across most of countries featured in this report, the split of populations is roughly equal by gender, yet women continue to dominate spending in the personal care industry.

The results of Datamonitor’s 2008 consumer survey showed that price was the biggest influence on men when choosing personal care products. Over half of all male respondents felt that price had either a "high" or "very high" influence on their choice of products. This was a substantially higher response rate than for any other factor, although habit/preferred brand and ease of use also ranked as fairly important influencing factors among men.

Many personal care brands targeted at women have been successful in achieving a high level of engagement with their consumer bases. This situation has not been replicated among men, where the more essential and necessary nature of personal care products has ensured a lower level of engagement. High-engagement brands will obviously be more successful in achieving a sense of loyalty with consumers and marketers must strive to ensure that men feel a stronger attachment to their male grooming products and brands.

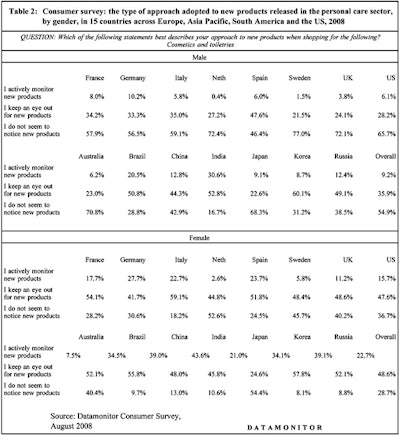

Findings from also showed that most men did not pay much attention to new products in the field of personal care. Coupled with the low engagement mentioned above, this suggests that many men will simply stick with what they know, without even bothering to check out alternative products in the marketplace. As shown in the table below, over half of all male respondents said that they did not seem to notice new products in cosmetics and toiletries. The equivalent figure for women was much lower at 28.7%, with 22.7% of females advising that they actively monitored new products in this category.

Many areas of male grooming are open to diversification, particularly when compared to the more mature female market. Skin care is the most valuable area of female personal care, but the equivalent male market retains a much lower percentage of the market. The signs of aging are a concern for many men, yet antiaging benefits are present in only a small number of male grooming products. The potential remains huge, but the industry has not yet been able to exploit this.

The personal and oral hygiene sectors are the most lucrative among men, illustrating the nature of the market, as both of these areas are regarded as a necessity. However, some men are not acting on their concerns in these fields through the use of personal care products. “While these categories are the most developed in the male market, the potential remains even here to grow sales in the future,” said Taylor.