According to the International Organisation of Aluminium Aerosol Container Manufacturers (AEROBAL), annual production for aluminum aerosols increased to approximately 5.7 billion cans in 2008—despite declining demand in the last quarter of 2008—an increase of 8% over 2007. It states that aluminum cans account for 44% of the global aerosol can production of approximately 13.1 billion units. With the exception of the Middle East, shipments to all continents increased in 2008.

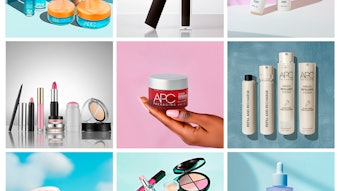

In addition, 76% of all shipments are sold to the cosmetics market. The key areas in this market segment in 2008 were: deodorant with a 46% share of total shipments, hair fixatives with 11%, hair sprays with 10% and shaving foams with 3%. The share of other cosmetic products amounted to approximately 6%. In 2008, deodorants and hair fixatives were the driving force behind the expansion in the cosmetics market.

A Challenging Year

In the wake of the international economic crisis, it is likely that the era of continued growth in the aluminum aerosol can industry will take a breather in 2009. Order income significantly decreased in the first quarter of 2009 because customers are largely destocking and ordering at short notice only. Short-term orders and increasingly smaller runs require utmost flexibility from aluminum aerosol can producers. Nevertheless, demand cuts in the aluminum aerosol can industry—which is primarily supplying the cosmetics, household, pharmaceutical and food market—are not as drastic as in other sectors. Demand for everyday and pharmaceutical products is less vulnerable to cyclical changes.

A positive side effect of the economic slowdown are declining raw material and energy prices, which should help to reduce production cost. Lower aluminum prices and simultaneously rising tinplate prices should also improve the competitive situation of aluminum aerosols because some customers might consider a switch from tinplate to aluminum cans.

“The industry hopes that demand will increase during the second half of 2009, when customers might feel the need to replenish their stocks to avoid out-of-stock situations at the point of sale,” said Emmanuel Perret, president, AEROBAL. “The aluminum aerosol can industry is developing innovative solutions to reduce costs and offer attractive packaging to be in a good position to catch opportunities after the crisis.”

Optimistic Outlook

Together with suppliers and customers, technological improvements along the entire supply chain can be achieved for better sustainability of the product. For example, thanks to new valve systems it is possible to pack the same amount of active ingredients in a smaller can because less propellants and solvents can be used. Also water-based formulations, which have a better environmental performance than alcohol-based systems, are increasingly used in the market. Aluminium cans, because of their excellent performance against corrosion, are well-suited to water-based systems.

In addition powder coatings are developed together with coating suppliers, allowing a reduction in solvents and savings of up to 50% of the energy needed for curing. Bag-on-valve systems, which use compressed gas as propellant, is another good example of the technological potential of aluminum aerosol cans. These systems are tailor-made for formulations where the active ingredient has to be separated from the propellant.

In terms of decoration, several improvements can be offered, from full body shaping to high definition printing and thermo transfer technology. All these developments give aluminum aerosol can producers good reason for optimism beyond 2009.