Euromonitor International has identified three key trends in beauty and personal care, utilizing the new Passport Innovation portal—an AI-powered platform that measures the incidence of new brand and sub-brand launches at online retailers across 54 FMCG categories and 32 countries. Based on the data, innovation in proactive skin care and multifunctional sun care are helping drive product launches and trends in the beauty and personal care market.

This article is only available to registered users.

Log In to View the Full Article

Euromonitor International has identified three key trends in beauty and personal care, utilizing the new Passport Innovation portal—an AI-powered platform that measures the incidence of new brand and sub-brand launches at online retailers across 54 FMCG categories and 32 countries. Based on the data, innovation in proactive skin care and multifunctional sun care are helping drive product launches and trends in the beauty and personal care market.

Differentiating Facial Skin Care

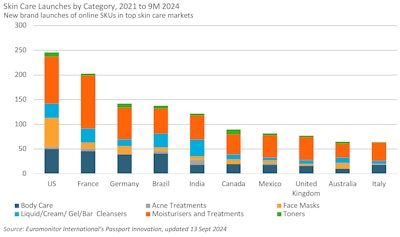

Facial moisturizers and treatments lead skin care launches, with more than 4,800 new brands and sub-brands launched since January 2023 (as of September 2024; F-1). The industry has responded with moisturizers and treatments that are differentiated by day products conducive to layering with makeup and night products that are more concentrated as skin cells regenerate.  F-1 Skin care launches by category, 2021 to 9M 2024Euromonitor

F-1 Skin care launches by category, 2021 to 9M 2024Euromonitor

Acne Care’s Slowdown & Opportunities

Acne treatments lag behind other skin care categories in product innovation. For example, toners–which typically do not experience rapid product innovation–have seen more launches than acne treatments since 2021.

The discovery of benzene in various acne products in early 2024 may have led to greater scrutiny and testing before a new launch. Opportunities in acne treatments exist, especially in adapting products to work with makeup more seamlessly, or launching new products in the form of patches, which are popular among Gen Z consumers.

Skin care brands are focusing on multifunctional, multi-benefit products. More consumers are choosing facial moisturizers that contain SPFs, as they are seen as an affordable substitute for sun protection for consumers who wish to simplify their beauty routines and reduce their discretionary spending.

Newer skin care launches will take a more proactive approach to skin concerns, such as elevated anti-aging claims, driven by consumer demand for more concentrated formulas and serums.

This aligns with patterns behind consumer usage of facial serum, facial oil and emulsion, which increased in 2024, according to Euromonitor’s Voice of the Consumer: Beauty, fielded June-July 2024.

What’s Driving Sun Care’s Boom?

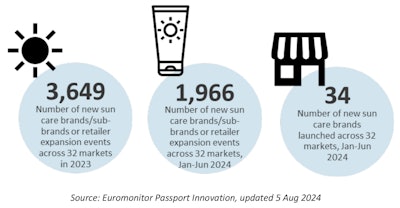

Sun care launches have grown significantly in the past two years, with many having a multifunctional or ethical positioning (F-2).

F-2. Sun care growth stats, 2023-2024Euromonitor

F-2. Sun care growth stats, 2023-2024Euromonitor

Sun Care Usage on the Rise

According to Euromonitor’s Voice of the Consumer: Beauty, fielded June-July 2024, consumers are using products with sun protection more frequently.

Additionally, weekly/ regular usage rates of multi-benefit day cream with SPF and specialized sun protection products have increased globally for all SPF ranges.

The U.S. saw the highest number of new sun care launches, which is expected given that it is the largest globally.

Top Growing Sun Care Segments

Globally, consumers have a growing appetite for more sophisticated, daily-use skin health formulas that are driving innovation. Mineral-based sun protection products are becoming increasingly popular, as is self-tanning as an alternative to UVA and UVB exposure.

The integration of skin care properties into sun care suggests the broader trend is moving toward multifunctional skin care solutions that address multiple skin concerns simultaneously.

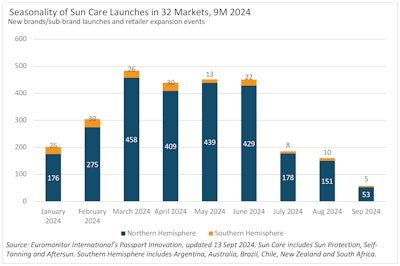

By offering products that combine sun protection with skin care benefits, brands can appeal to consumers seeking effective and convenient skin care routines, driving growth in sun care. F-3. A breakdown of sun care seasonalityEuromonitor

F-3. A breakdown of sun care seasonalityEuromonitor

Sunsetting Sun Care Seasonality

Sun care launches peak from March to June globally (F-3), in order to prepare for the busy spring and summer months. However, the trend is the opposite in the Southern hemisphere where sun care launches tend to peak between January and April.

However, as consumers become more aware of the advantages of using sun protection year-round, the industry may see the seasonality of sun care launches moderate to be more year-round.

Recommendations for Skin & Sun Care Brands in 2025

Focus on Proactive Skin Health

Consumers have become more evidence-oriented and are more inclined to scrutinize ingredients when choosing skin care, due to the momentum from ingredient-led beauty.

Brands should capitalize on this trend through functional new launches that address specific problems, such as pores and acne, in addition to offering hypoallergenic formulations suitable for sensitive skin.

Male beauty consumers are exploring advanced skin care features beyond basics, so brands should consider diversifying towards more specialized ranges, such as sun protection and texture improvement.

Emphasize Daily Use, Multifunctional Sun Care

Ongoing education efforts from the health and beauty industry have successfully changed consumers’ views on sun care. As a result, new launches that improve texture, even skin tone, provide tinted coverage, or improve skin health are recommended.

Brands should also focus on designing multifunctional sun care products, which can act as a cost-effective and time-saving option, particularly in markets where consumers’ spending power is diminished.