Dermocosmetic skin care growth has continued outpacing the growth rate of overall U.S. skin care for the past few years. So, while dermocosmetic brands have become the standard for safety and efficacy, dermocosmetic-adjacent ones have also begun adopting a similar positioning, tapping into motivating factors like clinical results, claims and, most importantly, scientific consensus. In this report we'll look at the consumer drivers of the dermocosmetic movement, how some brands are pivoting into the space, how K-beauty is naturally positioned to win in an ingredient- and efficacy-first environment, and what's next for the sector.

- Free report: Clinical Eclipses Clean in Today's Beauty

Consumer Skin Health Worries Driving Dermocosmetic Boom

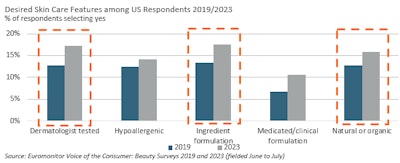

F-1. Euromonitor data shows that, since 2019, more U.S. consumers are looking for skin care features like dermatologist-tested, specific ingredients and clinical formulations, motivated by an underlying demand for safety, transparency and healthy living, which is placing a higher reliance on substantiated medical guidance.Euromonitor

F-1. Euromonitor data shows that, since 2019, more U.S. consumers are looking for skin care features like dermatologist-tested, specific ingredients and clinical formulations, motivated by an underlying demand for safety, transparency and healthy living, which is placing a higher reliance on substantiated medical guidance.Euromonitor

As such, U.S. consumers are becoming more sophisticated and savvier, increasingly searching for, and by, desired ingredients, claims and/or positioning to find the most efficacious, personalized and safe beauty routine.

Euromonitor data shows that, since 2019, more U.S. consumers are looking for skin care features like dermatologist-tested, specific ingredients and clinical formulations, motivated by an underlying demand for safety, transparency and healthy living, which is placing a higher reliance on substantiated medical guidance (F-1).

Health and wellness motivations are underpinning this consumer desire, with 46% of U.S. consumers citing moderate or extreme concern over their skin health in 2024, up from 38% in 2023 (Euromonitor Voice of the Consumer: Health and Nutrition Survey, fielded January to February 2024), encouraging consumers to further scrutinize the formulations of the products they use daily.

This has placed pressure on brands to build trust, with dermocosmetics becoming a standard as they check several consumer demands. This phenomenon is driven by brands with proven claims, well-substantiated efficacy and alignment with dermatologists to address skin pathologies.

Dermocosmetics Innovate to Meet Consumers' Top Skin Care Concerns

From a consumer perspective, motivations to purchase dermocosmetics for skin health benefits (30%) and better alignment to skin type (24%) have been increasing (Euromonitor’s Voice of the Consumer: Beauty Survey, fielded June to July 2023).

Dermocosmetic brands continue innovating to meet these developing consumer needs, like Cetaphil’s Healthy Renew range. Beyond specifically calling out dermatologist influence in design and development, Healthy Renew is centered around a retinol alternative ingredient, supported with clinical results on even sensitive skin, a growing concern among U.S. consumers.

Non-dermocosmetic Brands Get in on the Growth

The success of dermocosmetics is inevitably encouraging non-dermocosmetic players to lean into scientific and ingredient-led positioning.

With consumer appetite for evidence-based or results-driven products fueling dermocosmetics, non-derm brands are responding by emphasizing dermocosmetic-inspired features like efficacy, safety and the science-led nature of its ingredients, claims or clinical results.

This has led to an uptick in dermocosmetic-adjacent skin care brands positioned as clean, clinical or “cleanical," reflecting consumers’ desire for science-backed knowledge about the beauty products they use regularly.

Brands Target Skin Care Ingredients of Concern

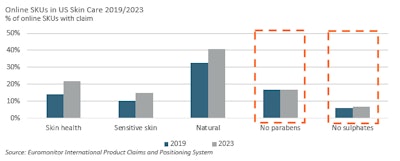

F-2. The number of U.S. skin care products with claims of no parabens or sulfates has been rising since 2019 (Euromonitor International Product Claims and Positioning), encouraging some long-standing beauty players to explore reformulations to address consumers’ safety concerns.Euromonitor

F-2. The number of U.S. skin care products with claims of no parabens or sulfates has been rising since 2019 (Euromonitor International Product Claims and Positioning), encouraging some long-standing beauty players to explore reformulations to address consumers’ safety concerns.Euromonitor

With health and safety top of mind, some consumers start their ingredient-led journey by focusing on eliminating ingredients suspected (or purported) to harm human or environmental health.

These clean beauty concerns have only been heightened amid recent product scares, as seen with periodic reports of benzene in products such as acne care.

Apps like ThinkDirty, Hwahae and Yuka are making it easier than ever for consumers to quickly check for what are purportedly potentially harmful or irritating ingredients, providing a curated service of ingredient scanning and product reviews in beauty.

Consequently, the number of U.S. skin care products with claims of no parabens or sulfates has been rising since 2019 (Euromonitor International Product Claims and Positioning), encouraging some long-standing beauty players to explore reformulations to address consumers’ safety concerns (F-2).

This includes the removal of ingredients like parabens, artificial dyes or sulfates when undergoing reformulations, as seen with Clean & Clear or Bath & Body Works.

Efficacy and Results Top Skin Health Motivations

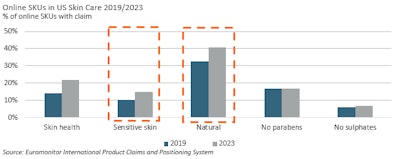

F-3. A growing number of consumers are exploring softer alternatives or products suitable for sensitive skin, searching for ingredients like bakuchiol instead of retinol, or plant-derived antioxidants like rosemary or ginkgo biloba instead of BHA and BHT.Euromonitor

F-3. A growing number of consumers are exploring softer alternatives or products suitable for sensitive skin, searching for ingredients like bakuchiol instead of retinol, or plant-derived antioxidants like rosemary or ginkgo biloba instead of BHA and BHT.Euromonitor

During the pandemic, consumers were drawn to powerful active ingredients, but overuse and resulting sensitivities are now encouraging consumers to take a gentler, but still efficacious approach.

In turn, a growing number of consumers are exploring softer alternatives or products suitable for sensitive skin, searching for ingredients like bakuchiol instead of retinol, or plant-derived antioxidants like rosemary or ginkgo biloba instead of BHA and BHT (F-3).

CosRX: How K-beauty Finds Success in the Dermocosmetic Movement

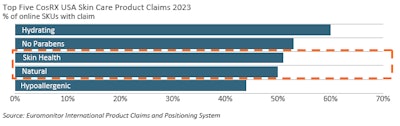

F-4. More than half of CosRX’s online product portfolio boasted skin health and natural claims in 2023, bringing forward K-beauty ingredient trends that focus on plant extracts and scientific formulas to maximize effects.Euromonitor

F-4. More than half of CosRX’s online product portfolio boasted skin health and natural claims in 2023, bringing forward K-beauty ingredient trends that focus on plant extracts and scientific formulas to maximize effects.Euromonitor

One such brand is CosRX, which is putting a spotlight on the natural ingredients like snail mucin. That ingredient can address common skin concerns like dryness or dullness, even on sensitive or acne-prone skin (F-4).

CosRX’s product descriptions lean into science quantifying the efficacy of the products, like 92% snail mucin and 1,000 ppm sodium hyaluronate in its Advanced Snail 92 Cream, providing a level of transparency and further skin health education helping to build brand trust.

While CosRX is not a new brand, its social media and distribution strategy have helped to not only catapult consumer awareness but also drive sales in recent years.TikTok, @DoctorYoun

While CosRX is not a new brand, its social media and distribution strategy have helped to not only catapult consumer awareness but also drive sales in recent years.TikTok, @DoctorYoun

While CosRX is not a new brand, its social media and distribution strategy have helped to not only catapult consumer awareness but also drive sales in recent years.

For example, its Advanced Snail 96 Mucin Essence reached virality on TikTok in 2023, selling out on Amazon and launching the product into the number one best seller ranking in beauty and personal care on Amazon in May 2023.

Likewise, Euromonitor International’s Passport: E-commerce System found that CosRX’s U.S. e-commerce skin care sales grew by triple digits from 2022 to 2023.

On TikTok, a balance of informative and educational yet fun and interactive content helped raise brand awareness, even tying the product’s ingredients and ability to achieve the highly desired “glass skin” effect on TikTok.

With U.S. consumers increasingly prioritizing skin health, K-beauty brands will likely grow in influence, especially as they lean into scientific positioning by emphasizing innovative technologies or functional ingredients to consumers.

What's Next for Dermatological Beauty?

The rise and cultivation of ingredient-led beauty will continue developing alongside consumer motivations like rising health considerations, propensity for dermocosmetic or adjacent science-backed brands, and momentum from movements like clean beauty or K-beauty.

As consumer standards continue rising, non-dermocosmetic brands are expected to continue exploring many of the same motivating factors drawing consumers to dermocosmetics, like substantiated claims or clinical results, leading to greater levels of competition and pressure to differentiate oneself.

Moving forward, simply cleaning up formulations will not be enough, as brands will have to lead with evidence-based, skin-healthy and scientific positioning.