Nielsen IQ has released its analysis on the effect that multicultural consumers have on the beauty and personal care industry.

Related: Study: How Beauty Labels Foundation Shades

Hispanic and African American consumers have a record of out-spending other ethnic groups when it comes to beauty and personal care and Nielsen expects that multicultural consumers will continue to fuel cosmetics growth into 2021 as they look for products that enhance their natural beauty.

Hispanic shoppers

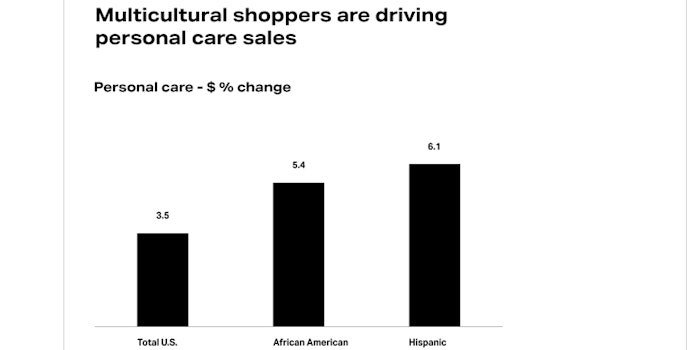

Hispanic shoppers spent 13% more than the average consumer on beauty and personal care in 2020. They also increased their overall beauty and personal care spending by 6.1% in 2020, compared to an average increase of 3.5%.

The analysis saw a trend in lip cosmetics and artificial nails, as Hispanic shoppers are 1.4 times more likely to purchase theses products.

Within the Hispanic segment, low-income shoppers (<$50,000) make up the largest portion of beauty buying households (38.8%) and dollars (39.6%).

Hispanics have also kept pace with the rise in natural DIY beauty and over-indexed for hair care treatments and artificial nails measured in 2020.

According to NielsenIQ’s Summer COVID Survey (July 2020), 21% of Hispanics said they would seek more natural products in the near future compared to 11% of White shoppers.

African American shoppers

African American shoppers increased their overall beauty and personal care spend by 5.4% in 2020, compared to an average increase of 3.5%.

Similar to the Hispanic segment, low-income shoppers account for a larger share of African American beauty buying households (43.3%) and dollars (39.1%) than middle and high-income.

Due to the pandemic, 41% of African American women indicated that it prompted changes to their hair styling and maintenance regimens. African American shoppers are 2.4 times more likely to purchase hair care treatments and 1.9 times more likely to purchase hair styling products than other segments.

For future spending, the analysis reported that 39% of African Americans expect to purchase more products from Black-owned brands while another 29% plan to purchase from brands that have spoken about the Black Lives Matter movement.