According to data from Nielsena, sales of personal care brands making natural claims grew 9% last year. A similar trend was seen in natural beauty care, which also grew 9% in 2017. There’s no doubt that it’s hip to be natural and organic.

Beauty and personal care products with these claims continue to cause excitement among consumers who want to live a more holistic lifestyle, with the industry redoubling its efforts to create product lines that are cleaner and greener. But what’s the consumer view?

Do buzzwords that connote “natural” beauty and personal care—including sustainable, eco-friendly, botanical, bio-natural, herbal, oils, clean and green—along with an image of a flower (or, gasp, a marijuana leaf!) cause consumers to gravitate toward certain products when perusing online and brick and mortar shelves?

What weight do consumers place on transparency of ingredients when considering a natural or organic product? Are they willing to pay more for natural or organic beauty and personal care products than for traditionally made goods? And where does the concept of wellness fit into this buyer’s life?

What 4,000 Consumers Think

For The Benchmarking Company’s 2018 PinkReport: The New Age of Naturalsb, we take a look at how far wellness and natural or organic beauty and personal care products have evolved over the past decade, and what that evolution means to brands in terms of guiding marketing plans.

Data for the study was derived from an in-depth quantitative online study of more than 4,000 US men and women, conducted in April 2018. Where possible, we’ve benchmarked data from this study against our original Age of Naturals PinkReport, published in 2008, to see how far consumers have come in their understanding of what constitutes a natural or organic beauty or personal care brand, how their buying behaviors have changed, and the brands that have moved the needle the furthest over the past decade.

The report also cross-tabulates every question by generation (Generation Z [young millennials ages 18-24], millennials [ages 25-38], Gen Xers [ages 39-53] and baby boomers [54+]) so that brands can best understand how to communicate with each audience. More than 300 natural or organic skin care, hair care, makeup, and bath and body brands were covered in this study, as well as every major retail distribution channel.

Who’s Buying Natural and Organic, and Why?

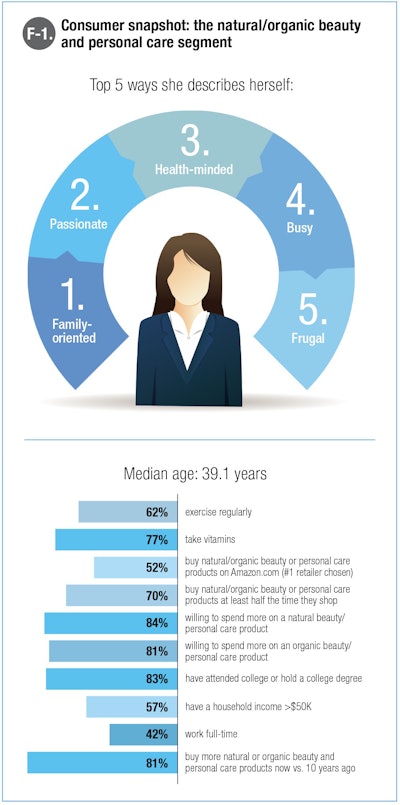

Sixty-eight percent of consumers buy some natural and organic products, in general. They do so because they believe natural and organic products are healthy for their bodies (74%), they feel better about purchasing natural or organic products (55%), they believe the products themselves are better for the environment (40%), and they don’t want to have synthetic chemicals on their skin or in their bodies (37%).

Of those who buy natural or organic products in general (F-1), 76% buy natural or organic beauty or personal care products, at least some of the time. We asked the same question of women in 2008, when 49% said they purchase natural or organic beauty products, representing an increase in natural/organic beauty buying of 27%. Gen Z and millennials buy natural and organic beauty and personal care the most, with 78% saying they do so some of the time, compared to 76% of Generation X and 69% of baby boomers.

Who Isn’t Buying Natural and Organic Products, and Why?

For those who don’t buy natural or organic beauty or personal care products, the top reason is cost: 61% of non-buyers find them too expensive (compared to 45% who felt this way in 2008). In addition, 31% don’t know enough about the benefits of using these products, 15% believe there isn’t enough variety when it comes to natural or organic beauty and personal care products, 14% say stores they shop at don’t carry these kind of products, and the same percentage believe these products won’t work as well as traditional/synthetically made beauty and personal care products.

Today, 11% of non-buyers don’t buy natural and organic products because they don’t know where to buy them; in 2008, not knowing where to buy them was the highest ranking reason consumers didn’t buy natural/organic beauty. Because natural and organic beauty and personal care products are now ubiquitous, that reason is low on the list today.

Meeting her Expectations, with Transparency and Responsible Practices

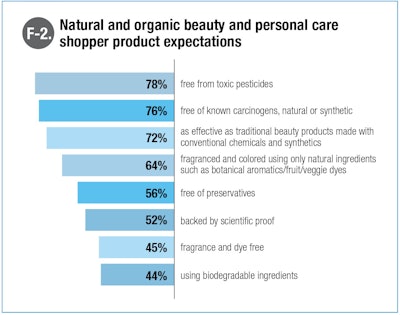

Buyers of natural or organic beauty and personal care products expect products with these monikers to deliver performance with perceived safety (F-2). In addition to those requirements, respondents ranked a series of attributes for importance when considering the purchase of a natural/organic beauty/personal care product, on a scale of 1-5, with 1 being not important and 5 being very important.

Ingredient transparency is of paramount importance to these consumers, with 91% of buyers saying “lists all ingredients clearly on packaging/website” was somewhat to very important (ranked 4-5) when considering the purchase of a natural or organic brand. Other factors that were somewhat to very important include “does not test on animals” at 82%, “is eco-friendly (does not pollute; has recyclable packaging)” at 76%, “pays a fair wage to all employees” at 72%, and “is socially and environmentally responsible” at 71%.

Do Buyers View Natural/Organic Products with Rose-colored Glasses?

Buyers of natural/organic beauty and personal care products were asked to agree, disagree or declare “I don’t know” for a short series of statements.

Fifty-four percent of buyers agreed that companies that make natural or organic beauty/personal care products use sustainable methods to cultivate ingredients, with 5% disagreeing and 41% saying they didn’t know. Of course, this statement isn’t necessarily true, but the implication of sustainability practices is inherent in the eyes of these buyers.

Likewise, 84% of buyers believe natural/organic products like these are better for the environment; and 54% believe that companies that make natural or organic beauty products are more ethical than companies that do not.

Claims and Safety: What Consumers Do and Don’t Know

When the marketing department at off-price clothier Syms (and Filene’s Basement) famously coined the phrase, “an educated consumer is our best customer,” the sentiment rang true for many other industries. Today, the phrase holds true for natural or organic beauty and personal care—at least in part.

Sixty-nine percent of natural/organic beauty and personal care buyers feel they understand the difference between a natural and an organic product. For those who don’t buy natural or organic beauty and person care, only 50% believe they understand the difference. Ten years ago, 51% of consumers (whether they bought natural/organic beauty or not) felt they understood the difference.

Consumer Confusion

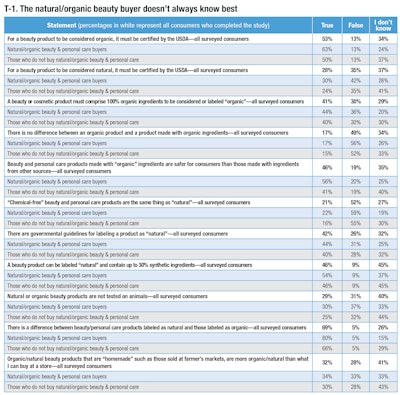

But is the natural/organic beauty and personal care buyer more aware of what it truly means for a product to be natural or organic? To further test buyer knowledge, we asked a series of questions and asked consumers whether statements about natural or organic products were true or false, or if they didn’t know. The results indicate that some clear misperceptions abound (T-1).

While the natural/organic beauty and personal care buyer knows the difference between natural and organic, there is ambiguity and false belief among this audience for other questions posed. For instance, 30% of buyers believe that beauty products with a natural claim are certified by the USDA, when in fact that’s not the case; government bodies haven’t established a regulatory definition of natural in cosmetic labeling.

Fifty-six percent of buyers of natural/organic beauty believe that natural ingredients are safer for the public than synthetic ingredients. In reality, an ingredient’s source doesn’t determine its safety, as there are plenty of potentially harmful organic ingredients.

Additionally, 30% of buyers believe that natural or organic beauty or personal care products aren’t tested on animals, when in reality animal testing is up to the brand, whether or not it is natural or organic.

Expectations of Safety

Buyers of natural or organic beauty and personal care products intrinsically believe the products to be safer than those made with synthetic ingredients. Forty-four percent of buyers believe that natural/organic products always go through rigorous safety testing before being sold to the public, with 42% feeling the same way about synthetically made products. Almost a quarter of buyers (24%) assume that “homemade” natural or organic beauty products, such as those found at farmer’s markets, are safer than products they can buy at stores.

Up Next

Part 2 of this series, coming in the September 2018 issue, will explore natural/organic shopping habits and purchase triggers, ingredients consumers want to see in their natural and organic beauty and personal care products, product categories they’re buying, along with the male consumer point of view on natural and organic personal care.

____________________________________

Denise Herich is co-founder and managing partner at The Benchmarking Company (www.benchmarkingcompany.com), which provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport and consumer beauty product testing for marketing claims.

Footnote:

awww.nielsen.com

bThe Benchmarking Company’s (TBC) 2018 PinkReport: The New Age of Naturals, provides an in-depth look at the natural and organic beauty buyers in the United States. Thousands of US consumers were invited to take part in the online survey, which was completed by 4,000+ respondents. The comprehensive survey instruments, which included more than 80 in-depth questions, was developed based on exploratory psychometric and demographic questions. To qualify for this study, respondents had to live in the United States, be over the age of 18, and shop for beauty or personal care products. All research was conducted in April 2018.