Consumers report spending the largest share of their monthly beauty budget on skin care, followed by hair care, color cosmetics, bath and body, and, finally, fragrance. On average, most consumers aren’t willing to spend more than $10 on items such as a bar soap (86%), makeup remover wipes (76%), cleansing wipes (75%), blotting papers (73%) and sheet masks (72%). However, she will spend more than $40 on devices (57%), serums (27%) and anti-aging treatments (25%).

Where Does She Shop for Skin Care?

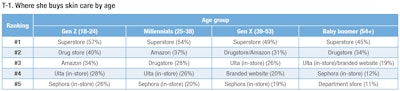

Superstores such as Target and Walmart are still her primary destination for buying skin care (51%), along with Amazon (33%), drugstores (31%), and brick and mortar locations for Ulta (25%) and Sephora (19%). Notably, Amazon doesn’t register among the leading skin care retail destinations for baby boomers (T-1).

Which Products Is She Already Buying?

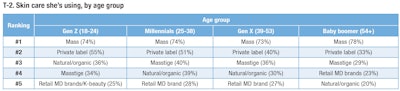

Regarding the types of skin care products she’s buying, mass brands such as Olay and Neutrogena are the top pick at 74%, along with generic and private label (45%), masstige skin care (36%), natural and organic (33%), retail doctor brands (27%), and luxury/prestige (22%). T-2 outlines the types of skin care products consumers are using, sorted by age group.

Her Biggest Influencers

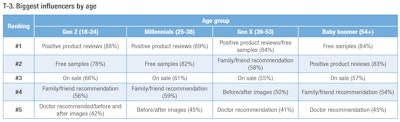

When consumers are ready to make an investment in a new skin care product or brand, several factors come into play (T-3). First and foremost, they want to know the products are suitable for their skin type (83%), followed by knowing the products will solve their skin problem (82%).

Other critical factors include consumer claims that the products actually work (76%), clean/safe formulas that also contain no harmful ingredients (72%), and last but certainly not least—price (70%). Factors she says that matter least to her include the founder/brand story (39%) and a brand that is trendy or popular (34%).

What Makes Her Try Something New?

Getting consumers to try a new product is no small feat. From packaging to claims to benefits to cost to colors, consumers have an opinion on just about everything, but the biggest influencers in trying new facial skin care products are positive product reviews (86%) and free samples (83%). Other factors that matter include products being on sale (59%), family/friend recommendations (58%) and before/after images (46%).

What Trends Excite Her Most?

The newest skin care trend she’s tried? Sheet masks. Twenty-three percent of consumers first tried sheet masks this year, followed by lip treatments (15%), eye cream/facial peels (14%), and anti-aging treatments (14%).

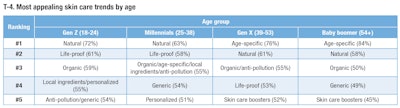

The growing age-specific skin care category tops out as the most appealing trend (64%), along with natural skin care (63%), organic/life proof/anti-pollution skin care (54%), skin care formulated with local ingredients (52%) and generic skin care (51%) (see T-4).

It is interesting to note the addition of “natural skin care” in this list. At this point, natural skin care is no longer really a trend or even trendy: natural skin care (and even color) brands and products have been dominating the landscape for some time, and the awareness of these brands is nearly universal among all consumers. Yet, given how popular and important this benefit is to consumers, many clearly still see it as a skin care “trend” that is highly appealing.

Up Next: Trending Skin Care Categories

In the third and final part of this series, we’ll take a look at the rising star of generic skin care and skin care kits, the continued appeal of luxury and mass skin care, and social media and beauty loyalty programs, as well as the continued appeal of natural and organic skin care products and brands.

__________________________________

Denise Herich is co-founder and managing partner at The Benchmarking Company (www.benchmarkingcompany.com), which provides marketing and strategy professionals in the beauty and personal care industries with need-to-know information about its customers and prospects through custom consumer research studies, focus groups, its annual PinkReport and consumer beauty product testing for marketing claims. The company’s latest report is The New Age of Naturals, which provides a detailed look at the U.S. beauty and personal care consumers’ affinity for natural and organic beauty and personal care products and the motivators and influencers that drive consumers to purchase more natural and organic products than ever before.