Unilever has announced its first quarter 2021 results, which showed a 5.7% increase in underlying sales driven by a 4.7% volume increase and 1.0% price jump. The beauty and personal care category reported underlying sales grew 2.3%.

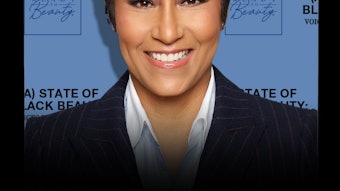

The company is also in the process of creating a new unit, Elida Beauty, which will comprise brands like Q-Tips, Caress, TIGI, Timotei, Impulse and Monsavon, which together generated revenues of about €0.6 billion in 2020.

In Q1, skin cleansing grew mid-single digits, with growth in the first two months followed by a decline in March.

Skin care and hair care both grew in the mid-single digits. In hair, wash and care growth was driven by strong performance in China and India, which was partly offset by a decline in styling, as restricted living continued to weigh on usage occasions.

Deodorants declined in the high-single digits because the market was also impacted by lower consumer usage.

Unilever's prestige business grew in the double digits, with help from the gradual restocking and reopening of brick-and-mortar stores.

CEO Alan Jope said:

Unilever has made a good start to the year. Our focus on operational excellence, innovation and purposeful brands is continuing to strengthen competitiveness and has delivered underlying sales growth of 5.7% for the quarter.

We are driving the evolution of our portfolio, with strong growth in prestige beauty and functional nutrition. The operational separation of our tea business is on track. We are also making good progress in creating a new unit, Elida Beauty, comprising a number of our smaller beauty and personal care brands.

We are confident that we will deliver underlying sales growth in 2021 within our multi-year framework of 3-5%, with the first half around the top of this range. We expect to increase underlying operating margin slightly for the full year, though with a decline in the first half driven by Covid-19 impacts, higher cost inflation and increased marketing spend over the prior year. Following another year of strong cash flow delivery, Unilever’s board has approved a share buyback programme of up to €3 billion.

We are committed to delivering superior long-term financial performance through our sustainable business model, which we believe has never been more relevant than it is today.