You probably know a lot about your customers, but how much do you know about what your customers really think of you? Social media insights, while less controlled than traditional research, can offer the most passionate, unfettered insight into customer perceptions and experiences. Any customer who tweets about a product is highly motivated to share her experience. She feels strongly about your product, and for better or worse, she wants the world to know about it.

In April 2013, SKIM conducted a meta-analysis of social media data from within the skin care category. The results illustrate how social media research reveals true customer sentiment and passion regarding a brand, including:

- which brands are most talked about and how;

- onsumer reactions and buzz around ailments related to skin, and treatments sought for these ailments;

- consumer personas of skin care users;

- a deep dive into the emotional and personality elements of the skin care category and what it stands for in the mind of the consumer; and

- how communications and social media warrant increased evaluation as consumer/marketer lines continue to blur.

For a period of two months, SKIM researchers compared consumer attitudes regarding 11 skin care brands sold in the U.S. The comprehensive and powerful approach utilized in this study is applicable to any consumer brand that is mentioned with sufficient frequency in social media conversations. The data-mining phase of the research study relied on text analytics and web scraping, often in association with pre-defined constructs. However, what sets this research apart from traditional social media monitoring is the subsequent analysis and the interpretation of the data that enabled important findings to be transformed into strategies.

Any relevant, publicly available comment was captured for analysis, including Facebook posts and likes, tweets, blogs entries and user reviews. Of all the conversations regarding skin care, 22% came from forums and communities, 20% from Tumblr, 13% from Facebook, and 13% from blogs. The remainder was garnered from online reviews and ratings, Twitter, video and other social networks. Whereas marketers strive to uncover the most current and candid thoughts of consumers, social media makes that possible like never before. But with great power comes great responsibility: It also raises expectations among consumers that a brand will respond to undercurrents of discontentment or waning loyalty.

Social media research (SMR) makes up for many of the shortcomings inherent to traditional classical research. It enables brands to listen to their consumers without even asking a question. As such, SMR complements traditional research by:

- relying on unasked, unprompted, spontaneous and candid perceptions;

- providing analysis based on current and real-time data that is trackable over time; and

- creating value from freely and publicly available data, which is only growing over time.

Meta-analysis Reveals Skin Care Truths

By 2014, skin care will increase its already sizeable lead in the beauty market to reach $91 billion. As such, there is no shortage of publically available discourse happening on the topic of skin care. From May through July 2013, SKIM culled 55,000+ results for skin care conversations on social media.

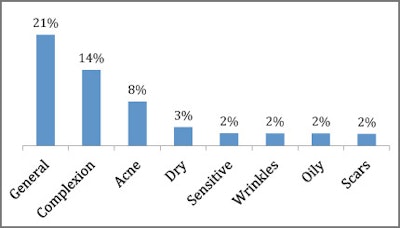

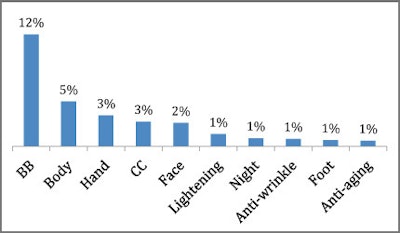

Within the broader skin care conversation, researchers looked at a collection of sub-categories including skin problems and types of products. Among the dominant skin “problems” that were identified, 21% of comments fell into a “general” category that included daily moisturizing, every day fatigue, daily washing and cleansing, etc. Trailing concerns included “complexion” (14%) and “acne” (8%). Rounding out the category were “sensitive,” “wrinkles,” “oily” and “scars.” (See Tables 1 and 3.)

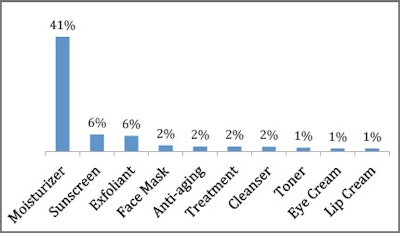

One clue to the sentiment behind the aforementioned general category of skin care concerns is that the dominant product type discussed in social media is “moisturizer.” Fully 41% of the online comments examined as part of this meta-analysis mentioned a moisturizer. “Sunscreen” and “exfoliant” trailed far behind at 6% each. This would indicate that skin care brands should offer moisturization as a core product or benefit, and as a gateway product to the plethora of complementary skin products that most also offer. (See Table 2.)

A Range of Emotions: Like, Love, Dislike and Hate

One could assume that volume is indicative of brand popularity, especially in a competitive context. But is volume a true measure of loyalty and positivity? To deepen the understanding of consumers’ subconscious perceptions towards brands, it is critical to evaluate how consumers view the brands’ functional characteristics. Such elements are trickier to deduce from traditional Q&A since respondents are less likely to speak authentically. Spontaneous online comments often look very different from those obtained during a brand-directed research Q&A scenario. But within social networks, deeply emotional insights can be interpreted with more certitude because they are coming from spontaneous and truthful conversations.

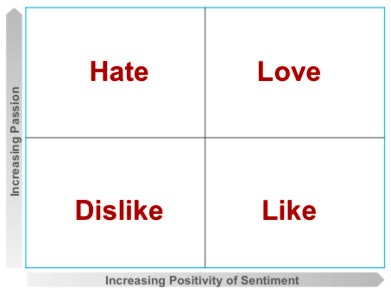

In order to understand and categorize the types of conversations happening around these skin care brands, a 2x2 framework (Table 4) was developed to plot sentiment and passion around a collection of perceptions, which emerged organically in decreasing order of overall importance:

- competence

- agreeableness

- classy

- confidence

- conscientiousness

- creativity

- energetic

- sociability

- sexy

- funny

- fashionable

Sentiment is the range of conversations going from less positive to more positive. Passion represents the intensity of the conversations, differentiating the "like" and "dislike" from the stronger emotions of "love" and "hate," respectively.

Social media research enables brands to measure the positivity and strength of conversations, as well as the relative volume of conversations regarding certain brands. In this case, strength could also be described as passion. How passionately does a consumer speak about their love or contempt for a particular brand or experience? By failing to consider the strength of a statement, one misses the important nuances and valuable insights inherent to social media research.

If a brand is talked about with high positivity and high passion, it’s in a brand’s best interests to try to sustain equity among consumers. Low passion and high sentiment indicates the need for brand revitalization, perhaps a booster shot of brand excitement. Similarly, if the sentiment is low and the passion is low, a more significant brand overhaul may be in order. The most challenging brand position is that of high passion and low sentiment, as this indicates that consumers actively dislike the brand or some experience they’ve recently had in relation to the brand.

SKIM’s skin care meta-analysis revealed one true winner and one true loser. (See Table 5.) Clinique dominated the “love” quadrant. For the two months examined, it was the most talked about brand, eliciting comments such as:

- “Clinique mild exfoliating lotion is exceptionally good. It contains salicylic acid which clears out the pores but it's mild enough to use every day. It is my miracle product.” —Community, June 2013

- “Clinique - my fav :).... last year i try clinique and i got hooked up on it now i cant live with out it” —Facebook, June 2013

- “I'm 47 and have been using Clinique since junior year in HS...some 30 years! People always tell me I look at least 10 years younger. I owe it to Clinique and their Dramatically Different lotion ... :) Thanks Clinique!” —Facebook, June 2013

Unfortunately, Garnier was alone in the “hate” category during these two months, receiving negative barbs including:

- “I ordered this Garnier bb cream… once you take it out of the box, it’s clearly not the same shade as the picture at all, it’s even darker than the other bb creams I have!” —Tumblr, July 2013

- “Has anyone had problems with the Garnier BB cream? It has alcohol in it.” &mash;Community, June 2013

- “Garnier Skincare Ultra-lift Anti-wrinkle Eye Roller, 0.5-Fluid Ounce - I have almost used this product up. I have not seen a noticeable difference in eye wrinkles, but I only use it once a day because it causes me 2 side effects. 1. It is very irritating when it leaks into your eyes. I have oily skin and my creams and lotions tend to migrate into my eyes after several hours. So I use it at night only for this reason. 2. It is giving me milia around my eyes. I like the roller ball application, but I will be searching for new eye cream.” —Reviews and Ratings, May 2013

Actionable Insights Bring Value to SMR

A great deal was learned from just two months of conversations. And all of it has long-term implications for the future of the brands themselves and the industry overall.

- It is important for every brand to understand the skin care competitive landscape. Every brand has a market position in terms of appeal, and each brand has perceived strengths and areas of needed improvement.

- Skin care is most talked about on communities/forums and Tumblr.

- Consumers talk about general skin problems, complexion and acne.

- They most seek moisturizer and use BB creams, and Clinique and Olay are perceived most positively for moisturizers.

- Most brands are purchased in pharmacies, followed by Sephora.

- In terms of skin care, consumers seek products that showcase competence, agreeableness and are classy, and do not care as much for fashionable, funny or sexy products.

Skin care consumers are generally overwhelmed by the array of brands and products ranging from $300 department store creams to $2 drug store serums. Social media shows that consumer desires are simple: moisturizing and general skin care, plus certain specific needs. Brands need not be similarly overwhelmed by the plethora of conversations available via social media. A powerful lens on the life of the consumer awaits; it’s time to dive in.

Sourabh Sharma is a New York-based communication and social media research expert for SKIM. He is passionate about extracting value from the rapidly evolving brand-to-consumer interface by his active work in social media research. Sharma has worked in management consulting, preceded by a role in brand management and product development at L'Oréal. Sharma holds degrees in engineering and marketing, and an MBA from the Wharton School at the University of Pennsylvania and the Rotterdam School of Management.